A Knockout Year: EC&M’s 2024 Top 50 Electrical Contractors Special Report

Despite headwinds, crosswinds, and perennial winds of change, a happy breeze was at the electrical contracting industry’s back in 2023. That’s evident from EC&M’s latest annual survey of electrical contractors that determines the EC&M Top 50 Electrical Contractors, a ranking based on reported annual revenue. From that top-line perspective, contractors belted a wind-aided home run out of the park.

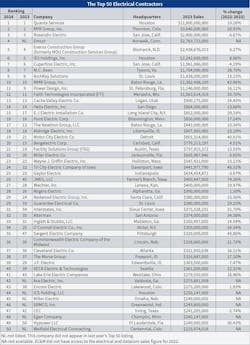

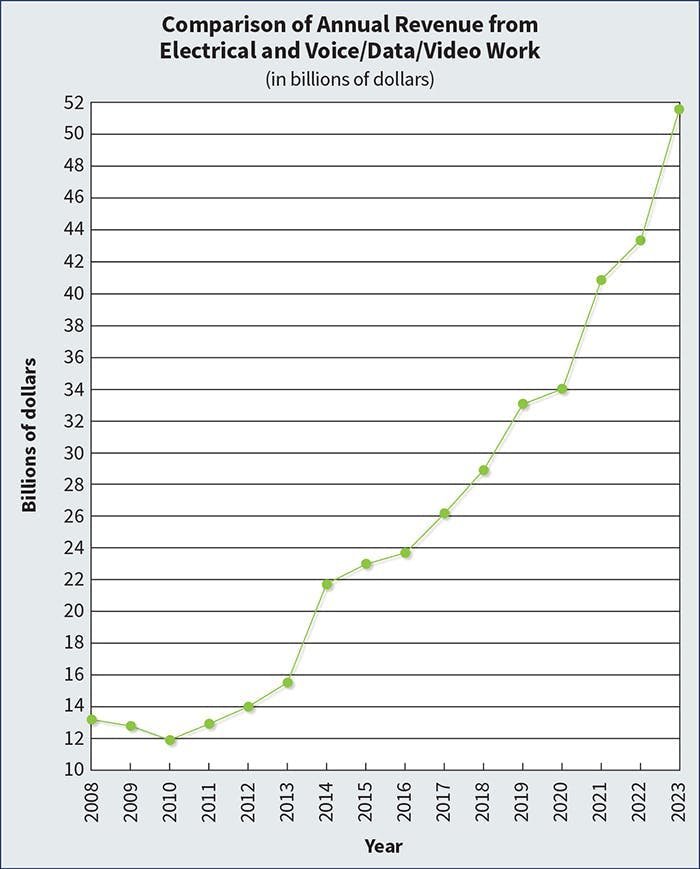

Combined, the 2024 EC&M Top 50 logged a record $51.737 billion in revenue in 2023 (the year in which 2024 rankings are based), up nearly 18% from the $43.888 billion reported in 2022 by the 2023 EC&M Top 50 (see Rankings Table). Aside from the pandemic rebound in 2021, that was the sharpest year-over-year revenue increase on record for the cohort (see Historical Trends Chart).

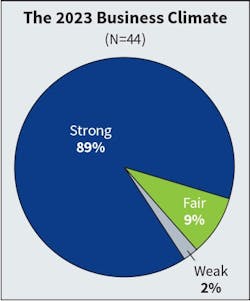

Recovery from the pandemic in the form of project resumption might have padded the revenue figure, but a strong-economy-fueled construction market was a clear contributor. Despite ongoing construction labor challenges, stubborn inflation, elevated interest rates, supply chain glitches, and ample underlying worries about what lay around the bend, 2023 was a year of continued building in a resilient and seemingly robust U.S. economy. Those benefits flowed to electrical contractors in enough volume for almost 87% of firms to rate the overall business climate in 2023 as “strong,” up 13 percentage points from last year (Fig. 1). Those rating it as such cited a range of reasons — from solid enough underlying construction demand to continued evidence of electrical’s expanding profile in projects to the steady emergence of broad “electrification” of the economy as an overarching trend.

“The construction industry, including electrical contracting, is in a relatively good place right now,” says Chuck Goodrich, CEO of Gaylor Electric (No. 25), Indianapolis. “We’ve seen the essential nature of this industry over the past several years, and the business climate looks promising, especially within the manufacturing and data markets. As we progress through 2024, we are seeing exceptional growth and potential.”

For others, “strong” means a lot of opportunity knocking and latitude to sift for the gold. Greg Padalecki, CEO of Alterman, Inc., (No. 32) San Antonio, which saw revenues grow 34%, could be more selective in 2024 with cost pressures rising in a demand-driven market.

“It’s a good time for the industry,” he says. “It’s now a lot about understanding when to say no. We’re regularly approached by customers that want to give us projects, but we have to look at resources available and make a responsible decision. We don’t want to overextend ourselves when it’s a constant challenge to maintain margins.”

Many sold more, made more

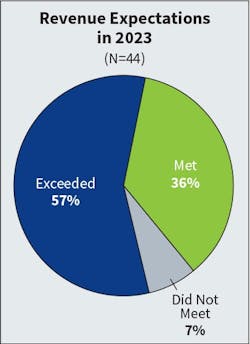

Strong top-line performance in 2023 — only eight of the 44 companies returning to the rankings reported lower revenues — was not wholly expected. In fact, 57% said revenues exceeded expectations (Fig. 2). Revenue surprises have steadily risen since 2021, when 24% said revenues were higher than anticipated.

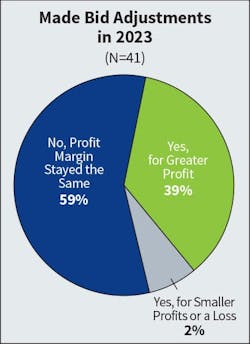

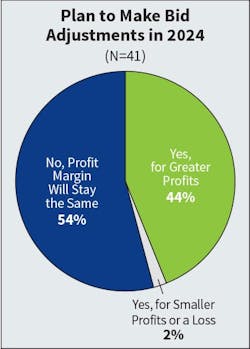

The bottom-line picture was better for many, too — a likely function of strong demand and the ability to be choosy despite the disruptive impact of rising prices of inputs like labor and materials, which contributed to uncertainty in bidding. The share saying they adjusted bids for higher profits shot up from 23% of last year’s top firms to 39% this year (Fig. 3). Still, nearly 60% said they kept their profit margins steady, down from 70% last year.

Revenue at Interstates Inc., (No. 31), Sioux Center, Iowa grew 32% to more than $375 million, partly a by-product of a wave of new investments in infrastructure in key markets it serves. Joel Van Egdom, chief financial officer, says many industrial, food/beverage, agriculture, data center, and oil/gas sector customers upgraded, retooled, and added new facilities, yielding revenue from both capital projects as well as operational support services. The latter accounts for a small but growing share of company revenues as it seeks to serve client needs through the life cycle of their facilities.

“We’re positioned as an electrical solutions provider, doing design through to construction, and providing integration and automation services that allow operators to run their facilities and automate operations digitally,” Van Egdom says. “In addition, with our operational technology services, we’re protecting our clients and realizing more recurring revenue based on annual contract arrangements.”

Profits also grew at Interstates, as the company had more latitude to assess jobs, price appropriately, and be selective. Profits were also boosted by more effective execution of project plans, Van Egdom says, “and our ability to mitigate negative impacts from schedule extensions and compression.”

Weifield Electrical Contracting (No. 50), Centennial, Colo., saw a solid boost in revenue to $226 million in 2023, allowing the company to stay on its 10-year growth target, says CEO Seth Anderson. Having sensed a slump in some markets, like housing, the company trained its eye on markets that were growing, such as water and distribution center projects — and the bet paid off. The strong performance was also aided by a nimbler approach to an electrical contracting market that seems to be changing.

“More projects will be smaller in size with a saturated market or will be mega project size,” he says. “The projects in-between are likely going on the decline, so we’re going to see some changes in the competitive landscape.”

Where the bucks are

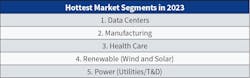

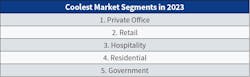

Shifting markets are a source of concern and opportunity for contractors, but there’s been little shift in the industry’s perception of where the real action lies. Once again, by a wide margin, data centers, manufacturing, and health care made more contractors’ “top three hottest 2023 markets” list than any other (Table 1). The only surprise was an uptick for renewable energy. Conversely, private office, retail, and hospitality were (like recent years) deemed the slowest (Table 2). Residential and government cracked that leader board, while oil/gas and chemical fell away.

Everus Construction Group (No. 5), Bismarck, N.D., is seeing new opportunity sprout in markets where it has cultivated strong relationships, giving it a leg up, says Jeff Thiede, president and CEO. Data center work looks unstoppable, while established utility clients are poised for a capital spending boom as AI, cloud storage, renewables, and electrification demands grow, he says. There are also green shoots in Las Vegas gaming, health care, and hospitality.

“These clients expect us to be a solutions provider, be proactive and a true partner, and we have highly skilled people ready to deliver,” he says.

Alterman has been all-in on the data center market — one that now clearly qualifies as core infrastructure — Padalecki observes. But he’s keeping a wary eye on it, because “it could be ripe for disruption, and work could taper off if technological progress leads to smaller and fewer data centers someday,” says Padalecki.

So, diversification remains key, and a decision to move into the water/wastewater market that’s booming in Texas has paid off handsomely.

“It’s less commoditized and more technical, so you have to be a sophisticated contractor to get them,” Padalecki says. “They’re not as labor intensive as other mission-critical jobs; they’re longer lasting and require a different skill set.”

Broadening its geographic reach, Hunt Electric, Inc., (No. 16) Bloomington, Minn., has tapped into more hyperscale projects like battery plants and mission-critical facilities, says President and CEO John Axelson. A move away from health care has continued, and the automotive market has crept back into the mix.

“Since the pandemic, health care has been trying to find its way for what’s next, while in data centers, artificial intelligence seems to have ignited that market — where we’re involved in many 100-megawatt-plus projects,” he says.

A sluggish commercial high-rise market continues to eat into E-J Electric Installation Co.’s (No. 15) business, but the Long Island City, N.Y.-based contractor is finding replacements.

“Renewables and clean energy are a huge focus because the future is electric,” says President and CEO Anthony Mann. “We’re seeing clients consider more initiatives, like microgrids, fuel cells, solar, hydro and fully electric buildings.”

Laboring through a challenge

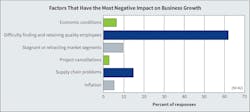

With industry growth accelerating, top contractors know that continuing to get a share of it for their firms becomes the expectation and primary goal as they scale up. But obstacles abound — the biggest one by far of which is staying fully staffed with the best workers available. More than half named finding and retaining quality employees as the single biggest growth impediment, leaving others in the dust (Fig. 4).

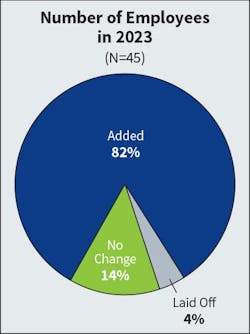

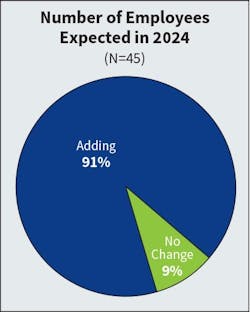

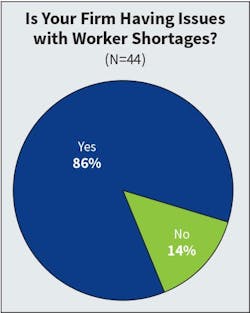

Staffing in a period of growth is critical. Therefore, hiring expectedly had the bright green light again in 2023. Eighty-two percent of firms said they added employees (Fig. 5), and 91% said they were looking at net additions in the current year (Fig. 6) — a number that’s shot up 13 percentage points since 2022. But hiring remains a slog; 86% say labor shortages are complicating the effort (Fig. 7), up 10 percentage points from two years ago.

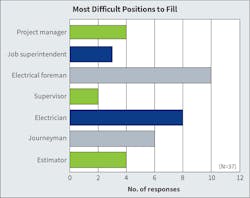

What’s the biggest hiring challenge? “Electrical foreman” once again (Fig. 8), a position that’s made the top three the last three years. That’s partly a function, some contractors say, of older workers’ steady exit from the trades and the difficulty of moving less-experienced workers into supervisory roles.

“The skill set on the job site is not what it used to be,” says Padalecki, whose firm, like others, is battling turnover and the effects of a greener workforce in need of cultivation. “We have a history in the industry of rewarding great craftsmen with supervisory roles, and now we’re losing more of those foremen and adding lower skilled people. The weakest link is the front-line field supervisor.”

Yet contractors have little choice but to play the hand that’s dealt. That means devotion to bringing a new crop of people into the labor ranks and committing to training.

At ArchKey Solutions (No. 9), St. Louis, Ron Mortimer, senior VP, commercial strategy, says labor shortages are acute in some, but not all, areas the company works in. And it’s not limited to field workers. Vital project managers, he says, are harder to find as well. The company’s response is to expand its field of vision.

“Our approach to mitigating the shortage is organic development of a diversified workforce,” he says. “There’s a general lack of awareness of opportunities in the industry, so we’d like to make underutilized groups more aware of them. The industry has outgrown the traditional avenues for hiring for electrical roles.”

Gaylor Electric concurs and is crafting new ways to recruit. As part of its broad student outreach, it has established an on-site accredited high school where at-risk teens spend half their day learning elements of the electrical trade alongside Gaylor employees.

“This initiative has proven to be a rewarding pipeline for producing skilled electrical apprentices,” Goodrich says. “We’re confident these (and other outreach) efforts will help bridge the gap in labor availability and produce a steady supply of skilled professionals to meet our growing project demands.”

Few contractors see those demands moderating any time soon, meaning they’ll likely contend with labor issues this year and beyond.

One new wrinkle in the labor picture is the requirement that project labor agreements (PLAs) be in place on federally funded construction projects exceeding $35 million. Bidders must agree to abide by PLA rules that mimic stringent union labor agreements, which could increase their labor costs. That might have the effect of limiting bidding opportunities for contractors likely opposed to PLAs, notably non-union contractors. Top 50 contractors are evenly split on the potential impact on their companies and the industry: A quarter say it would be positive; 37.5% negative; and 37.5% no impact (Fig. 9).

Cause for optimism

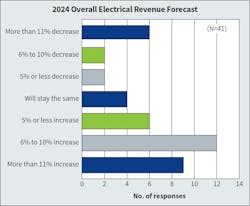

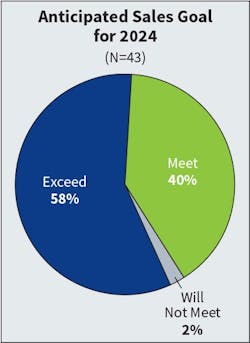

Labor challenges notwithstanding, many firms expect to thrive in 2024. Surveying the year from a late spring vantage point, more than half think 2024 company revenue growth will exceed 6% at year-end (Fig. 10). And 58%, compared to 41% last year, expect current-year revenues to beat expectations (Fig. 11). On the profits front, while a majority don’t expect to adjust bids at all, 44% will aim for greater profits — up seven percentage points from last year (Fig. 12).

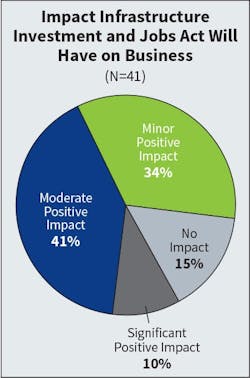

Some of the strong outperformance expectations for 2024 could be tied to prospects for increased infrastructure spending. Though slow in coming, dollars from the landmark Infrastructure Investment and Jobs Act (IIJA) are beginning to flow to construction contractors.

Electrical contractors might not prove to be the biggest beneficiaries, but spending on certain projects could pad their top lines. A plurality sees the IIJA having a moderate positive impact on their businesses in 2024, while another 10% see a significant impact, lower than last year’s survey number (Fig. 13).

Some of the strong outperformance expectations for 2024 could be tied to prospects for increased infrastructure spending. Though slow in coming, dollars from the landmark Infrastructure Investment and Jobs Act (IIJA) are beginning to flow to construction contractors.

Electrical contractors might not prove to be the biggest beneficiaries, but spending on certain projects could pad their top lines. A plurality sees the IIJA having a moderate positive impact on their businesses in 2024, while another 10% see a significant impact, lower than last year’s survey number (Fig. 13).

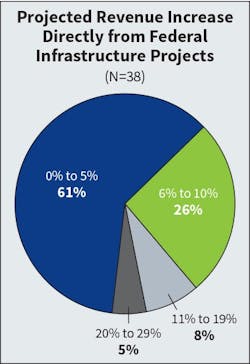

A year has also seemed to change thinking about infrastructure spending producing a new source of revenue. Slightly more than one-quarter of firms see a possible 6% to 10% increase in new project revenue tied to it, down from 31% in last year’s survey (Fig. 14). The shift is seen in lesser impact: 61% see a 0% to 5% impact, up from 48%.

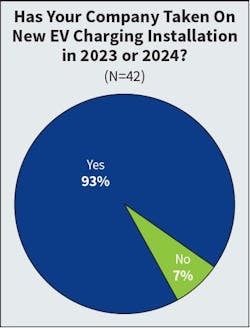

Those expecting an impact see it coming in a variety of forms, the largest being electric vehicle (EV) charging infrastructure, renewable energy, and electric grid updates (Table 3). While it garnered the most mentions, EV charging work doesn’t land on most contractors’ priority list. While the vast majority have performed EV charging work in 2023 or 2024 (Fig. 15), only a small share sees EV charging work accounting for 6% to 10% of their 2024 revenues; most see it in the 0% to 5% range. Of the few not active, 44% say they don’t plan to enter that market in 2025, while 56% do.

EV charging is a market Hunt Electric is watching and studying this year, but the jury is still out on whether it’s something to get excited about. The bigger possible source of new revenue, Axelson says, is the IIJA and the CHIPS and Science Act. The latter is bringing in some semiconductor-related construction work. Transmission and distribution work under the IIJA could blossom, he says, but the company isn’t heavily in that market. Overall, despite rising construction costs, work with established customers and markets should drive company revenues 6% to 10% higher this year.

“The level of activity being talked about is higher than in the past, and we’re at our high in terms of revenues,” he says. “Not too many developers are saying the cost of money is giving them pause.”

E-J Electric is predicting modest growth this year but sees the year’s better story as one of more groundwork being laid. Health care and a host of renewable energy projects — ranging from E-bus depots to EV charging to battery energy storage systems — are contributing to 2024 revenues, Mann says. Infrastructure spending is also starting to trickle down.

“The IIJA is a positive thing for our business, affording the opportunity for many projects to move forward,” he says. “In July, the Gateway Tunnel project (in metro New York City) locked in billions in federal funding, and there are billions allocated for clean energy, grid infrastructure repair and renovation, and manufacturing, which are key markets for us.”

Tangled up in the supply chain

A big boost in infrastructure spending will likely put pressure on materials availability and cost. Transformers, for instance, will be needed in huge numbers for transmission and distribution system upgrades — components that have become harder to secure and more costly due to rising demand and changes in core technology.

Many contractors continued to feel the sting of rising material costs, shortages and delays in 2023, but there are signs the pressure, for now, is easing. Whereas all 50 firms last year said they had to deal with higher materials prices in 2022, 39 this year said that was the case in 2023 (Fig. 16). Most said distribution equipment and wire and cable led the way in price increases, but the share naming distribution equipment was halved while wire and cable mentions grew. Like last year, most contractors said the product up most in price had risen 6% to 10%.

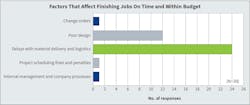

All told, myriad supply chain issues have taken a toll on contractors. Rising costs and other supply chain problems rank high as company growth impediments, though their impact has moderated. And no factor comes close to eclipsing “delays with material delivery and logistics” as the biggest obstacle to keeping jobs on schedule (Fig. 17).

Most contractors are taking a matter-of-fact approach — unsure whether problems will continue but trying to work around them. Interstates’ Van Egdom say lead times on many commodity products are back to normal, but specialized components some customers need are in short supply, necessitating better planning.

“Electrical gear needed to run industrial facilities is still 50 to 60 weeks on deliverables,” he says. “That requires up-front planning and coordination to get enough design done on the front end to pull the trigger early. That is the new normal that we need to plan for and work with.”

For ArchKey’s Mortimer, the situation requires adaptations on all ends. He sees bottlenecks easing and prices moderating, partly the result of the industry players adjusting expectations, improving communications and bolstering supply infrastructure. Progress has been made, and the supply chain is “normalized and improved,” but “it’s still important to maintain clear lines of communication and set clear expectations.”

AI joins growing tech bag

Electrical contractors and designers have turned to design workarounds, efficient planning, improved ordering processes, and reconfigured supply chains to address shortages and higher costs — tactics that could be aided by technology. That’s just one of many roles technology’s current heartthrob (artificial intelligence) could play in the industry’s future.

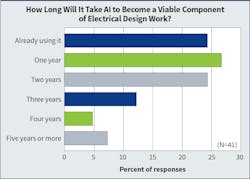

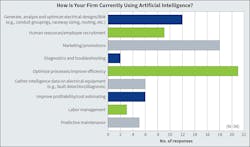

As a viable electrical design tool, contractor views vary on the timing of AI making inroads. The vast majority see that happening within just two years (Fig. 18). That includes nearly a quarter who are already using it in design. But more are now using it for other purposes, too — primarily process optimization/efficiency improvement; marketing and promotions; and human resources (Fig. 19).

Inglett & Stubbs (No. 33), Mableton, Ga., is assessing AI as part of a continual process of seeing where technology fits in an industry where it has long lagged. AI’s potential to speed up analysis and boost productivity is clear, says Gaël Pirlot, vice president, but essential questions remain.

“Sometimes we get caught up in getting data for data’s sake, and so maximizing our ability to sift through it better using AI is interesting,” he says. “We have made a financial commitment to looking at it, and we’re prepared to see what might stick, but also to fail quickly (if it dead ends).”

Likewise, Hunt Electric’s Axelson says the firm is studying AI but now more from a more rudimentary angle. He wants to get a feel for its security — until then, it’s limited to internal data analysis.

“We’re keeping it more in-house for use in scheduling, safety records, and education before we start projects,” he says. “There are concerns about how open you can be with inquiries. Where does the data go, and who has access to it?”

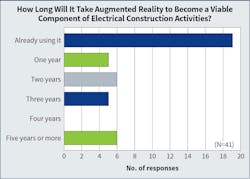

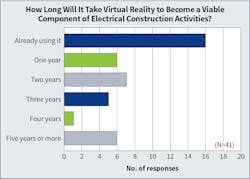

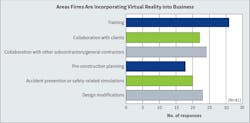

Other technologies continue to find their way into electrical contracting work. Among them, augmented reality (AR) and virtual reality (VR) tools that allow design and construction to better merge may be gaining. Almost half say they’re now using AR (Fig. 20) and more than a third VR (Fig. 21), but those survey numbers have tended to fluctuate. Contractors see a range of potential applications for both — chiefly collaboration, pre-construction planning, training, and design modifications (Fig. 22 and 23).

Weifield’s Anderson said AR, VR and similar tools that improve the speed and accuracy of design through better visualization are valuable in managing the faster pace of projects, a growing concern. Merging AR with BIM, for instance, aids quality control, which is key because “things are happening so fast on projects that we want to make sure we don’t miss something.”

For Gaylor Electric, these technologies are gaining buy-in, Goodrich says, because they enhance communication and collaboration while improving accuracy and efficiency. VR, for instance, helps show how manufactured electric modules will be implemented, enables site walks and immerses users in models, “ensuring all stakeholders have a clear understanding of project scope and execution.”

Information technology tools also continue to make a difference in contractors’ project field operations. With most workers now carrying mobile devices, contractors are focused on providing software and apps that can boost efficiency and productivity.

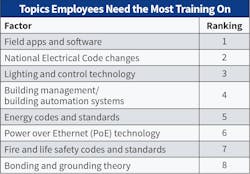

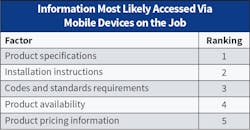

Those continue to evolve, though, and many contractors say when it comes to training, their employees would benefit most from learning how to better understand and use field apps and software (Table 4). They’re helping them manage key job elements — ranging from project and time management to product specs and installation guidelines to codes and standards interpretation (Table 5). Utilizing mobile devices for everything from product specifications and installation instructions to pricing and product availability information, workers are getting critical data they need quickly and remotely (Table 6).

“One of the best things we can do for workers is provide craftspeople with the information essential to performing their work,” says ArchKey’s Mortimer. “Mobile devices are helping with specs and the accuracy of information, and that even helps build morale with team members.”

Improving the lot of workers — whether through making their jobs easier and safer via technology, improving training and advancement/growth opportunities, or offering better pay and benefits — might be close to “job one” for electrical contractors facing an array of challenges. Indeed, that was the top overarching challenge cited by contractors asked to name their biggest one over the next few years. As one put it succinctly: “Insufficient qualified labor to complete extremely large and complex projects.”

So it has been — and likely for the foreseeable future — so it shall be.

Improving the lot of workers — whether through making their jobs easier and safer via technology, improving training and advancement/growth opportunities, or offering better pay and benefits — might be close to “job one” for electrical contractors facing an array of challenges. Indeed, that was the top overarching challenge cited by contractors asked to name their biggest one over the next few years. As one put it succinctly: “Insufficient qualified labor to complete extremely large and complex projects.”

So it has been — and likely for the foreseeable future — so it shall be.

About the Author

Tom Zind

Freelance Writer

Zind is a freelance writer based in Lee’s Summit, Mo. He can be reached at [email protected].