Renewables Pace Slows in 2022

United States renewable energy capacity growth has hit something of a speed bump in 2022 and it could take a geared-down installation schedule until mid-2023 to get back on track.

Two new reports characterize 2022 as a less-than-robust year overall for alternative energy, most notably for solar, but conclude that the clouds will likely lift once there’s more clarity on the resolution of temporary roadblocks.

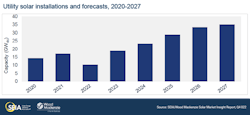

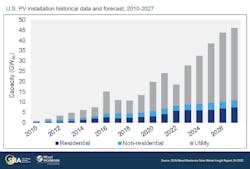

The latest installment of Solar Energy Industry Association’s quarterly market reports – U.S. Solar Market Insight Q4 2022 – puts new solar capacity added in Q3 2022 at 4.6 GW, 17% below that added in Q3 2021, and 2% below Q2 2022. At year’s end, total solar capacity added is expected to hit 18.6 GW, which would be 23% less than that added in all of 2021. Utility-scale solar installation declines are expected to take the biggest hit, down a likely 40%, as shown in Fig. 1 below.

Taking a broader view, a new report from Deloitte – 2023 Renewable Energy Outlook – cited notable reductions in utility-scale solar and wind capacity in describing 2022 as a year of “slackened growth.” Solar and wind installs during the first eight months of the year declined 26% and 8%, respectively, from 2021’s first eight months. Still, it put renewable energy’s share of U.S. electricity generation at 23% at the end of August, up two percentage points from August 2021.

A confluence of events will have been responsible for the down year for renewable energy additions. The common denominator is constraints on elements needed to bring projects online, obstacles that are likely to begin receding in 2023, opening the door to a resumption of growth.

The SEIA report cites restrictions on imports of key components as the primary cause of the slower pace of solar installations. The Uyghur Forced Labor Prevention Act, passed in Congress to block the importation of components produced with suspected slave labor in China, has held up imports from Asian suppliers that might be helping China circumvent UFLPA sanctions.

An SEIA news release announcing its Q3 report put import issues at the center of the slowdown in solar project growth during the year.

Quoting SEIA president and CEO Abigail Ross Hopper, the release stated, "The solar and storage industry is acting decisively to build an ethical supply chain, but unnecessary supply bottlenecks and trade restrictions are preventing manufacturers from getting the equipment they need to invest in U.S. facilities.”

The Deloitte report, addressing the broader renewables market, spread the blame for the 2022 slowdown more widely, noting that “in 2022, US renewable energy growth slackened its pace due to rising costs and project delays driven by supply chain disruption, trade policy uncertainty, inflation, increasing interest rates, and interconnection delays.”

Both Deloitte and SEIA, however, see points of light for renewables among 2022’s clouds. Both cited statistics showing residential solar’s resilience. With 1.57 GW installed in the quarter, residential was up 43% quarter-over-quarter, SEIA says. Deloitte had it up 35% in the first half of 2022 over 2021. SEIA says commercial solar grew 3% year-over-year and Deloitte says corporate renewables procurement is on track to set a new record in 2022 after a record 11 GW were installed in 2021.

While 2022’s experience has highlighted some fundamental challenges for renewable energy, the reports have an overall optimistic tone. While imports might continue to be an area of concern into 2023, supply chain issues are likely to recede over time, due in part to incentives for more domestic supply. The government’s Inflation Reduction Act (IRA) is sure to spur more investment through supply and demand accelerators. Imbalances could crimp growth well into 2023, but toward year end the table could be set for a resumption of robust growth.

The SEIA report sees it playing out like this: “In 2023, some projects that were delayed this year should obtain module supply and come online. And by 2024, the real impacts of the IRA will begin to come to fruition. From 2023-2027, Wood Mackenzie forecasts 21% average annual growth across all solar segments.” See Fig. 2 below.

In Deloitte’s view, the 2022 downturn may extend well into 2023, but it will turn out to be a blip: “Moving into 2023, drivers for renewable growth are some of the strongest the industry has seen, including competitive costs, supportive policies, and burgeoning demand.”

Tom Zind is a freelance writer based in Lees Summit, Mo. He can be reached at [email protected].