While they live in different parts of the electrical market, electrical contractors and their suppliers have dealt with similar challenges over the past few years.

Electrical distributors and contractors both had to adapt to hybrid officing strategies during the COVID-19 era; endure the waiting game with product shortages; wrestle with head-spinning price increases; decide how much time and personnel to invest in new products like electric vehicle charging stations and the new generation of LED luminaires and controls; and, for some companies, decide if the time was right to sell the family business in the latest wave of mergers and acquisitions.

Despite it all, the largest electrical distributors proved once again that they, like electrical contractors, are a resilient bunch. For some companies ranked in the 2023 Top 150 Distributors listing published by Electrical Wholesaling, EC&M’’s sister publication, 2022 was a banner sales year, and many saw their annual revenues blow past the 4% to 8% annual revenue increase range in the electrical market (Table 1).

Mike Pratt, CEO of American Electric Supply, Corona, Calif., said supplier support and the strong Southern California economy contributed to his company’s sales increase in 2022. He applauded the suppliers that allowed the company to have stock for its customers when they needed it. Pratt sees an 8% sales increase in 2023 and says the continuing construction projects at Los Angeles’ LAX airport and anticipated revenues from work related to the 2028 Los Angeles Olympics will support good future growth.

At OmniCable, West Chester, Pa., Greg Lampert, the company’s recently retired president & CEO, said the company’s 2022 sales increase was due to the new products, new markets, and investment in inventory to serve customers when supplies are tight. Lampert is optimistic about 2023 and is forecasting a 51% increase in revenues.

For some companies, price increases due to inflation accounted for a major portion of revenue increase. In the utility market, Matt Brandup, CEO of Rural Electrical Supply Cooperative (RESCO), Middleton, Wis., says inflation accounted for two-thirds of his company’s 2022 sales growth and that real growth accounted for 33%. Brandup noted that RESCO’s transformer sales increased considerably in 2022. He’s expecting a 30% increase in 2023 revenues.

TEC Manufacturing and Distribution Services, Georgetown, Texas, is another utility specialist expecting a double-digit increase in 2023 sales. Johnny Andrews, the company’s COO, is forecasting an 11% increase in revenues. He said that in 2022, the biggest driver for the company’s sales increase was adding new sole-source alliances for electric cooperatives and municipal electric systems. “TEC manages the total supply chain for those organizations (demand planning, procurement, warehouse operations, inventory management, job kitting, and freight logistics),” he said in his response.

A prosperous Canadian economy and growth in the greater Toronto market and in the province of Ontario supported a 2022 revenue increase for O’Neil Electric Supply, Woodbridge, Ontario. Stephen Kleynhans, the company’s president, said in his response that other contributing factors included immigration, an increase in construction spending, and the development of enhanced customer service programs. Kleynhans is forecasting a 15% increase in 2023 revenues.

At Jo-Kell Inc., Chesapeake, Va., a tightly defined OEM niche is producing solid growth. “The largest projects we have seen (and see in the immediate future) are in the automatic car wash OEM sector,” said John Kelly, the company’s chief corporate officer. “Our business in that market tripled in the past year, and we expect even more growth over the next year.”

Acquisition activity

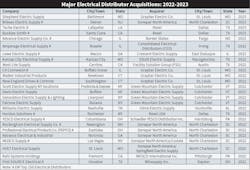

While the national chains (WESCO, Sonepar, Graybar, Rexel, and CED) were once again the most active acquirers over two years, some large regional independents including Green Mountain Electric Supply, Colchester, Vt.; Elliott Electric Supply, Nacogdoches, Texas; Schaedler YESCO Distribution, Harrisburg, Pa.; and Inline Electric Supply, Huntsville, Ala., also made significant acquisitions. Bruce Summerville, president, Inline Electric Supply, said although his company’s acquisition of Williams Electric Supply in the Nashville, Tenn., area last year was a big factor in the company’s growth, Inline Electric Supply’s revenues were up 30% across its existing footprint.

2023’s biggest challenges

Although the majority of the Top 150 respondents believe a recession either has already started or will start before year-end, they were still bullish on their business prospects for 2023. Despite their optimism, they also see some challenges ahead. Concerns over longer lead times persist, and 60% of respondents ranked longer lead times as the top challenge in 2023. American Electric’s Mike Pratt said his top concern in 2023 is the switchgear industry’s slow recovery to improve lead time and lack of availability for common SKUs.

Growth expectations

Larry Swink, president, Jackson Electric Supply, Jacksonville, Fla., said that while his company had its second-best year in 2022, it was a decrease from 2021. “The largest impact was the delays in the switchgear market, resulting in 52 week-plus lead-times. The backlog carried over from these orders would have been another +35% in revenue with typical 12-week to 16-week lead times.” Swink expects sales to increase by 20% in 2023.

Lead times were a challenge for K/E Electric Supply, Mount Clemens, Mich., said Rock Kuchenmeister, CEO and president. “Vendor improvements in fulfillment during the second half of 2022 allowed K/E Electric to begin the process of shrinking our customer backlog. However, customer expectations quickly recovered (from COVID levels), and the company backlog has actually grown to unprecedented levels.” He is forecasting a 14% increase in K/E Electric’s 2023 sales.

Other major concerns included the impact of remote officing on demand for new office construction and/or office retrofit work; price increases; the impact of the regional banking instability on the commercial real estate market; and rising interest rates.

Acquisition mania

Mergers and acquisitions have always been a huge part of the electrical wholesaling industry, but over the past few years, the pace of M&As has quickened. Since 2020, about 30 distributors formerly ranked on the Top 150 listing have been acquired (Table 2). Over the past 12 months, the largest acquisitions of electrical distributors included Sonepar’s purchase of Billow Electric Supply in the Philadelphia market; Rexel’s purchase of Buckles-Smith in Santa Clara, Calif.; and Teche Electric in Lafayette, La.; and Graybar’s acquisition of Baltimore’s Shepherd Electric Supply.

While several thousand independent electrical distributors still thrive, the larger national and regional wholesalers have steadily grabbed more market share through dozens of acquisitions and geographic expansion. In fact, Electrical Wholesaling estimates that the 10 largest distributors (Wesco, Pittsburgh; Sonepar USA, Charleston, S.C.; Graybar Electric Co., St. Louis; Rexel, Dallas; Consolidated Electrical Distributors, Irving, Texas; City Electric Supply, Dallas; Border State Electric, Fargo, N.D.; Elliott Electric Supply, Nacogdoches, Texas; U.S. Electrical Services, Middletown, Conn; and McNaughton-McKay, Electric, Madison Heights, Mich.) account for $65 billion in total sales — at least 40% of the market’s $140 billion in total sales. These companies employ at least 51,000 employees and operate more than 4,000 locations.

About the Author

Jim Lucy

Editor-in-Chief, Electrical Wholesaling & Electrical Marketing

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling, Electrical Marketing newsletter and Electrical Construction & Maintenance magazine on topics such as electric vehicles, solar and wind development, energy-efficient lighting and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas. In 1999, he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in communications and a bachelor’s degree in journalism from Glassboro State College, Glassboro, N.J. (now Rowan University) and studied electrical design at New York University and graphic design at the School for Visual Arts.