On a typical electrical construction project, a project management team's success is measured on gross profit. Cash flow concerns are left to the controller, CFO, or sometimes even the owner. What's behind this mindset? For one, there is the thought process that outside of progress billings, project managers have little control over cash flow. The second is the theory that cash flow and profitability are two separate things. How are these two concepts related? In theory, there is no direct connection — it is possible to have a job with horrible cash flow turn out to be very profitable. In reality, however, there is usually a strong correlation between good cash flow and project profitability.

Do an analysis of all of your projects over the last few years, analyzing both cash flow metrics and gross profitability. Throw in some additional factors such as customer satisfaction and repeat business, and chances are very good that you'll find strong statistical evidence linking good cash flow to good profitability. This is why banks and bonding companies focus on under billings as potential flags to profitability problems.

A good portion of the project manager's job is to facilitate and expedite processes inside and outside your company — everything from getting deliveries to the jobsite to getting purchase orders out. Armed with the right information, they can do the same with cash flow processes. Following are 10 useful guidelines project managers can use to improve cash flow. Although many of these tips may seem small, implementing just one new idea might add thousands of dollars of free cash flow to your next project.

- Relationships are everything

Have you every had a company or computer approve your schedule of values? Sign off on your project? Enter your invoice into the accounting system? Approve your compliance documents? Cut your check? These are all activities in the cash flow process that are managed by people outside your organization. Don't underestimate the value of building strong relationships with all parties involved in your cash flow process.

- Prioritizing processes

Creating a flowchart for each process on a project that impacts cash flow will help you identify relationships and potential areas for improvement. The Chart shows how adding just a few steps (indicated by dashed lines) in the process can improve cash flow. Making simple process improvements such as these can produce big results in the long run. Here are a few tips that can help.

-

Share the schedule of values with the foreman a week before it is due, and go over billing items he believes the team can complete to provide the best cash flow scenario.

-

Have the foreman “informally” go over the billing and percentages complete with the inspector or on-site owner's representative a couple days ahead of time to avoid processing problems.

-

If there are compliance documents that are due, such as certified payroll or lien releases, make sure the project manager knows about them, is aware of who is responsible throughout the process, and checks in to make sure these are taken care of.

These three steps can add thousands of dollars to each billing cycle and improve receipt of payment by days or even weeks. Mapping out other process improvements can gain you even more.

-

- Schedule of values

Outside of having a profitable estimate to begin with, the most opportunities for improving cash flow lie in the billing process. Following are some specific steps you can take to cure cash flow problems in this area.

Include items on the billing format for “Mobilization and Submittals/Shop Drawings.” These are the first activities that happen on a project, and if managed properly, they can give you an immediate boost in cash flow. Break out major material procurement (lighting, switchgear, generators, etc.) as separate line items so that you can get paid as soon as the material hits the jobsite. Require project managers to create a cross-reference between the billing items and the budget — load your gross profit into activities that will happen earlier on in the project. Check with your customers to find out their billing process and format. Then make your billing format easy for them to incorporate.

If yours is the easiest for the customer to work with, it will get processed first. Follow up with your customer immediately after sending the billing to verify receipt and to check that everything is in order. Follow up 20 days after that to get a “check-cut” date.

- Vendor pay schedules

Another trick to improving your cash flow and performance of large vendors and subcontractors is proactively designing their pay schedules. As with billing, design their pay schedules to integrate seamlessly into your format. Provide incentives up-front for critical activities, such as mobilization, submittals, and shop drawings. Retain money to provide a financial hammer at the end of the project to facilitate rapid collection of as-built drawings, test reports, O&M manuals, and other close-out documents.

Electrical contractors are often responsible for large subcontracts, including A/V, voice-data, security, and life-safety. Each year, this scope of work grows in relationship to the overall electrical contract. Poorly managing these large subcontracts will inevitably lead to cash flow problems, relationship problems, or both.

- Streamline submittals

For projects requiring submittals, the submittal log and entire submittal process offer significant opportunities for improving customer service and cash flow.

Be very detailed in the creation of the log — break submittals down into every detail required in the specifications or contract. Coordinate the submittal log dates with the schedule to maximize cash flow. Include responsibilities for all submittal line-items. Use the log filtered by these responsibilities in conjunction with the financial incentives and hammers built into their pay schedules to move the process along rapidly. Include every close-out detail on the initial submittal log.

- Improve changeorder processing time

A common misconception in the industry is that changeorders are good for profitability and cash flow. The truth is: Changeorders often don't have that much gross profit margin built into them, considering the amount of disruption they cause to the construction process. This misconception often leads to sloppy management of the changeorder process, which results not only in poor profitability but also in slow approval and payment of changeorders — impacting cash flow.

Of the total number of changeorders on a project, the electrical contractor is usually involved in a high percentage of them because their work touches all aspects of the project and they interface with most other trades. Changeorder management for electrical contractors is critical. Below are some ideas to help maximize changeorder management.

-

Use project pre-planning to identify changes before you start.

-

Get to know everyone involved in approving your change requests.

-

Find out exactly what the specified change processing time is.

-

If a time isn't specified in the contract, try to insert your own clause.

-

Enter potential change into your log as soon as you think there may be an issue.

-

Make pricing changeorders a top priority in the company.

-

Manage all your documents electronically.

-

Attach all supporting documents to your change request in one PDF.

-

Make sure your backup format meets the contract requirements.

-

Build your change request format to match the customer's.

-

Get change requests on billing as soon as they are submitted.

-

- Compliance and administrative documents

These documents are usually managed as part of the contracts department, accounts receivable, or payroll. The project manager should be aware of these processes and make sure that these processes occur in a timely manner.

Not handling compliance and administrative issues promptly impacts cash flow. In fact, poor handling leads to the perception of poor customer service. The processes for approval and how they impact cash flow should also be mapped out at the pre-job meeting.

- Punch early, punch often

No matter how good of a job you have done throughout the rest of the project, the perception of customer service will rest largely on how well the punch list and close-out processes are handled. In addition, long punch lists eat up job profits and delay final payments.

To ensure this happens, don't wait until the end of the project to act. Make your own punch list, documenting every few hundred manhours. In doing so, note areas where others are impacting your work, and resolve red flag items quickly.

- The close-out

Even at the very end of most projects, you may still have a significant portion of your cash still being held by the customer — either in the form of final payment, retention, or both. How fast this money is released has a lot to do with how efficiently the close-out process is managed.

This means starting this step early as possible — many of the pieces of the close-out process can be done almost immediately after the submittals are approved. Make sure your billing schedule has been loaded to shift most of your money away from these final close-out items. Use all communication tools at your disposal to notify subcontractors, vendors, and members of your own project team about what needs to be done to close out the project. Use the financial hammers you have put in place for your large vendors and subcontractors to make sure these close-out items are not put on the back burner.

- Make cash flow a game

Don't let these ideas sit in your desk drawer and collect dust. Cash flow is serious business, and the best way to improve it is by getting everyone involved, not just the foreman. This also means project management, contracts, accounts payable, accounts receivable, purchasing, and payroll. Because all companies could benefit from better cash flow, consider the following ideas for achieving your goals.

-

Share this article, including your notes, with everyone on your team. Use it as a starting point, and brainstorm more details that can improve cash flow.

-

Create company-specific training with the results from these brainstorming sessions.

-

Analyze your past projects, and show the correlation between cash flow and profitability.

-

Put systems in place to manage the processes as well as verify you're consistently getting company-wide results.

-

Change or add to the compensation system to take cash flow into account.

Just because you don't have a cash flow problem today doesn't mean you won't tomorrow. Implementing some of the ideas discussed in this article can make a good situation better or hopefully mitigate future cash flow problems from starting.

Brown is president of D. Brown Management, Lodi, Calif., a consulting firm specializing in project management and operational processes for contractors.

Sidebar: Cash Flow vs. Profitability Primer

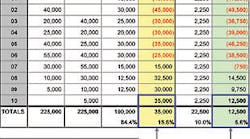

To clearly demonstrate the difference between cash flow and profitability, the following example references a simple project with $225,000 in revenue and a construction duration of nine months. The company is running at 10% overhead.

Billed: Shows the amount billed on the project — typical lag of 30 days from the time money is spent. As you can see, in the end, the total amount billed equals the total revenue.

Paid: This is what really matters when it comes to cash flow. For an electrical contractor, typically one or two tiers removed from the owner, the cycle time between a bill being sent and paid is often closer to 60 days.

Costs: These are the costs incurred on the project. A large portion of the costs for electrical contractors is in labor. Therefore, there is an almost immediate cash cost. Suppliers also often demand their money before subcontractors get paid, placing an additional burden on the cash flow for electrical subs.

Project cash flow: This shows the flow of cash on the project and is calculated by subtracting total costs to date from total paid to date. In the end, the cash flow equals the gross profit — but notice the variations throughout the project. This is what kills contractors.

Overhead: All the costs that go into running the company, such as rent on the building, utility costs, marketing costs, management salaries, etc., are costs that go on steadily every day. Once you factor these costs in at 10% you can get an idea of what cash flow on the project actually looks like at the company level.

Net cash flow: Shows the cash flow at the company level — this is the number that really matters and will cause a business to run into problems or even fail. This is better demonstrated with a graph (below) showing flow of cash over the course of the project.

The project illustrated above will generate $12,500 of net profit but will require almost $50,000 of cash. However, what if the customer paid just a little slower? How much cash would you need if you had three of these projects starting at about the same time? These are all things to consider.

The first step in proactively managing cash flow is to get every member of the project team, including foreman, superintendent, project manager, project administrator, estimator, and purchasing agent on the same page from the very beginning.