Uncharted Territory: EC&M’s 2020 Top 50 Electrical Contractors Special Report

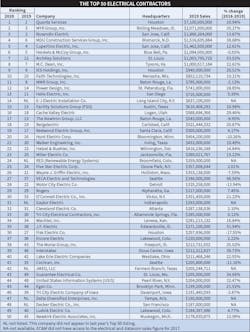

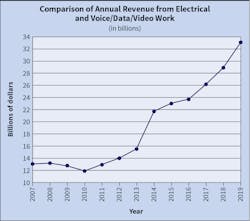

If 2019 proves to be a high-water mark of some duration for the pandemic-shocked U.S. economy, there’s no doubt the nation’s electrical contractors (ECs) closed the year out in style. The largest ECs, represented in EC&M’s annual Top 50 Electrical Contractors ranking by revenues (see Table 1), crushed another revenue record. Combined revenues hit $32.7 billion for the 2020 Top 50 (based on 2019 revenue numbers), a nearly 14% increase from 2018, the biggest one-year increase since 2014, when they spiked 39% to $21.8 billion (Fig. 1).

But amidst the pandemic wreaking havoc in so many ways, that now seems oh-so-long ago. It’s a near certainty that the Top 50’s decade-long streak of year-over-year revenue growth will end in 2020. Rocked by the economy’s collapse, the industry’s revenues are sure to slide this year, and contractors could be facing a protracted recovery into 2021 and beyond. Lashed heavily to building and construction activity, contractors’ fortunes will depend on how quickly that turns back up and which sectors rise or fall due to long-term changes wrought by the virus. To see a sampling of some of the innovative projects Top 50 companies worked on in 2019, representing a broad range of vertical markets and specialties, view the 2020 Project Spotlight Photo Gallery.

Taking the industry’s pulse, the annual survey that produces the Top 50 finds that leading contractors this year are, as a group, wary. They’re resigned to a down 2020 in terms of revenue and profit, reluctant to hire new headcount, and working to adapt to a rockier business environment. Still, they’re moving forward, keeping an eye on the far horizon and thinking about how to address longstanding challenges that will outlive the pandemic. Despite all the swirling changes and uncertainties, a majority express confidence that somehow 2021 will see the beginnings of a return to normalcy.

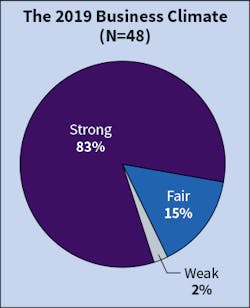

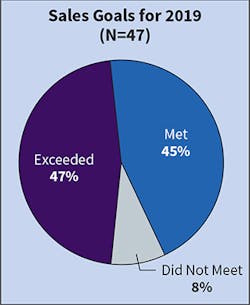

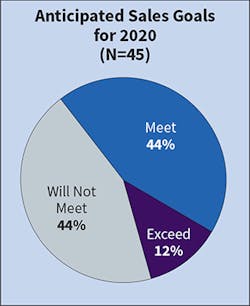

As it now stands, electrical contractors can only hope that next year will see a restoration of the business climate they enjoyed in 2019 (Fig. 2) — one that was judged strong by most contractors that brought upside revenue surprises for 22 companies (Fig. 3). Few believe 2020 has any such pleasant surprises in store. Only five companies think they will meet their revenue expectations, while 20 predicted they would not (Fig. 4). Compare that to the 2019 Top 50, which had 18 companies looking for 2020 revenues to beat expectations and only one expecting not to, and clearly things have changed.

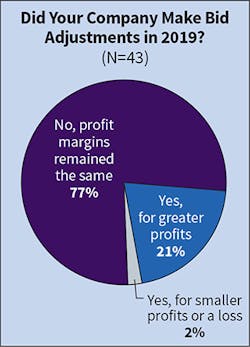

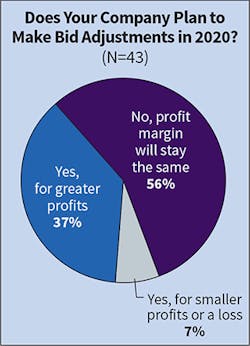

Similarly, there’s concern about profits. Nine companies said they made bid adjustments for higher profits in 2019 (Fig. 5) — most 5% or less — but only three said they expected to follow suit in 2020 (Fig. 6), perhaps due to anticipation of fewer jobs and more bidders. Among last year’s Top 50, a dozen companies said they adjusted for higher profits in 2018, and 15 said they anticipated higher profits in 2019.

Lowered expectations

A bulging backlog that included some major utility-scale renewable energy and airport projects fueled a second-straight 14% revenue-growth year at Rosendin Electric (No. 3), San Jose, Calif. However, it was judged only a fair business climate in retrospect because sights were set high, and failure to hit the target stirred worries that a slowdown was coming.

“Before the pandemic hit, we wondered about when we’d see the end of the great, fabulous run we’ve all been on, and we thought we still had a runway of three to five years, but all of that changed with COVID-19,” says Michael Holmes, vice president of pre-construction.

Still, expectations were high heading into 2020, but they were tempered beginning in March when many job sites were closed, and clients began pulling back from commitments. Although some projects have restarted, there are not enough still on track or in development to give the company much hope of avoiding a revenue decline for the year.

“Owners, general contractors, and developers have a lot of uncertainty now, and so there’s some skepticism about the state of the construction market,” Holmes says.

In 2019, Hunt Electric Corporation (No. 20), Bloomington, Minn., had what President and CEO John Axelson judged as its third best year in 55 years, despite a 10% revenue decline from 2018. The new year began with optimism, he says, but those hopes were dashed when some 18 construction projects were put on hold in March, and service group clients began scaling back. Some projects have since restarted, but others — including a big water park and some airport work — are held up until at least early 2021.

“My positive side wants to think we’ll be back in the saddle next year and jobs will come back, but it will probably be longer term — not until 2022 or 2023 — until we can get this all fully behind us,” Axelson says.

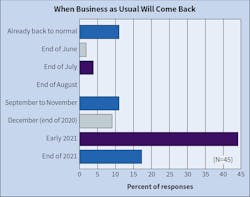

It could take at least that long for companies to recoup all that will have been lost this year, but contractors see a somewhat quicker path to a first step: normalization of business. Around 60%, presumably optimistic about pandemic control efforts, see “business as usual” resuming in 2021, with a majority expecting it in the first half (Fig. 7).

At Walker Engineering (No. 21), headquartered in Irving, Texas, 2020 is shaping up to be a more difficult year, following one that saw 10% revenue growth. CEO Scott Walker says delayed projects, reduced service contract work, and new job-site productivity constraints will make the year tricky on the revenue and profit fronts. Some of the company’s work has been disrupted by some 40 positive coronavirus tests across various job sites, he says, prompting concerns that productivity challenges and their pressure on margins could become more systemic.

“Starting and stopping to test and clean and take safety precautions has an effect and, moving forward, we’ll have to evaluate that when we price projects if that becomes the norm,” says Walker.

Revenues, profits at risk

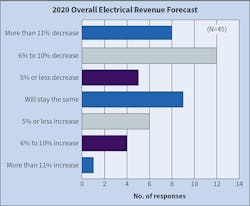

Concern with taking jobs that could be especially vulnerable to a drawn-out pandemic could be one component of a 2020 revenue decline for contractors. The other might take the form of fewer jobs to bid on due to slower economic activity. Whatever the cause, most foresee revenue declines for their companies this year. Of those offering a revenue forecast, 55% said they expect a decline; however, 17% say it could decline more than 11% (Fig. 8).

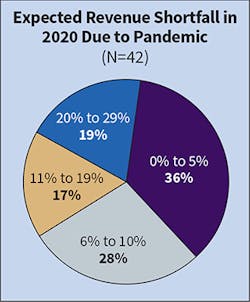

That’s the biggest share predicting a drop in years. Last year, only 11 of 47 companies expected revenues to fall in 2019. Trying to gauge the pandemic’s financial effect, 27 companies expect directly attributable revenue declines of at least 6% in 2020 (Fig. 9).

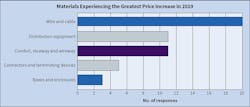

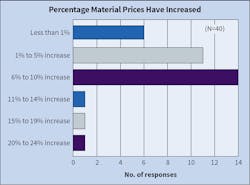

From a profit perspective, contractors could be squeezed by more competition and lower productivity. On the ledger’s other side, leaner operations and reduced labor costs could balance that out. But another factor, materials prices, doesn’t look to be of great concern (Fig. 10). Thirty-four contractors said they were seeing price increases, but most said the single item with the biggest hike increased by 10% or less (Fig. 11). For most, that was wire and cable, and mentions rose from 12 last year to 20.

That’s the item Facility Solutions Group (No. 15), Austin, Texas, cited, but executive vice president, Bob Graham, isn’t alarmed.

“Overall materials prices have been relatively flat,” he says. “We’ve been in a non-inflationary period for some time, and it’s not been affecting bid awards — so it’s less of an obstacle. There’s been some increases in lighting and controls packages, but they’re stabilizing.”

The pandemic could end up affecting global supply chains and raise material costs, but its revenue effect might also be measurable in terms of market sector impact. With speculation that office, retail, and entertainment-related construction could enter an extended depression, contractors reliant on them could suffer in a post-pandemic world. Conversely, those strong in data center, health care, and manufacturing markets could thrive.

Markets in play

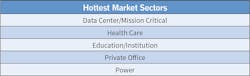

Over time, that could lead to a shift in the composition of the Top 50’s “hottest” and “coldest” markets. Nevertheless, that didn’t show up in 2019. Markets judged the most active were data center/mission critical, health care, education/institution, and private office, just as in 2018 (Table 2). Each of those sectors have been highly ranked going back several years. The roster of markets considered lackluster has shown more churn, and last year’s — led by hospitality, retail, automotive, and public building — reinforced that trend (Table 3).

Egan Company (No. 45), Brooklyn Park, Minn., had a 22% revenue gain in 2019, aided by ample health care, housing, and transportation jobs. A 24-story multi-family project in Minneapolis and a Twin Cities light rail line project stood out. Looking ahead, President and CEO Duane Hendricks sees a possible tilt away from office and high-rise residential work toward more health care and manufacturing.

“I’m very concerned about the working-from-home trend,” he says. “There could be an abundance of office buildings and a downturn in construction. Transportation infrastructure work could also slow, but with more health concerns (and the need to better isolate people in those environments), there could be a positive impact on health care building work.”

But many healthcare projects were hit hard when the pandemic reduced medical services utilization. Guarantee Electrical Co. (No. 43), St. Louis, saw construction, electrical service updating, and structured cabling work in that key revenue sector wither and spark concerns about a prolonged slump.

“We thought health care would be more secure, so that surprised us,” says Dave Gralike, president of Illinois and Missouri operations. “But some work has been postponed and just a few cancelled. We’re going to be anxious to see what happens with health care and education — another important area for us — how much brick and mortar will be needed.”

Rosendin, which reported that renewable energy and transportation markets were especially active last year, is approaching 2020 and beyond with an eye toward understanding where new or enhanced opportunity might lie in a post-pandemic world, while being cautious not to overestimate the potential impact.

“The pandemic has shown people can effectively work remotely, so we think that will impact the need for more data centers, and that possibly biotech and health care spending could grow,” Holmes says. “But we believe that solar and clean energy is the future no matter what circumstances we find ourselves in.”

Fewer labor woes

The present circumstances — delayed and suspended projects and contracts, fewer projects up for bid, uncertainty about future demand — has tempered (at least temporarily) one problem the industry has battled for years: finding enough workers. Long cited by Top 50 contractors as a chronic obstacle to company growth, difficulty finding/retaining quality employees now pales in comparison to the new worry: the coronavirus (Fig. 12). Only 16% called staffing the top barrier, down from 84% last year.

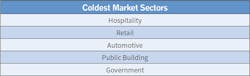

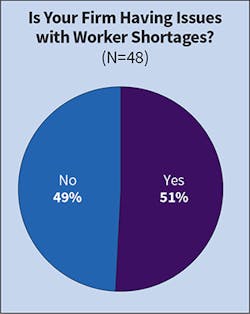

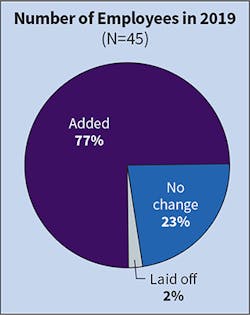

Across many recent annual Top 50 surveys, upward of 80% of contractors agreed worker shortages were a concern. This year, though, only half of the group rated it an “issue,” as shown in Fig. 13. The reason seems clear: Hiring has slowed concurrent with a business downturn. Only about 30% of contractors said they planned to add to their payrolls in 2020, while half said they would be laying off workers (Fig. 14). That’s a big change from recent years, including last year, in which some three-quarters routinely indicated they were in net hiring mode (Fig. 15). Should those expectations for reduced hiring pan out, it would be an abrupt about face from 2019 — a year in which almost 80% of contractors said they added employees.

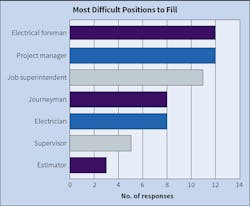

Not all hiring is frozen, of course, because contractors still have jobs to fill as workload needs dictate and workers leave. But the survey suggests contractors are having less difficulty hiring for a range of key jobs. A list of seven such jobs generated 59 total mentions as “difficult to fill,” down from 79 among the 2019 Top 50. Electrical foreman, project manager, and job superintendent drew the most mentions this year (Fig. 16), while journeyman, electrician, and electrical foreman topped last year’s ranking.

At Guarantee, Gralike says project manager has become a tougher slot to fill partly because the job demands increased familiarity with emerging technologies, which the company has become more reliant on to improve productivity and reduce the need for labor. The company has worked to manage its labor needs by generating a large enough backlog to permit better planning and scheduling, while avoiding getting beyond capacity.

“We’re mitigating man-hours through technology like robotic station layout, prefabrication, and process changes,” he says. “Our projects don’t require as many people as in the past; a 100 man-hour project has become an 80 man-hour project in some cases.”

Despite a receding business outlook, Walker Engineering still faces the long-term task of finding enough qualified workers — especially electricians, its top executive says.

“It won’t be as big a challenge as in 2019 because of where we’re at in the cycle, but we have some markets where we’ll experience some difficulties,” Walker says. “A lot of what we’re seeing is having to bring on people without much experience and then teach them using training programs and mentorships.”

Axelson says Hunt Electric’s labor force is unlikely to grow this year, but that areas of need persist. A few “strategic hires” have been made even since the pandemic slowdown began, he says, and widening talent gaps in technology areas like BIM continue to be addressed with new hires. But hiring, he added, is just one element of addressing manpower needs. The other is robust training, using all available resources to give staff the knowledge and capabilities to handle evolving demands.

“There’s been a concerted effort to evaluate what our own expertise is and how we can utilize that effectively in training, including a lot of cross-training between various divisions,” he says.

Training reliance

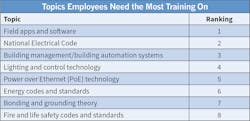

With an expanding range of knowledge needed to perform today’s demanding electrical contracting work, training needs continue to mount. Those new to the industry and even more experienced workers are challenged to learn critical elements of the work — everything from technical subject matter down to knowledge needed to navigate information technology essential to performing jobs. But foundational knowledge, it seems, concerns contractors the most when it comes to training needs. More again named field apps/software and the National Electrical Code as areas where employees need the most training support (Table 4). Other technical areas like building management/automation systems and lighting and control technologies also ranked high.

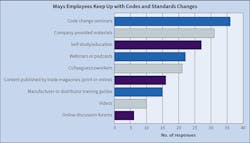

An evolving element of training concerns how it is delivered. Digital platform training usage has been growing and could become more important if distanced interaction becomes more entrenched. One area of impact might be in all-important electrical codes and standards education. The survey found formal code change seminars are still the most utilized education format, but that webinars/podcasts and self-study/education are gaining more traction (Fig. 17). Both got about a half-dozen more mentions than last year.

Up-to-date codes familiarity is vital at Rosendin, a big player in the highly regulated California energy market, and more of that knowledge is coming through digital platforms, Holmes says.

“We utilize live web-based instruction that can be shared anywhere and pre-recorded online content like LinkedIn Learning, which includes electrical code updates and clarifications,” he says.

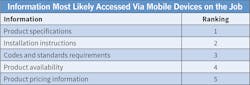

Meanwhile, more powerful information technology continues to revolutionize electrical construction and maintenance work, and contractors are finding it more indispensable in enhancing productivity, quality assurance, and safety. Contractors indicate employees are improving management functions — project, time, and labor primarily — with digital tools while also employing them for checks on estimating, product specification, and codes/standards compliance (Table 5). In the field, worker mobile device usage is spreading, and contractors say they are helping the most in quickly accessing needed product, installation, and codes/standards information (Table 6).

“People as a rule in the field aren’t carrying around paper drawings anymore,” Walker says. “They’re getting information they need much quicker off computer screens.”

AR/VR makes inroads

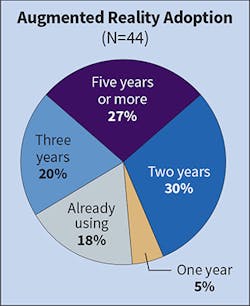

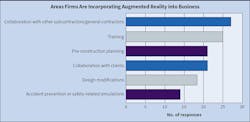

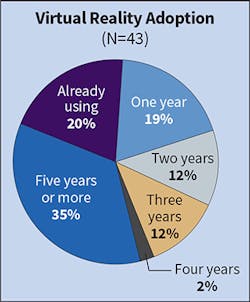

Improving digital tools that permit detailed plan and job-site visualization and manipulation, and design and construction collaboration continue to make inroads into contractor work. Augmented reality (AR) and virtual reality (VR) technology usage looks to be on a slow rise as a gap opens between committed users and wait-and-see types. With VR, the ranks of current users among the Top 50 grew to 20%, up from 7% among the 2019 Top 50. Still, 35% said usage is five years or more off, up from 27%. With AR, current-user ranks grew to 18% from 13%, while 27% said it’s five years or more, up from 18%. Both technologies present multiple productivity-enhancing opportunities but improving collaboration with other trades and training remain the top usage scenarios (Figs. 18, 19, 20, and 21).

At Hunt Electric, VR has moved beyond the experimentation stage and into a position where it could address a need for more distanced collaboration.

“We’re forced to look at this more with COVID,” says Axelson. “It’s still a matter of finding our way with it, but it could be a way to get information from remote sites to our main office and to let project managers walk through projects without being on the ground.”

Capabilities like that have long been considered part of a gauzy future for electrical contractors, but their time and other new ways of conducting business may be moving closer. One inescapable reason is the pandemic, a disruptive event that’s been described in futurist circles as an accelerant of slow-moving but inexorable trends.

The future, in other words, is here, and it’s one that many Top 50 contractors know they must learn how to navigate with less room for error. Almost without exception, top contractors referenced the pandemic in outlining the specifics of their companies’ greatest business challenges in coming years. While some see it as something to get beyond, others see it as something to respond to constructively. As one contractor described it, “Our biggest challenge will be learning what our ‘new normal’ looks like. As restaurants and retailers (our clientele) adapt amidst changes in the economy due to COVID, our business must learn how to proactively and reactively adapt to continue to grow our business.”

SIDEBAR: Pandemic Perspectives

The coronavirus pandemic has infected almost every element of business for electrical contractors. Besides hitting company revenues, it’s changing how EC&M’s Top 50 contractors conduct operations, protect employees, manage job sites, and juggle scrambled schedules.

Widespread pandemic-related project delays, many of which likely persist after taking hold in the spring, are now seen as the biggest barrier to timely and on-budget project completion, contractors say. Almost half place at least some of the blame on those delays, far outranking other reasons projects jump the rails (Fig. A).

In early summer, about half of Top 50 contractors said they had projects underway or set to start up to six months down the road that primary stakeholders had halted or delayed. Project types varied, but many were likely non-essential in nature.

“We’ve had a fair number of health care, food, and manufacturing jobs delayed or postponed, and while there have been discussions about restarting with some it could be a while, maybe a couple of years, before they pick up again,” says Egan's President and CEO Duane Hendricks.

Project opportunities of all types have receded as a direct result of the coronavirus, say many contractors, but common denominators include sectors hit by a slowing economy like oil and gas and entertainment, and those hit by temporary demand reduction like health care and non-essential service work. One pointed to stadiums and entertainment as casualties and another to manufacturing tied to specific industries.

Facility Solutions Group's Bob Graham, executive vice president, says reactive electrical services work has dipped more than 30% this year.

“Maintenance/repair/operations work and building electrical retrofit projects have slowed because of capital spend holds and a lot of unknowns for our customers,” he says.

Contractors have also struggled with how to navigate a work world where movement is restricted, social distancing is a priority, and environmental dangers lurk. All those factors complicate the completion of essential tasks, but contractors have been working to adapt.

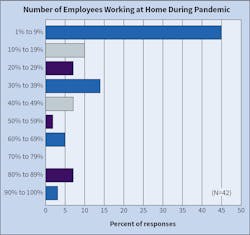

At the time the survey closed in early July, 42 companies said they have had to arrange for at least some of their employees to work remotely for the first time ever. Almost half, though, say they’ve moved less than 10% of their normally office-bound workforce to work-from-home status (Fig. B), a low number, suggesting that some workers may now be slowly returning to offices following widespread lockdowns.

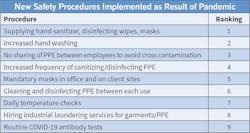

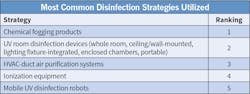

However, offices that may be filling back up are likely being restructured to accommodate more social distancing, while contractor project job sites that present major virus-spread concerns are incorporating new controls. Sixty percent or more of contractors polled say they have implemented seven procedures, ranging from increased hand washing and limiting PPE sharing to daily temperature checks and mandatory mask-wearing (Table A). Far fewer contractors, though, say they’re installing decontamination/sanitization products or systems at job sites to protect workers. Those that received the most mentions, by from nine to 13 companies, were chemical fogging products, UV lighting, and HVAC-duct air purification (Table B).

Zind is a freelance writer based in Lees Summit, Mo. He can be reached at [email protected].