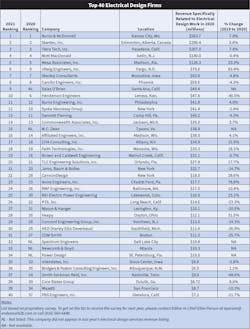

Designs on the Future: EC&M’s 2021 Top 40 Electrical Design Firms

With COVID-19 sending much of the U.S. economy into hibernation in the late winter of 2020, construction engineering and design firms worried for a time that demand for their services might go into a prolonged slumber as well. Though many ultimately held up, numerous projects underway, on the drawing board, or in the early proposal stages were canceled, shelved, or scaled back. Firms that had been basking in the warmth of an improving construction economy suddenly found themselves plunged into a cold, strange, and unpredictable new world.

The ensuing months proved to be a roller coaster of alternating worry and optimism about business prospects as the coronavirus pandemic ebbed and flowed. But the year ended with strong evidence — borne out this spring — that the pandemic’s end was in sight and that demand for construction services would rebound, possibly even stronger than before. Still, 2020 will likely leave its mark and could go down as a year when things changed for engineering and design firms, with its full impact on business growth prospects, operational practices, and market orientation likely to ripple out over the course of the next several years.

A recent probe into the condition of one important slice of these firms’ business — electrical design services — reveals that 2020 left a fair number of companies reeling and uncertain about the near-term future, but also optimistic that recovery would come, perhaps paired with changes in how they conduct business. That insight comes from the latest installment of EC&M’s annual spring survey of the country’s design firms with significant electrical-related business, producing a ranking, by electrical design revenue, of the Top 40 Electrical Design Firms (see Rankings).

The challenges 2020 delivered, however, wouldn’t be evident just by looking at revenue figures. This year’s Top 40 reported combined electrical design revenues for 2020 that were 4.8% higher ($2.301 billion) than those reported by last year’s group for 2019 ($2.195 billion). And while 17 firms reported revenue declines from 2019, a nearly equal number reported growth. That apparent disconnect — revenues being up despite a broad business slowdown — is probably best explained by revenue booking flow.

Scratch the surface, though, and a clearer picture comes to light from the survey: The full impact of the pandemic year of 2020 on business activity likely won’t be fully revealed until 2021’s electrical design revenue is long in the books. The year 2021 is shaping up to one of recovery and reset, possibly even to a market that rebounds and then some, but almost surely to one that will be navigated a bit differently.

Navigating a slide

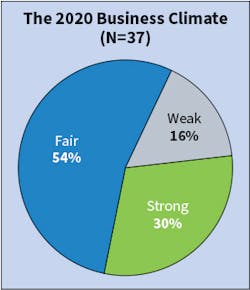

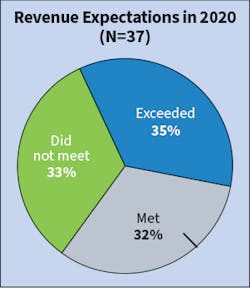

Putting that headline revenue number aside, there was an understandably big swing in sentiment among firms regarding 2020’s overall business climate. Just 30% of companies described it as “strong,” compared with the 74% of last year’s Top 40 that characterized 2019 that way (Fig. 1). And 16% said “weak” was the only word for it, a business climate descriptor rarely used by companies in annual Top 40 surveys of late. That may be a function of seriously dashed hopes and an onslaught of uncertainty: One-third of firms said electrical revenue figures for the year were disappointing (Fig. 2), spiking from the 8% last year who said they didn’t hit their numbers in the prior year. Clearly, COVID-19 was a game changer.

“We were looking forward to a banner year, up 10% to 15% on revenue, and then all of a sudden a lot of developers and institutions halted work,” says Mark Torre, managing partner at Jaros, Baum & Bolles (No. 21), New York. “Within a week of March 13, we were getting requests to wind down work and send the final bill. We hunkered down and worked to figure out ways to keep our business going.”

With many commercial and office projects suspended, JB&B moved up plans to expand outside its New York metro area-centric business base, namely into Boston and Philadelphia, Torre says. Offices were opened in those cities partly to be closer to life sciences business clients whose demands had been expanding and were being supercharged by the pandemic. That helped plug the gap, but by year’s end the firm’s electrical revenues were off 15% from a year earlier.

At Burns Engineering, Inc. (No. 11), Philadelphia, COVID delivered an “immediate shock,” says Michael Walton, director of advanced power systems. Within a month, though, it began getting reassurances that many large power distribution, transportation, and campus projects already in the pipeline would continue.

“Many of these critical projects needed to meet future needs that couldn’t be deferred and had to move ahead, so we were lucky to have many clients who continued with their plans,” he says. “There was some decline in the number of opportunities overall, but we had enough to see some growth, if not exactly what we projected. Geographic and market diversity helped us.”

Flexibility also helped Stantec, Inc. (No. 2), Edmonton, Alberta, Canada, weather the COVID downturn and ultimately meet its revenue goal. Though 2020 was judged only “fair,” Principal Byron Schmidt says teams were able to adjust, reposition, and collaborate to capitalize on new opportunities.

“Our broad regional reach and sector diversity allowed us to pivot quickly to markets like civic and industrial (particularly warehouse and distribution sectors) that were experiencing surges because of shifting consumer behavior and government funding priorities,” he says.

Market shifts

Construction design money flowed in new directions (sometimes quickly) in 2020, but many of the electrical design markets that performed well in the past continued to do so. Health care and utilities/transmission and distribution made it to the top five hottest markets list for the fifth straight year, education made its fourth appearance. A newcomer was renewable energy (wind and solar), hardly a surprise given growing demand for both utility-scale projects and microgrids (Table 1).

On the “cool” side of the market ledger, hospitality made it five years in a row on the most-sluggish market list, joined by retail, food and beverage, and private office, as well as education — a market that a near-equal number of firms found robust as well. The common denominator for the group was their linkage to a locked-down economy (Table 2).

With fewer markets to tap and fewer still hitting on all cylinders, companies had to be nimble or count themselves either lucky or star-crossed, depending on their mix of specialties.

Salas O’Brien (No. 9), Santa Ana, Calif., profited from its diverse client mix and its status as a preferred provider for many of its core governmental clients, enabling it to blunt some of the effects of a slowdown in other markets.

“We did see a decrease in hospitality — and some went on hold in commercial office — but repeat clients in markets where we’re not just competing on fees, in government, education, and critical infrastructure, helped us out,” says Tom Evans, principal/senior electrical engineer.

A diverse client and services mix on the electrical engineering side helped P2S, Inc. (No. 26), Long Beach, Calif., extract solid electrical revenues from health care, the federal government, and community college markets, says President/CEO Kevin Peterson. But that was counteracted by weakness in other markets. The net effect was a notable slide in revenues from 2019, but Peterson says the company navigated the pandemic well and managed to hit its COVID-adjusted revenue expectations by year’s end.

“The biggest hits in 2020 were in public universities, K-12 schools, commissioning, and related horizontal services like low-voltage technology, science & technology, and the respective electrical services in these segments,” he says.

Arora Engineers, Inc. (No. 23), Chadds Ford, Pa., rode largely uninterrupted work in its core aviation market to one of its strongest revenue growth years on record, says Adam Oliver, chief marketing officer.

“Once projects like large airport terminal projects with their long financial approval and contract processes get started, it’s hard to slow them down, and so a lot of our work kept up,” Oliver says. “And a lot of the building work continued during COVID, capitalizing on a supply-exceeds-demand construction market and reduced airport traffic that helped expedite construction work.”

Scheduling upended

Arora, along with many other design firms, benefitted in 2020 from a large slug of backlog — and it helped firms like Stantec weather the sudden hit to new business.

“We went into 2020 with a very strong backlog that sustained us through the first half of the year,” says Jeri Pickett, a firm principal.

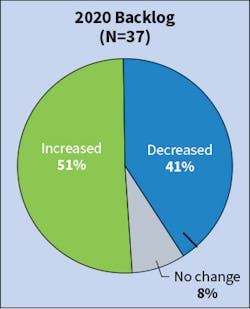

Ample backlogs allowed companies faced with unexpected project holdups and interruption in new business flow to shift resources to projects further back in the queue and keep them deployed. Another effect was to chip away at work in the pipeline at a rate not seen in years; 41% of firms said their backlog decreased in 2020 (Fig. 3), up from an average of about 10% in recent survey years.

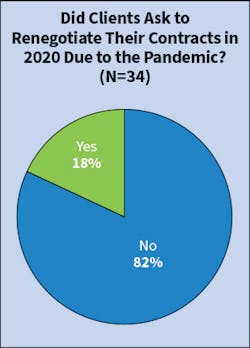

While hugely disruptive for design firms forced to change workflows, hammer out contract details on projects in progress, and consult with prospective clients in a confounding environment, the pandemic, it appears, didn’t produce wholesale concessions on the financial terms of design projects. While revisions might be expected in a suddenly turbulent marketplace, few firms indicated they were made or even discussed. Only 18% said clients asked to renegotiate contracts because of the pandemic (Fig. 4).

Looking back, most firms say, the greatest immediately felt impact the pandemic delivered was temporary: holds placed on projects. Though project cancellations and supply chain issues were among troublesome short-term by-products of the pandemic, delayed projects apparently proved disruptive and impactful — maybe well into 2021 — to more firms than anything else; 75% said they were a noteworthy result (Fig. 5).

Heavily oriented to government work, CDM Smith (No. 31), Boston, whose reported electrical revenue fell 25% last year, was exposed when pandemic shutdowns led to a shift in client priorities.

“A lot of municipal and federal work was put on hold as funds were diverted and funding mechanisms became a problem,” says Matt Goss, senior vice president/practice leader - MEP and energy. “A lot of projects were delayed, but not much was canceled. Some of that is starting up again now over the last several months.”

As 2021 unfolded, design firms were expressing optimism about postponed projects getting back on track and new work coming in the door. Progress in getting the coronavirus under control and the economy opened back up were telegraphing that perhaps the worst was over.

Signs of a turnaround

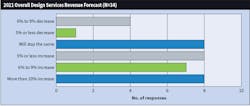

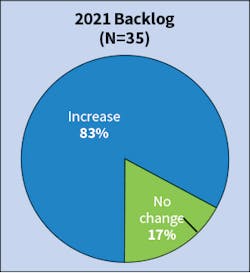

Even after so many failed to hit their revenue goals in 2020, 23 of 36 firms making a prediction expected company revenue increases in 2021, six more than last year (Fig. 6). Eight thought growth could rebound on the order of 10% or more. In another sign of strong optimism, 83% said they expected backlog to increase this year (Fig. 7), the likely result of postponed work restarting combined with new business, further testing firm resources. That’s way up from just over half of last year’s Top 40 predicting a backlog growth for 2020 as the pandemic unfolded, but more in line with backlog growth predictions going back three surveys earlier.

Smith Seckman Reid, Inc. (No. 37), Nashville, Tenn., is eyeing markets that could begin to see a pickup in demand in 2021 after suffering during the depths of the pandemic, says Kevin Rettich, technical resource group leader.

“At the end of last year, we started getting more inquiries,” he says. “Health care is picking up with a couple of hospital new construction projects that could become a reality, and we’re looking to diversify into multi-family with people who’ve come on board with background in that area. We weathered the storm last year, and we’re prepared for a 2021 that could be a good year for us.”

Core States Group (No. 38), Duluth, Ga., saw its revenues leap about 9% in 2020 and sees electrical revenues climbing strongly again this year as ongoing program work continues and new revenue streams form. John Ferguson, director of electrical engineering, sees retail and restaurant work that declined in 2020 coming back, and a push to break into both health care and a renewable energy market that looks to be sinking roots.

“Electric vehicle charging, battery storage, and solar are the three big legs of the opportunity stool in the energy market for us,” he says. “We’re not currently in the substation and T&D world, but that might be something to evaluate via an acquisition or merger. Health care, too, is an area we’re not in and is very specialized. We did some bolt-on acquisitions to support work in retail, restaurants, and financial markets a few years back, and we could do that again in these markets.”

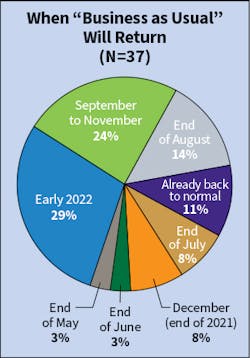

Tapping emerging markets that may beckon design firms in the wake of the pandemic could be drawn out, and that might throttle progress to fully recover from 2020’s disruption. Predictions of a return to normal has been a moving target ever since the pandemic hit. Nearly 40% of last year’s Top 40 said in the spring that “business as usual” would return by the start of summer 2020. The consensus of this year’s Top 40 is the latter part of this year or early next (Fig. 8).

“Some new things are starting to come in, but it’ll be mid- to late this year before we see a fuller recovery,” says JB&B’s Torre. “It takes time. We hope to maintain our revenues this year and they’ll hopefully take off by early 2022.”

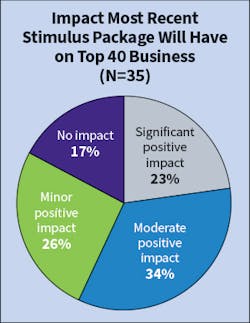

Firms’ fortunes going forward are almost sure to be influenced by the amount of public money flowing into the U.S. economy. Portions of several rounds of pandemic-related stimulus have found their way into construction projects. When asked about the impact of the most recent American Rescue Plan injection of $400 billion on their business, more than half said it would have a notable impact (Fig. 9).

Infrastructure to the rescue?

An even bigger boost to construction could flow from a domestic infrastructure plan now taking shape. That could open the floodgates on certain types of projects, some of which could incorporate significant electrical design components, such as grid hardening and renewable energy.

P2S, says Peterson, could be well positioned to benefit from any infrastructure spending that falls outside the transportation-related sphere. With its electrical and mechanical focus, he says, “I expect that a national infrastructure plan could boost our electrical engineering revenue by 20% or more.”

Stantec’s Schmidt says electrical design revenues almost surely would be bolstered by funding to improve and refashion the nation’s aging and vulnerable electrical grid. “Opportunities to update the grid, through resiliency, will be shifted more to underground, particularly in storm-laden areas of the country,” he says.

Engaged in New York’s Moynihan Station rail rehab project, JB&B is eager to see how an expansive infrastructure program might take shape. A broad one could be a boon to electrical design firms, Torre says, especially if elements include building upgrades, schools, energy efficiency, and more. “The supply chain and efforts to improve the urban-last-mile distribution facilities could be part of it.”

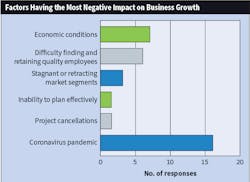

Passage of an infrastructure bill that could coincide with a last gasp for the coronavirus might amount to a one-two punch for juicing the economy. That’s a likely recipe for improving the fortunes of design firms, 65% of whom named either general economic conditions (seven mentions) or the coronavirus epidemic (17 mentions) as the primary impediment to business growth (Fig. 10).

Help “still” wanted

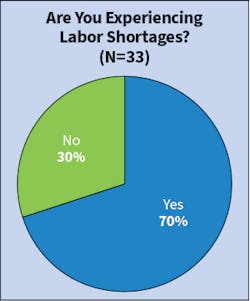

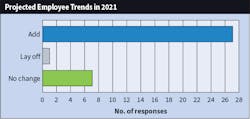

A notch below on that list of obstacles was difficulty finding and retaining quality employees. Even in a year that saw business fall off, six firms said that was negatively impacting growth, further evidence that the industry’s hiring and recruiting challenges continue. More came from the finding that 70% continue to experience labor shortages, up from 65% last year (Fig. 11). Still, last year’s challenges relieved some of the constant pressure to find talent; 15 firms said they added employees in 2020, half as many as those among last year’s Top 40 saying they added staff in 2019 (Fig. 12). But in another sign of optimism for a rebound, 27 firms said they anticipate net hiring this year (Fig. 13).

The consensus among top design firms is that talent and experience is in almost perpetual demand and that it’s a constant challenge to scout and lure those with the resume needed for a demanding and ever-changing discipline. Even after adding employees last year, including several electrical engineers, Salas O’Brien remains in the market, especially for those with experience.

“We have senior level openings almost everywhere in the country,” says Brad Kalmans, a firm principal. “But electrical talent is extremely tough to find.”

At Core States, there’s been more focus on luring talent away from other firms because interest among new grads in commercial construction electrical applications seems low, Ferguson says. But that became tougher with last year’s pandemic.

“People were reluctant to even start conversations about new opportunities and risking the move to a new firm,” he says. “They were more interested in security.”

At Arora, the slowdown in business allowed the company to reassess its staffing needs and structure. However, demand for stars hasn’t slowed, but picked up, Oliver says.

“We’re struggling to find electrical talent, specifically, at every level,” he says. “We need high-level leads and production engineers in jobs that have been open 18 months or more. The high-tech specialized nature of what we do is an issue. We can’t hire a senior electrical engineer if it’s their first time to take on an airport project.”

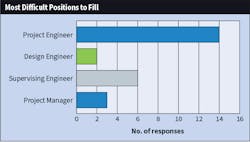

Engineers with both technical experience and a project-level orientation remain in particularly high demand. Project engineer, by far, is the toughest slot to fill, firms said, one that’s drawn the most total mentions over the last four survey years (Fig. 14).

Stantec’s Pickett says mid-career project engineers are in high demand but hard to find, “a ripple effect from the 2008/2009 economic slowdown” that saw many engineers leave the industry.

A new development challenge

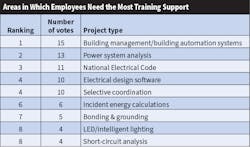

Getting people in the door, experienced or not, is just part of the readiness challenge for design firms. Ensuring engineers are continually gaining knowledge as they perform their work and through formalized training is essential for growth. Areas of emphasis in building knowledge and experience in the electrical realm are expanding as demands for expertise multiply. One that’s been growing in line with demand is building management/automation systems, once again selected (from a list) by the most firms as the area where training support is most needed (Fig. 15).

“As buildings begin to utilize the Internet of Things and become more automated, everyone needs to be more well-versed in that area,” says CDM Smith’s Goss. “It was just lighting for a long time, but now we’re adding more and more on top of that, so everything has to work seamlessly.”

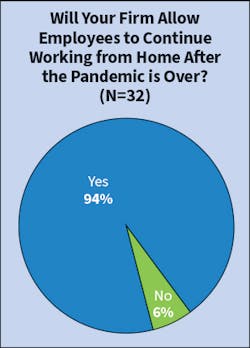

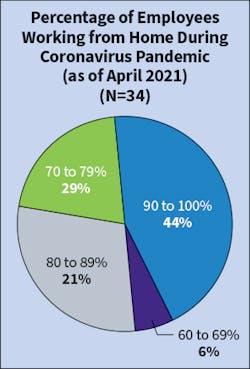

Training and staff development, along with collaboration and bonding long considered essential to productivity, might have suffered setbacks in 2020 as firms shifted to remote work arrangements, but evidently not enough to convince firms that the practice must end. On the contrary, almost all firms surveyed said they would allow employees to continue some degree of home-based work after the pandemic ends (Fig. 16). And as of now, that’s a fairly big number. About 70% of firms say that at least 70% of employees who transitioned to home-based work when the pandemic hit last year were still doing so this spring (Fig. 17).

Smith Seckman Reid management, Rettich says, has grown comfortable with remote work and plans to give managers leeway in determining what level of it works for their teams going forward.

“Our competition will be out there doing remote work, so we need to be flexible,” he says.

Indeed, flexibility and adaptation are watchwords for design firms emerging from a pandemic that could have repercussions on business and society. From a short list of possible lasting impacts on operations, three generated the most agreement: replacing more in-person meetings with virtual; more employee remote work; and expanded use of competitiveness-boosting design technology tools (Fig. 18).

At Burns Engineering, the pandemic forced physically separated team members to use high-tech design technology more collaboratively, a need that will likely outlast the pandemic as remote work becomes more routine, Walton says. That’s yielded some new efficiencies and accelerated comfort with virtual communication, but the company is guarded about the downside.

“We do feel that a hybrid (remote/in-person) working environment that aids interaction and mentorship is still important,” Walton says. “In-person is still necessary on large projects, and it also is important in creating opportunities for staff member advancement.”

However work gets done going forward, there’s little doubt that established design firms that lead the way in delivering the electrical component of projects will have a commanding perch.

Electrical design, says Stantec’s Pickett, “is increasingly becoming a larger part of the design component of facilities,” and requires engineers competent in power, fire alarm, security and controls, and “trained as power specialists, lighting designers, and information and communications specialists” to be at the table.

“New and renovation work will continue to drive the buildings industry,” he says. “Electrical engineering plays a key role in both types of projects.”

Tom Zind is a freelance writer based in Lees Summit, Mo. He can be reached at [email protected].SIDEBAR: Little Momentum Evident on VR/AR in Electrical Design Work

Construction is almost certainly on a path to broader adoption of digital plan visualization enhancement technologies like virtual and augmented reality (VR/AR). But Top 40 electrical design firms don’t seem to be pushing too hard to get there.

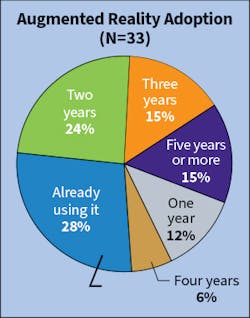

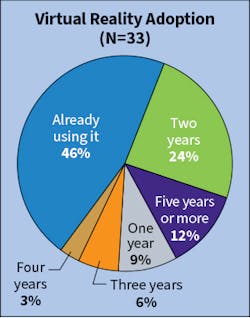

The latest EC&M Top 40 survey shows little discernible movement in firms moving closer to seeing AR or VR as viable components of their electrical design work. Just 28% of firms say they’re already using AR, close to the average of the last four surveys, as shown in Fig. A. With VR, 46% of firms say they’re using it, but that’s down from 58% of last year’s Top 40, a bit different mix of companies. Two years ago, the number was 30% (Fig. B).

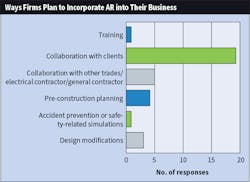

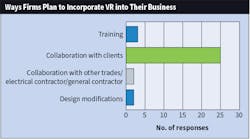

There’s some consistency, however, in what firms have been speculating about where the technologies fit in. The overwhelming majority again say the most likely application for each over the next few years will be client collaboration (Fig. C and Fig. D).

New this year was a question about how both AR and VR are now being used specifically in electrical applications. A few answers were detailed and specific, but most were generalized speculation.

Among the AR responses: “provide visual representation of electrical equipment on mobile devices using AR;” “in BIM models for clash detection;” “scan and document every detail of some of the most challenging and tight spaces, viewable on any computer or VR device;” “conduct site investigations to document as-built conditions, conduct virtual walkthroughs of space and immersive client meetings within virtual space;” and “overlay of new design over existing facilities to stitch in new design and evaluate design options.”

The VR responses included: “as part of the project review process, used to view electrical devices, including above-ceiling cable trays, along with architectural mechanicals, structural elements to visually check working clearances and coordination;” “walk through of facilities with complex electrical and mechanical systems;” “lighting simulations;” “to explain the detailed electrical design as well as multi-disciplinary/contractor coordination;” and “the technology is still at the proof of concept level for electrical in collaborative design workflows.”

At Salas O’Brien (No. 9), Santa Ana, Calif., neither technology is finding much application yet in electrical design, says Tom Evans, principal/senior electrical engineer.

“They don’t carry through projects all the way,” he says. “It’s now done more as a marketing or visualization tool in the architectural drawing stage for the owner to see what they’ll be getting.”

At Core States Group (No. 38), Duluth, Ga., the director of electrical engineering sees potential value.

“It’s very limited usage now, but we see opportunity as far as modeling things in the actual space and helping visualize what an EV charging or battery storage space might look like,” says John Ferguson. “We haven’t done much in electrical yet because so much of it is limited to switches and receptacles.”