Interconnection is the process of hooking a generation source to the grid. That term also describes the delicate relationship between the land, labor, lines, zoning, grid capacity, and equipment that make up a solar farm. If just one piece isn’t in place, the whole project falls apart. Sometimes multiple pieces are absent simultaneously, while other times putting together a project can feel like a game of Whac-A-Mole.

“Elevated financing costs, transformer shortages, and interconnection bottlenecks are impacting the utility-scale segment, which saw its lowest level of new contracts signed in a quarter since 2018,” according to the latest U.S. Solar Market Insight report from the Solar Energy Industries Association (SEIA) and Wood Mackenzie. “However, improvements in the module supply chain have led to a record 12GW of utility-scale deployment in the first nine months of 2023.”

No wonder solar farming can seem as feast or famine as agriculture, with the political equivalents of droughts and floods emerging out of nowhere.

“You get large federal regulatory items like the Inflation Reduction Act (IRA) that drive a bunch of demand and new projects,” says Robert Wright, solar and storage business line lead at 1898 & Co., a Burns & McDonnell consultancy subsidiary. “But then you get issues with anti-dumping tariffs for international imports on stuff like solar modules and a couple-year lag bringing on domestic products.”

The U.S. Department of Commerce anti-dumping investigation created so much uncertainty that it prompted the cancellation or delay of 318 projects in 39 states worth a total of $52 billion, according to a 2022 SEIA study, which added that this “represents only a fraction of likely impacts.”

“You start solving one piece — modules — but right now it's the high-voltage equipment that's the longest lead times on our utility-scale [projects],” Wright says. “Main power transformers and high-voltage breakers are the critical path item on a lot of these. Even compared to transmission constraints and the queue times to get interconnect applications through, a lot of times we're seeing those long lead procurement items being even more of a constraint on when we can actually get facilities online.”

Prime real estate is elusive

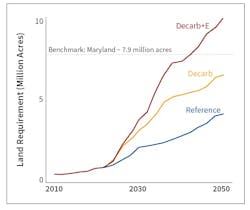

To meet the goal of supplying 45% of all U.S. power by 2050, solar panels will need to blanket about 10.3 million acres, according to the U.S. Department of Energy’s Solar Futures Study, as shown in the Figure at right. That’s more than all of Connecticut and Massachusetts combined. Some of that will be atop homes and businesses, but most will be on the ground in the form of solar farms spanning hundreds of acres apiece.

That scale makes them a tough sell — even in rural areas. Many communities have blocked or delayed projects amid concerns about their impact on the environment, property values, and arable land. The same objections often stand in the way of the transmission lines that those farms need in order to be built.

“What I’m seeing in working with some of the larger clients is there are definitely siting challenges: getting available land at a reasonable cost and proximity to high-voltage lines that are not congested,” says Dan Akselrod, principal electrical engineer at Centennial, Colo.-based Stanley Consultants.

A big plot of land on the edge of town with high-voltage lines nearby might look ideal. However, digging into the ground and local codes can uncover issues that drive up the project’s complexity and cost.

“A lot of times that area is split up — gas lines underground, telecom lines, easements, and rights of way for rail or roadways — so there’s a lot that we have to build around,” Akselrod says. “Depending on the location, local fire codes also are an issue. On one of my battery energy storage projects, the fire department is considering the location to not be a rural or isolated location. That is affecting our ability to even build the project because we don’t have space for a 100-foot offset from the property line. There are a lot of regulatory issues like that.”

But in other cases, government control can enable projects that wouldn’t be viable elsewhere. For example, Nevada has about 50 days more sunshine than the national average, but that’s not the reason why it’s home to so many utility-scale solar farms. Roughly 80% of the state is owned by federal agencies such as the Bureau of Land Management (BLM).

“You have the advantage of tremendous insulation [and] a lot of available land,” Akselrod says. “Also, at least north of Las Vegas, there are available transmission lines.”

More is on the way. In January, the BLM updated its 2012 Western Solar Plan, which originally identified areas in Arizona, California, Colorado, Nevada, New Mexico, and Utah with “high solar potential and low resource conflicts.” These areas have “fewer sensitive resources, less conflict with other uses of public lands, and close proximity to transmission lines.” The 2024 plan adds Idaho, Montana, Oregon, Washington, and Wyoming, bringing the total amount of public land available for solar farms to about 22 million acres.

Girding the grid

The limited number of viable interconnect locations around the country is just one grid-related challenge. As the solar farm market grows, so does the number of interconnect applications and thus the length of the approval queues.

“Nationwide, they're getting longer and longer,” says 1898 & Co.’s Wright.

The good news is that grid operators have a vested interest in streamlining this process.

“The transmission owner/planner [thinks]: ‘How can I make my grid more attractive to renewable developers?’” says Debrup Das, Hitachi Energy's head of renewables for North America. “All the counties, states — you name it — they want to have this energy transition. So, if I don't make my grid attractive to developers, they will invest somewhere else.”

But those upgrades require a lot of time and money, according to the U.S. Department of Energy’s October 2023 National Transmission Needs Study.

“Their finding was when it comes to transmission within a region, we have to grow 64% or so,” Das says. “In terms of interregional transfer, we have to grow more than 110%. The bottom line is if we want to go through this energy transformation really quickly, we have to really invest a lot in transmission.”

High-voltage direct current (HVDC) technology could provide flexibility on a national scale, according to the National Renewable Energy Laboratory’s Interconnections Seam Study. HVDC lines would bridge the seam between the country’s eastern and western interconnections to create a national macrogrid.

“We need to have more interregional transmission because when it is peak usage on the eastern side [of the country], it's not peak on the western side,” Das says. “Their conclusion was out of the various technologies that can help, HVDC is the most effective and [has] a benefit-to-cost ratio of 1.2 to 2.5 [to 1].”

Another emerging option is dynamic line rating (DLR) technology. Each transmission operator has ratings that determine how much power its lines can safely handle. DLR uses sensors on that infrastructure to monitor aspects such as temperature and wind, which affect each line’s thermal capacity. For example, strong winds can cool a line enough that it can accommodate more generation while they’re blowing.

“The whole point of DLR is there's the ability to flow more power on these lines than a static limit would entail,” says Patrick Finn, a Wood Mackenzie senior analyst who covers North American power markets. “They're giving real-time information to the transmission operator saying, ‘Based on the temperature on this on this sensor and the wind speed, the actual limit of this line right now is 120 as opposed to 100.’”

A couple of Pennsylvania transmission operators studied how DLR compares to reconductoring or rebuilding lines in terms of time, money, and additional capacity.

“In their presentation, PPL said DLR would be the more cost-effective solution and increase the capacity of that line by 10 to 30%,” Finn says. “I think Duquesne [was] similar: around a 20% increase.”

DLR also could complement battery energy storage systems (BESS) by enabling the grid to handle more stored power — and not just from solar farms.

“Technologies such as DLR allow us to maximize the existing transmission infrastructure by helping move all resource types,” says Brandon Morris, a Midcontinent Independent System Operator (MISO) spokesperson. “Renewable technologies like solar and wind are weather dependent, and their availability can fluctuate. We’re focused on answering the questions of how to ensure both adequate resources and necessary grid services to manage the grid under increasing penetrations of renewable energy.”

Solar farms also could leverage the coal-fired plants that they’re helping replace.

“When they're decommissioned, you could use the existing generator and electrical interconnections as a synchronous condenser to provide volt-amp reactive (VAR) power to the grid and inertia,” says Stanley’s Akselrod. “That is something that the solar power plants do not provide. The power generated must equal the power consumed in any given instance. The reason why the grid doesn't collapse when you turn on the lights is that inertia. Solar fields don't have that spinning energy storage that traditional power plants have.”

BESS is more

Grid bottlenecks are one of the reasons why solar farms increasingly include co-located BESSs, either from day one or as a follow-up project. Utility-scale BESS can store power that the grid can’t handle at certain times of the day and then release it when capacity becomes available.

“I think it's becoming more of the norm,” Akselrod says. “I'm seeing more demand for just standalone BESS at the distribution level to help local utilities.”

If solar production were a line on a graph, it would look like a duck’s back and neck, with output dropping and then increasing during the course of 24 hours. BESS helps flatten this “duck curve.”

“One of the ways that we're mitigating it in this project I'm working on is the inclusion of a BESS to pick up that load in the very late afternoon and early evening,” Akselrod says. “As more coal-fired generation is retired, this is going to be even more important. We need more energy storage in general.”

Help wanted

As with electric vehicle charging infrastructure and so many other sectors, capitalizing on the utility-scale solar business opportunity requires an ample supply of people and equipment.

“There is a lot of wiring work,” Akselrod says. “This is not master electrician-level stuff. It's more journeyman level. There's a tremendous opportunity for electrical contractors. It's not like building a nuclear power plant. It can be fairly cookie-cutter, so these guys can make a lot of money.”

The catch is that they can make a lot of money close to home, too.

“That is one of the issues I see on my project in Nevada,” Akselrod says. “It's a fairly rural area not too far from Las Vegas. They would rather work close to home in Vegas versus driving all the way up to the project site.”

On the equipment side, solar farm developers are becoming more flexible to keep projects on schedule.

“We're seeing our clients expand their approved vendor lists [to] consider more OEMs that they otherwise would not,” says 1898 & Co.’s Wright. “If you can shave a year off a 345kV breaker, that makes sense.”

But despite all of the challenges, the future looks bright.

“These issues are really the result of a very strong industry with a ton of demand,” Wright says. “So, it's a good problem to have.”