Wind energy pricing for land-based, utility-scale projects remains attractive to utility and commercial purchasers, according to an annual report released by the U.S. Department of Energy (DOE) and prepared by the Lawrence Berkeley National Laboratory (Berkeley Lab). Prices offered by newly built wind projects in the United States are averaging around 2¢/kWh, driven lower by technology advancements and cost reductions.

Key findings from the U.S. DOE’s "Wind Technologies Market Report" include:

- Wind power additions continued at a rapid clip in 2016. Nationwide, wind power capacity additions equaled 8,203MW in 2016, with $13 billion invested in new plants. Wind power constituted 27% of all U.S. generation capacity additions in 2016. In 2016, wind energy contributed 5.6% of the nation's electricity supply, more than 10% of total electricity generation in 14 states, and 29% to 37% in three of those states (Iowa, South Dakota, and Kansas).

- Bigger turbines are enhancing wind project performance. The average generating capacity of newly installed wind turbines in the United States in 2016 was 2.15MW, up 11% from the average over the previous five years. The average rotor diameter in 2016 was 108 meters, a 13% increase over the previous 5-year average, while the average hub height in 2016 was 83 meters, up 1% over the previous 5-year average.

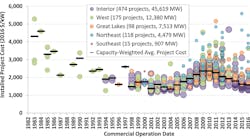

- Low wind turbine pricing continues to push down installed project costs. Wind turbine equipment prices have fallen from their highs in 2008, to $800-$1,100/kW, and these declines are pushing down project-level costs. The average installed cost of wind projects in 2016 was $1,590/kW, down $780/kW from the peak in 2009 and 2010.

- Wind energy prices remain low. Lower installed project costs, along with improvements in capacity factors, are enabling aggressive wind power pricing. After topping out at nearly 7¢/kWh in 2009, the average levelized long-term price from wind power sales agreements has dropped to around 2¢/kWh — though this nationwide average is dominated by projects that hail from the lowest-priced region, in the central United States.

- Manufacturing supply chains continued to adjust to swings in domestic demand for wind equipment. Wind sector employment reached a new high of more than 101,000 full-time workers at the end of 2016, and the profitability of turbine suppliers has generally rebounded over the last four years.

To read the full report, click here and scroll to the bottom of the web page to access the .pdf.

Voice your opinion!

Voice your opinion!

To join the conversation, and become an exclusive member of EC&M, create an account today!

Continue Reading

Continue Reading

Sponsored Recommendations

Sponsored Recommendations

Latest from Renewables

Latest from Renewables

Sponsored

Sponsored