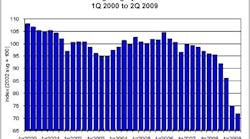

In addition to a substantial first quarter decline, the National Electrical Manufacturers Association (NEMA), Rosslyn, Va., reports that its Lighting Systems Index contracted another 4.3% during the second quarter of 2009. The drop marked the third consecutive quarter in which the index has fallen to a new all-time low reading. On a year-over-year basis, the index was down even more sharply, plunging almost 25%, and has registered more than a collective 30% drop from its cyclical peak in early 2006. For the third consecutive quarter, all major types of lighting equipment that comprise the index posted lower inflation-adjusted shipments versus the second quarter of 2008, with a particularly sizable year-over-year decline in luminaire shipments.

After seeing macroeconomic activity nose-dive in late 2008 and early 2009, economic conditions appear to have stabilized, although at a low level. In fact, it’s probably the 3-year plunge in new home construction came to an end in early 2009, with homebuilding registering moderate gains over the past several months. Although this should improve the declines in residential lighting equipment, the tenuous state of the U.S. consumer’s balance sheet and poor conditions in the labor market suggest spending on lamps, especially energy-efficient lamps with a higher first-cost basis, could remain under some downward pressure.

By comparison, the backdrop for lighting equipment mainly used in nonresidential market applications is anticipated to meet with several more quarters of weakness as the commercial real estate downturn expands. Office vacancy rates are quickly nearing levels seen during the aftermath of the dot-com bust and 2001 recession as financial and business services companies have laid off a countless number of workers while the manufacturing sector’s downturn has resulted in a new record high in industrial vacancy rates. Furthermore, capacity utilization rates are at a record low as producers have drastically cut back output as businesses have slashed capital spending outlays and liquidated inventories. Replacement demand for lighting as well as retrofitting to energy-efficient systems will be diminished as firms try to find short-term fixes to cut costs and restore profitability. Even as economic activity begins to recover within the next few quarters, the large amount of vacant office, industrial, and retail space available will weigh on new construction activity, and by extension constrict demand for nonresidential-use lighting equipment as late as 2011.

Source: NEMA