Although the commercial communications cabling market has slumped, home systems remain steady sellers.

There has been talk in the voice-data-video (V/D/V) cabling industry for the last few years that residential networking will be the next big thing. However, those with long memories will recall similar claims made for ISDN, video conferencing, and most recently for DSL, so they may be forgiven if they take a wait-and-see approach.

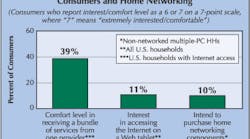

All indications, though, are that the residential cabling market is for real. Consumer demand for broadband communications services is clearly growing. Parks Associates, a Dallas-based market research firm, recently released a market study showing that nearly 40% of Internet-connected households in the United States are very interested in receiving bundled broadband services (Fig. 1 above). According to Parks Vice President of Research Kurt Scherf, “2001 proved to be eye-opening in what we learned about the consumer, the technologies, and the market strategies aimed at home networking. We believe that 2002 and 2003 will be critical years in the deployment of home networks and residential gateways.”

Market-research projections do not always translate into sales, but V/D/V industry insiders report the residential side of the cabling market has remained strong into 2002, despite the economic downturn.

“The cabling industry is still strong,” says Bob Jensen of Fluke Networks, Everret, Wash. “Sales on the residential side are probably level, while the commercial side has declined somewhat. I think this is because networks continue to be installed in high-end homes. I don’t see much in the middle to lower end of the market, but that should come back after the downturn.”

Housing starts are key. Unlike the commercial cabling market, where a substantial percentage of the business comes from network upgrades, the residential market depends heavily on new housing starts, creating a dilemma for residential installers.

The 2002 McGraw-Hill Construction Outlook, known as the F.W. Dodge Report, reports that although the economy weakened in 2001, single-family housing showed surprising strength. The report estimates single-family housing for all of 2001 to be 1.2 million units, a 1% gain from 2000. It goes on to say new-home construction will not show much upward movement during the first half of 2002, but stronger contracting is expected during the second half of the year.

“The economic downturn is not affecting the residential market,” says Rob Jewson of Superior Essex, Fort Wayne, Ind. “Builders are still putting in standard networking packages, while the retrofit market remains slow, probably because of increased wireless opportunities.”

Clearly, there is business opportunity in residential networking. So, why is it that if you open your local Yellow Pages, you won’t find many, if any, listings for residential communications cabling installers?

Challenges accompany opportunities. The installers themselves have the best answer to that question: It’s a tough way to make a living. “I won’t turn the work down if I get it,” says Douglas McNie, owner of Low-Voltage Systems of San Leandro, Calif. “But I won’t advertise for it either.” McNie’s complaints are common among other installers: The work takes longer to complete, the jobs pay less, and doing this work is a bigger headache than it’s worth.

“It’s a pain to work with home customers,” he adds. “They don’t understand the systems and they’re prone to changing their minds.”

Perhaps more importantly, retrofits to existing homes can be time-consuming and unpredictable. Wooden house construction is not conducive to running new wires because unlike commercial environments there are no dropped ceilings above which to install cable. Finished basements and attics—and sometimes even the absence of them—can also make it difficult to fish cable runs.

New construction is different because it usually involves the installation of standard cabling packages put in when the walls and ceilings of a home under construction are still open. However, new construction has its drawbacks, too. The margin for installations in middle- to lower-priced tract housing is kept low by the developer, and the installer must be willing to meet very tight rough-in and trim-out schedules.

Technologies are changing. In addition to economic and labor difficulties, there are technological obstacles to entering the residential cabling marketplace. Residential networking is a new area, even compared to the 15-yr-old commercial cabling industry, dating back to the divestiture of the Bell system in the mid-’80s. As such, it faces problems common to technological innovation, among them:

-

The development of standards has lagged behind the initiative of manufacturers, creating a marketplace where proprietary systems are common and interoperability is a serious concern. For example, the ANSI/TIA/EIA-570-A standard for residential wiring does not currently cover residential gateways, whole-house audio systems, home theater, home automation, home security, lighting control, or other consumer technologies already on the market.

-

New vendors, technologies, and ideas come and go rapidly, making it difficult to keep up with the market and impossible to know where it may go in the future. For example, will the much-touted residential gateway be the predominant technology 5 yrs from now, or will some alternative emerge?

-

Home networking today is fragmented among a number of different industries, each with its own trade organization, standards, vendors, technologies, cabling media and components, and installation procedures. There is little crossover, for instance, between the video standards of the Society of Cable Telecommunications Engineers (SCTE) and similar telecommunications standards of the TIA.

-

Because so much of the residential market potential is in retrofits, a number of greatly advanced technologies not involving structured cabling have been introduced, further clouding an already diverse and complicated picture. Among these “no new wires” initiatives are the Home Phoneline Network Alliance (HomePNA), HomePlug Powerline Alliance and HomeRF Working Group, which depend, respectively, on installed telephone cabling, the electrical network installed in the home, and wireless technology that circumvents the need for rewiring.

Although these issues may appear to be overwhelming, they are far from it. Each of the problems and obstacles in the residential cabling marketplace is being attacked aggressively and will be resolved in the near future. The real challenge for installers and contractors either entering this area or interested in entering it comes in getting reliable training and finding up-to-date information sources.

Information, training are crucial. “‘Structured cabling’ has become a buzzword, but many installers don’t really know what it means. Two coax drops and two phone lines to service a whole house is not structured cabling,” Jewson says. He points out that many electrical and communications distributors are starting to offer half-day training courses on home networking. He recommends installers look for such introductions as a way of getting better acquainted with the market.

Union and independent electrical contracting groups have also introduced residential networking into their training curricula. However, for unaffiliated installers and contractors, there remains a dearth of professional-level information about this discipline.

BICSI is one group trying to remedy this situation. The telecommunications organization has just published the first edition of its Residential Network Cabling Manual, the first technical and training manual aimed at the residential installer rather than the homeowner. The manual covers the design and installation of residential structured cabling systems in new construction and existing homes, and in single-family residences and multitenant units (See Figure). In addition to installation, the manual covers such related topics as safety, grounding and bonding systems, and testing and troubleshooting. BICSI will follow up the manual this spring with a training program in residential cabling, eventually leading to a registered specialization in this area.

BICSI offers an online training program covering the TIA’s residential cabling standard, and PowerPoint presentations updating the residential marketplace are available on its Web site.

A few more information sources on residential networking are also worthy of mention. The Copper Development Association (CDA) has sponsored the development of two training videos produced by residential networking specialist, The Training Dept. The videos cover both retrofit and new-construction installations. Further information is also available from the Home Automation & Networking Association (HANA) and the Continental Automated Buildings Association (CABA).