Solving the Skilled Labor Shortage

In the next six years, the construction industry could face a shortage of 1.6 million workers, according to the U.S. Bureau of Labor Statistics. However, many of the nation’s top electrical contracting companies and engineering firms aren’t waiting until the last minute to embrace this challenge.

For example, a six-year apprenticeship program has been going strong for 15 years at USIS, a Pearl River, N.Y.-based electrical contracting firm. The Lagana family, who owns and operates USIS, has expanded its number of instructors and classrooms and employed such recruiting channels as local vocational schools, colleges, and Armed Forces Veteran Representatives.

“During a seminar in the 1990s, an industry leader named Peter Cockshaw told everyone that the Baby Boomers would retire, and the young kids wouldn’t want to work with their hands, but instead work in an air-conditioned office,” says Jimmie Bodrato, vice president of electrical services for USIS. “Over the last four years, I’ve realized that Peter’s predictions have proven to be quite accurate.”

Today, about a quarter of today’s electrical engineers are aged 55 or over, according to Economic Modeling Specialists International (EMSI). In addition, roughly 40% of the construction workforce is 45 years or older. As a result, 3.7 million construction workers will be approaching retirement within the next decade, according to the “2013 Current Population Survey” from the U.S. Census Bureau.

With more electricians and electrical engineers heading toward retirement, many of the largest electrical contracting companies and engineering firms are placing a large emphasis on hiring, training, and recruitment. For example, 70% of the electrical contracting companies on EC&M’s Top 50 list planned to hire new staff in 2015, and 32 of the Top 40 electrical design firms expected to hire new employees last year.

When work slowed down in the construction industry, however, not all firms took such a proactive approach to hiring skilled workers. According to the Associated General Contractors of America (AGC), the industry was forced to lay off more than 2 million workers since 2006. Nine years later, the industry is now scrambling to find skilled workers to fill key positions. As a result, the skilled labor shortage could undermine the recovery of the industry and impact the broader economic growth if staffing shortages delay construction projects, according to the association’s 2015 Workforce Development Plan.

While the AGC recently reported that construction industry employment is now on the rise (see By the Numbers: A Look at Today's Construction Labor Market below), and 55% of the country’s regions are adding construction jobs, the labor shortage could be impeding employment growth, says Ken Simonson, chief economist for the AGC.

“Contractors are adding workers in many parts of the country again, which is consistent with the robust growth that is occurring in construction spending,” Simonson said in a recent report. “But job gains would be even more widespread if contractors could find enough qualified, experienced craft workers and supervisors as well as new entrants to the industry.”

According to the U.S. Bureau of Labor Statistics, the number of electricians in the market will grow nearly 20% from 2012 to 2022, and 114,700 new job openings will be created over the 10-year time frame. For electrical engineers, the BLS job outlook is lower than average — at 4% — as 12,600 new jobs are expected to be added by 2022.

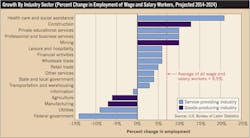

In terms of the overall construction industry, the BLS estimates that it will add 790,204 jobs by 2024. While employment in this sector won’t return to the peak level of 2006, even with the addition of jobs, the BLS ranked construction as having the fourth highest employment change out of all the industries (see Chart).

Poaching problems

Adding to this ever-growing problem, electrical design and construction firms are now facing a threat from an unusual source. Over the last few years, sophisticated building owners have hired engineers and project managers, worsening the labor shortage, says John Boncher, president and CEO of Cupertino Electric, San Jose, Calif.

“Companies have always had facility departments, but what we are seeing now is that they are bringing high-level construction expertise in-house,” Boncher says. “They are hiring those folks who used to sit on the contractor side and bid, design, and build projects. While we have a great company, it’s hard to compete with these Silicon Valley firms and big-name brands.”

Not only are building owners poaching electricians, but tech companies are also luring engineers away from the electrical design industry. Many times, Glumac trains new graduates, and grooms them to become managers, only to have them recruited through LinkedIn by the large tech firms, says Steve Strauss, CEO of Glumac, San Francisco.

“We have lost some of our best engineers to Google, Facebook, and those kinds of companies that are paying much higher salaries than we can afford to pay,” Strauss says. “That is creating a shortage of engineering staff up and down the West Coast. Other people are stealing from our competitors and from us, and it’s not a good situation.”

As a result, Glumac is facing a serious shortage of engineers, Strauss says. To fill its open positions, the firm has hired new graduates, put them through boot camp, and trained them, which has its benefits and drawbacks.

“The advantage of a young staff is that they are very enthusiastic and know technology so much better,” he says. “They grew up with technology, and can adapt to it very quickly. After a few years, they can even be more productive than the older, more experienced staff.”

Oftentimes, however, this creates a generational conflict between the young and experienced engineers, he says.

“The more experienced staff expects the younger staff to do the grunt work, but since the younger engineers know the technology so well, they think they are on an equal playing field with the experienced engineers.”

Bridging the gap

With so many engineers quickly nearing retirement age, firms face the challenge of transferring years of experience and knowledge to new hires. To tackle this problem head-on, Burns and McDonnell focuses on training and developing new leaders through its robust internship program, offering tuition reimbursement for advanced degrees and engaging employees in its mentoring program.

“Our culture is very strong in helping others,” says Ray Kowalik, president of global practices for Burns and McDonnell, a Kansas City, Mo.-based company that topped EC&M’s list of Top 40 design firms in 2015. “Everyone — from our senior leadership and engineers down to the people who have only worked for us for a year or two — mentor the new employees who come into the company. The key to success is training and developing new leadership and growing it.”

Stanley Consultants, Inc., a Muscatine, Iowa-based engineering firm, also bridges the gap between new and veteran employees by capturing knowledge from seasoned veteran employees, developing enhanced analytical tools and processes, and holding frequent lunch-and-learns, which engage employees in technical discussions. As such, the firm is able to attract candidates through its reputation, challenging work, growth opportunities, and benefit plans. Even so, competition within the industry for applicants is making it challenging to hire experienced engineers, says Mak Wagner, chief electrical engineer and senior project manager for Stanley Consultants. In particular, he says it’s difficult to find mid- to senior-level electrical engineers with consulting engineering experience in power generation, electrical system protection, controls and automation, and electrical transmission/distribution systems.

“The current senior-level pool is shrinking due to Baby Boomer retirements,” Wagner says. “There seems to be a big gap in the availability of mid-level candidates with 10 to 15 years of experience in the power generation and electrical distribution industries. Our senior-level engineers are extremely busy with projects, and the entry-level engineers are developing at an accelerated pace.”

Burns Engineering, Inc., a Philadelphia-based engineering firm, is able to attract experienced talent through making long-term investments in its future business and staying committed to achieving its growth goals. Still, like many other firms, the company is also experiencing a labor shortage, especially when it comes to engineers and managers, says John Burns, senior vice president.

“In our specialized areas of engineering, there is a limited pool of experienced engineers and managers,” Burns says. “Combining that with retirement of senior technical leaders creates challenges in recruiting experienced talent.”

Burns attributes the current labor shortage to the fact that for the last decade or two, electrical engineering graduates have many options outside of the traditional power industry such as electronics and Internet technologies. Also, engineering schools must offer co-ops and internships to help young engineers become workplace ready and get them interested in power engineering.

“They must be prepared to face the challenges of an engineering career, where success depends on a combination of very hard work, technical competence, and interpersonal relationships,” Burns says.

To address this challenge, the primary education system must increase the science, technology, engineering, and mathematics (STEM) programs to increase the influx of engineering students, Burns says. The AGC agrees, stating that an insufficient number of secondary school career and technical education training schools is fueling the labor shortage. Over a period of eight years, the federal funding for career and technical education has plummeted from $1.3 billion a year to a little over $1.12 billion, a 29% decline considering inflation.

“A number of changing trends have combined to cripple what was once a robust education pipeline for new construction workers,” the workforce development plan states. “These factors include the dismantling of the public vocational and technical education programs, declining participation in union apprenticeship training, and an increasing focus on college preparatory programs at the high-school level.”

For example, to spark an interest in STEM programs at the elementary and secondary level, the Burns & McDonnell Foundation created the “Battle of the Brains” educational competition in 2011. Each year, schools across the Kansas City metropolitan area have the opportunity to design an exhibit for Science City, an interactive children’s science museum within Union Station in Kansas City, Mo. Over the years, winning concepts have focused on everything from genetics to water conservation.

Giving hands-on experience

While many engineering firms are trying to cultivate an interest in math and science in schools nationwide, electrical contractors are attracting future electricians through hands-on apprenticeship programs.

For example, during its one-year pre-apprenticeship program, students can work in USIS’ prefabrication shop — where they assemble panels and fixtures and punch down voice and data. They also learn how to properly operate trucks and help manage the shipping/receiving department to get a better understanding of material and tool handling.

At the same time, USIS identifies aspiring project leaders within each pre-apprentice class. Within the first three months, the estimating staff teaches these students how to review drawings and blueprints to help create estimate takeoffs.

“It’s a weeding and filtering process for them and for us,” Bodrato says. “They figure out if they want to be electricians, and we make sure that they are a good fit for our company.”

After the students wrap up the pre-apprenticeship program and are officially hired as USIS apprentices, they graduate into the field and participate in a shadowing program. During this time period, they work side by side with the foremen and journeymen and attend two nights of classroom training at the contractor’s Pearl River, N.Y., training center. Bodrato says while recruiting is important, on-the-job training is critical.

“Through the pre-apprenticeship and shadowing program, they can understand our systems at an early point in their career so they will become better leaders in the industry,” Bodrato says.

Through its extensive outreach, USIS has ramped up its apprenticeship program from 10 to 80 apprentices. During the six-year apprenticeship program, the aspiring electricians learn about electrical, security, A/V, voice, data, and RF/wireless systems. That way, USIS can interchange its workforce because they all have the same set of skills.

“We provide diversified training across the board, we integrate technology into the field, and we teach them how to work with their hands,” Bodrato says.

Keeping skilled talent

Through apprenticeship programs, electrical contracting companies can pull future electricians into the trade. To retain these employees, however, contractors are finding that they must not only identify what their employees are looking for in a career, but also try to meet their demands.

While many electricians entered the trade looking for long-term job security, most are leaving the industry due to the decline in available work or to seek other job opportunities, according to a recent “State of the Industry” survey sponsored by Klein Tools (see Eye on Electricians below).

As far as the engineering and construction industries, FMI Capital Advisors recently uncovered a widening gap between what employers are offering and what employees are searching for. While both employers and employees agree on the importance of competitive pay for retention, employees are also engaged by other factors such as work-life balance and personal development.

With the labor shortage intensifying, firms must implement strategic and holistic processes to recruit and retain talent (see Five Tips for Recruiting and Retaining Electrical Workers below) to stay viable both now and in the future, says Chris Daum, the president of FMI Capital Advisors, about the findings of FMI’s recently released report titled, “2015 Talent Development Survey in the Construction Industry.”

By surveying executives and employees of engineering firms and electrical construction companies, FMI discovered 86% were experiencing skilled labor shortages compared to 53% two years ago. Due to increased competition, Daum says it’s critical for companies to focus on employee development.

When hiring new employees, Engineering Enterprise, an Alameda, Calif.-based engineering firm, strives to keep employees for the long-term. Right now, Scott Wheeler, principal, says that electrical engineering graduates have a lot of options, and the firm is trying to find graduates who are interested in the electrical design industry.

To recruit candidates, the firm places job postings on job boards at three of the top engineering schools in California, including Cal-Poly, UC-Davis, and Sacramento State.

“Our business model has been to recruit out of universities and then just train new employees,” he says. “Our success rate hiring recent graduates has always been better than finding someone with more experience.”

Oftentimes, however, the firm tries to hire the students on as interns before they even graduate. As a result, the company can evaluate the intern as if it were a three- to four-month-long interview. Right now, the firm even has a high school student who comes to work every day after school.

“He has exceeded our expectations, and is doing some great work,” Wheeler says. “If you find kids like that, you try to hold on to them forever.”

By retaining their top talent and actively recruiting and training new employees, both electrical contractors and engineering firms are aiming to overcome the obstacles of the labor shortage.

“We feel like we have to treat our employees like no one else does so we can keep them,” Wheeler says. “That is our goal when we hire them — to hire them for life.”

Fischbach is a freelance writer and editor based in Overland Park, Kan. She can be reached at [email protected].

SIDEBAR 1: By the Numbers: A Look at Today’s Construction Labor Market

As the demand for construction continues to expand, the number of job gains in the construction industry continues to grow, according the Associated General Contractors of America. Here are some fast facts this group recently compiled on the construction labor market.

- In November 2015, construction firms added 46,000 workers for the largest monthly gain in employment for the sector since January 2014.

- The construction industry’s unemployment rate declined to 6.2%, and the number of unemployed job seekers who last worked in construction dropped to 536,000 — the lowest November number since 2007.

- In 180 out of 358 metropolitan areas, construction employment increased between October 2014 and October 2015. The areas adding the largest number of construction jobs were Riverside-San Bernadino-Ontario, Calif.; Los Angeles-Long Beach-Glendale, Calif.; Denver-Aurora-Lakewood, Colo.; and Las Vegas-Henderson-Paradise, Nev. Construction employment declined in 132 areas, and remained unchanged in 46 areas. The largest job losses were in Fort Worth-Arlington, Texas; Bergen-Hudson-Passaic, N.J.; Miami-Miami Beach-Kendall, Fla.; and Minneapolis-St. Paul-Bloomington, Minn.-Wis.

- The metropolitan areas with the highest percentage gains in construction employment between October 2014 and October 2015 were Weirton-Steubenville,

W. Va.-Ohio; Wenatchee, Wash.; Buffalo-Cheektowaga-Niagara Falls, N.Y.; and Las Vegas-Henderson-Paradise, Nev. On the other hand, the following areas experienced the largest percentage decline — Watertown-Fort Drum, N.Y.; Gulfport-Biloxi-Pascagoula, Miss.; Bloomington, Ind.; Elizabethtown-Fort Knox, Ky.; and Terre Haute, Ind.

Source: Associated General Contractors of America

SIDEBAR 2: Five Tips for Recruiting and Retaining Electrical Workers

1. Engage young engineers with recruiting. With only one location in New York City to serve a global market, JB&B is focusing its ongoing recruiting process on 10 of the leading engineering schools on the East Coast. As such, the firm sends its active project managers and young engineers out to these schools to recruit the next hiring class, says Mark Torre, partner for the firm. “Who better to identify the necessary traits and core competency requirements than those who these new hires will be supporting?” he says.

2. Create a model for internal upward mobility and advancement. At JB&B, the company hires each engineer for tactical and long-term planning. Next, the firm puts him or her to work on projects to gain exposure to the latest engineering technologies. Once the new engineers gain expertise, then JB&B has the tradition of promoting staff from within.

3. Grow your staff from the ground up. Burns Engineering has made a sustained commitment to university recruiting, internships, and co-ops. As a result, it has been able to fill its talent pipeline at the entry level and grow the engineers and technicians internally.

4. Attract new talent through word-of-mouth referrals. When it comes to recruiting electricians, word-of-mouth is absolutely paramount, says John Boncher, president and CEO of Cupertino Electric. “It’s very hard to recruit using recruiters, especially when it comes to electricians. They often aren’t working in a cubicle or office, and it’s very difficult to call them when they’re out on a job site.”

5. Provide growth opportunities. At Parsons, young engineers typically enter the company through an internship or an entry-level project engineer program. By hiring and training the recent graduates rather than recruiting them away from other firms, Joel Moryn, president, found that they are more prepared to execute the firm’s values and mission.

“By offering them an environment of increasing responsibility, we are able to give them the challenges and career growth that they are looking for,” Moryn says.

SIDEBAR 3: Eye on Electricians

What makes electricians stay in the field or hang up their tool belts? To discover what drives electricians to remain in the field or look for other job opportunities, Klein Tools recently partnered with an independent research firm to conduct roughly 200 online interviews. Here are some highlights from their findings.

- Forty-two percent of electricians entered the field because they thought it offered long-term security, 35% thought it was a field that was always in demand, and 36% entered the field because they had family members or friends who were in the trade.

- Fifty-one percent of electricians pursued other careers due to a decline in available work.

- When their peers leave the field, the electricians surveyed reported that 28% go into professional trades, such as installers or technicians; 22% pursue careers in computer/IT or engineering; and 22% go into professional specialties, such as computing/IT or engineering. Also, 19% go into such careers as maintenance or construction.

Source: Klein Tools