Electrical professionals have much to look forward to in 2025 if demand for new construction projects and renovation work picks up next year as much as some forecasters believe possible. The big “if” is whether or not interest rates will decline enough in 2025 to have an impact on still-pricey construction loans and mortgages for new homes. Following are the 10 most important market drivers the editorial team at EC&M and Electrical Wholesaling magazines expects to shape the 2025 construction market.

No. 1 — Interest rates will have a major impact on the willingness of developers to borrow funds for construction loans.

Many construction economists believe lower rates in 2025 will juice up construction spending. In her monthly analysis of the Dodge Momentum Index, a measure of future business conditions in the construction market, Sarah Martin, the associate director of forecasting for Dodge Construction Network, said rate cuts could impact the construction market by mid-2025. The Dodge Momentum Index is a monthly measure of the value of non-residential building projects going into planning, shown to lead construction spending for non-residential buildings by a full year.

“By late 2025, the impact of the Fed’s rate cuts should be substantial enough that we see projects in planning reach groundbreaking more quickly than they have over the last year or so,” she said. “That should lead to some stronger non-residential construction starts in mid-2025 to early-2026. There really is a steady pipeline of construction projects that we believe are going to be ready to break ground once those market conditions are right.”

Richard Branch, chief economist for Dodge Construction Network, said in his monthly analysis of construction starts that lots of projects are “coming into the top of the funnel but are not yet coming out of the spigot.” He expects that to change if the U.S. Federal Reserve cuts a full point off of the current federal funds rate.

Nick Lipinski, vice president and electrical equity analyst for Vertical Research Partners, Stamford, Conn., said in his quarterly analysis of electrical business conditions that underlying bidding/quoting activity seems healthy, and the outlook for 2025 seems “broadly positive.”

“Data center and utility verticals remain the key growth engines,” he said in the report. “The recent Fed rate cut has already been broadly positive for commercial construction but less impactful on residential housing demand/affordability at a time when inflation is pinching consumer budgets.”

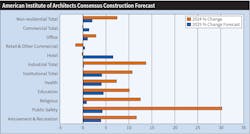

The American Institute of Architects (AIA), Washington, D.C., was less bullish than these forecasts in its evaluation of construction market business conditions that was posted with its update of the AIA Consensus Construction Forecast in mid-July (Fig. 1). AIA is predicting a +7.4% increase in non-residential construction this year, followed by a marked decrease to +2% in 2025.

This forecast is developed with the estimates of nine construction economists from Dodge Construction Network, S&P Global Market Intelligence, Moody’s Analytics, FMI, ConstructConnect, Associated Builders and Contractors, Wells Fargo Securities, Markstein Advisors, and Piedmont Crescent Capital. There’s approximately a four-point swing in their non-residential construction forecasts for 2024, ranging from +5.2% on the low end (Dodge Construction Network) to +9.9% on the high end (Associated Builders and Contractors), as noted in Fig. 2. There’s an even broader 10.7-point swing in their 2025 non-residential forecasts. Three forecasters see declines: S&P Global, Market Intelligence (-2.7%); Moody’s Analytics (-0.7%); and ConstructConnect (-0.1%). Associated Builders and Contractors came in the highest at +8%.

In its Consensus Construction Forecast analysis, AIA reported: “Construction spending, while continuing to increase, has seen the pace of growth slow so far this year, and this slowdown is expected to continue through this year and into 2025. Indications of a continued slowdown include a challenging lending market for construction projects, continued weakness in commercial property values, and ongoing softness in billings at architecture firms.”

The AIA post, published in July before the 50-point federal rate cut, also said, “Currently, lending rates are significantly changing the calculations of project feasibility. The Federal Reserve Board’s survey of senior loan officers documents the tighter lending standards for commercial real estate lending. A significant net share of banks reported tightening standards for all types of commercial real estate (CRE) loans. Meanwhile, a moderate net share of banks reported weaker demand for construction and land development loans, while significant net shares of banks reported weaker demand for loans secured by nonfarm non-residential and multi-family residential properties. The most cited reasons for tightening credit policies on CRE loans were less favorable or more uncertain outlooks for CRE market rents, vacancy rates, and property prices.”

AIA’s Architecture Billings Index (ABI), a monthly indicator of construction spending nine to 12 months in the future, is also signaling weakness. “Quarterly billings at architecture firms have been declining since the fourth quarter of 2022, according to the AIA/Deltek Architecture Billings Index,” said Kermit Baker, AIA’s chief economist, in the analysis. “However, the pace of decline — though volatile — has begun to accelerate over the past 10 months. Firms that specialize in the multi-family residential market have seen the steepest downturn in billings, followed by those specializing in commercial/industrial activity. Firms with an institutional specialization have generally seen revenue levels hold steady, although there has been emerging weakness in recent months. Given that both new design contracts and project inquiries at architecture firms have been about as weak as billings, prospects for a turnaround in design activity do not appear to be imminent.”

No. 2 — High office vacancy rates will continue to tamp down demand for new office space.

One of the best indicators of the health of the office market are vacancy rates. The rule of thumb for years has been that markets with vacancy rates of 10% or below are primed for new office construction while those with 20% or higher don’t see many new offices being built. Since the COVID-19 era and the move toward remote offices, vacancy rates have skyrocketed, and we see few metropolitan areas with office vacancy rates as low as 10%.

The Colliers 2Q 2024 U.S. office vacancy report tells a remarkable story — with only three of the nation’s largest market areas logging office vacancy rates less than 20% (New York; Miami; and Silicon Valley, Calif.). In that report, Colliers said the office vacancy rate in the San Francisco metropolitan area touched 30%. Houston was near that high mark.

At least one commercial real estate firm thinks the office market may have bottomed out. According to the JLL U.S. Office Markets Dynamics-Q3 2024 report, “The U.S. office market reached an important milestone in Q3 2024. With the concurrent acceleration in leasing activity and slowdown of new supply, availability levels have begun to decline for the first time in over five years. Leasing activity continued to grow after establishing a post-pandemic high last quarter, and downsizing activity is steadily normalizing as tenants become more comfortable with their existing office footprints. At the same time, new supply has fallen dramatically, and a record volume of inventory is being removed for conversion and redevelopment, leading to a tightening office market nationally for the first time since 2019.”

If you want to get a sense of the impact of remote officing on office life in the nation’s largest cities, look no further than Kastle’s Back to Work Barometer, which calculates office occupancy based on the number of swipes of its access cards in 2,600 buildings in 138 cities. In a recent report, the average midweek occupancy rate was only 51% in its 10 largest metropolitan areas (New York; Austin, Texas; Dallas; Los Angeles; Chicago; Washington, D.C.; Houston; Philadelphia; San Jose, Calif.; and San Francisco).

You hear about offices being retrofitted into much-needed multi-family housing units in some urban areas, but the location of plumbing and HVAC systems, windows, and other building structures often complicate these conversions to the point that — for some office buildings — a total tear-down to make space for a new building is a better option than a conversion.

No. 3 — Mega-projects of $1 billion or more in total construction value will continue to grab headlines.

When you consider that electrical work typically accounts for 10% of the total value of a large non-residential construction contract, you can see why landing work at one of the many mega-projects valued at a billion dollars or more is such a big deal. Table 1 and Table 2 list 50 of the largest projects in the pipeline or underway, including 16 mega-projects with a contract value of $1 billion or more. Data centers, EV plants, utility-scale renewable projects, hospitals, and airports were among these mega-projects.

No. 4 — A handful of local markets and states will continue to see the lion’s share of business.

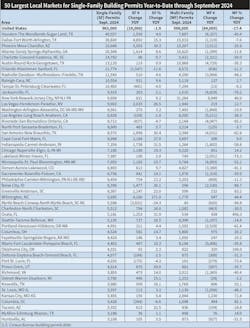

While it’s always important to look at national construction data or economic indicators as a baseline, the disparity in the growth rates of individual states or local market areas should always be considered, as should the consolidated nature of the electrical construction market. For example, according to ConstructConnect’s “August 2024 Starts Forecast” published in 2024, 10 states accounted for 55% of the United States total of $953.6 billion in total construction spending — Texas, California, Florida, New York, North Carolina, Georgia, Arizona, Ohio, Virginia, and Tennessee. Building permits also show that same consolidation, as 10 states accounted for 45% of all single-family building permits year-to-date through August 2024.

Consolidation is often the case with local markets, too, where a single metropolitan statistical area (MSA) can account for a tremendous amount of building activity or electrical contractor employment in an individual state.

Two of the most dramatic examples are the Phoenix and Las Vegas metros. For example, the Phoenix-Mesa-Chandler, Ariz., MSA accounted for 72% of all of Arizona’s single-family building permits year-to-date through August 2024, and the Las Vegas-Henderson-North Las Vegas, Nev., MSA accounted for 80% of single-family building permits in Nevada year-to-date through that same period.

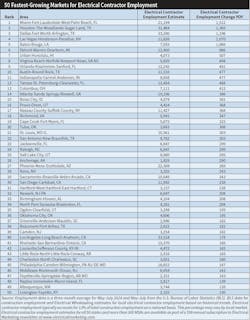

When you look at electrical contractor employment in these two markets, the same trend is apparent. According to the most recent construction employment data from the U.S. Census Bureau and estimates from Electrical Wholesaling, the Phoenix metro accounts for 79% of all electrical contractors in Arizona while the Las Vegas metro accounts for 71% of electrical contractor employment in Nevada (Table 3).

No. 5 — Electrical contractors may start to see more single-family construction work if mortgage rates decline.

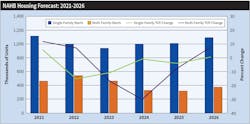

While the decline in single-family home construction can be linked to a lack of available lots, permitting red tape, and broad demographic declines in the key first-time homebuyer age group of 25- to 33-years-old, comparatively high mortgage rates have probably wreaked the most havoc on the homebuilding industry over the past few years. Robert Dietz, chief economist for the National Association of Home Builders (NAHB), said in the association’s September building date report, “While single-family home building increased in September, higher mortgage interest rates in October are likely to place a damper on growth in next month’s data. Nonetheless, NAHB is forecasting a gradual, if uneven, decline for mortgage rates in the coming quarters, with corresponding increases for single-family construction,” as shown in Fig. 3 and Table 4.

No. 6 — Future federal funding for many large industrial projects and federal support for EV purchases is currently in doubt because of the 2024 presidential election results.

In the industrial market, dozens of semiconductor plants and EV or battery plants partially funded by federal Inflation Reduction Act (IRA) funds or other financial stimulus are underway or in the pipeline. Changes in the White House and on Capitol Hill could impact future funding for the Chips and Science Act, IRA, and Infrastructure and Investment Jobs Act (IIJA), passed early in the Biden Administration. This legislation pumped billions of dollars in grants, tax breaks, and other financial incentives into semiconduction plants, EV and battery factories, and renewables projects with wind farms, photovoltaic panels, and battery storage systems. For individuals, federal legislation has provided tax incentives to consumers for the purchase of some electric vehicles and energy-efficient equipment for their homes, including water heaters and solar panels, as well.

According to an August 2024 White House press statement, since the beginning of the Biden-Harris Administration, companies have announced $900 billion in clean energy and manufacturing investments in the United States (including more than $265 billion in clean energy investments) since the IRA was signed into law. On the residential front, the release said more than 250,000 Americans have claimed the IRA’s electric vehicle tax credit, saving these buyers about $1.5 billion total.

Not all of the allocated funds for this legislation have been spent yet, and President-Elect Donald Trump has said on the campaign trail that he would not allow unallocated funds to be spent on future green projects, calling the IRA the “greatest scam in history.” It’s hard to know what campaign trail rhetoric on this legislation from Trump will become policy, in part because so many of the industrial projects funded by it are being built in states that voted him into office.

James West, senior managing director at Evercore ISI, said about 75% of the job creation and the capital spending on new manufacturing and other clean energy resources has gone to red states or red counties in blue states, and a report on Yahoo Finance said according to data from the Department of Energy, $10.8 billion in investments in solar energy have gone to red states, while just $4.1 billion have gone to blue states. That post also said $35 billion tied to electric vehicle spending has gone to Republican districts, while $22 billion has gone to Democratic ones.

No. 7 — Battery energy storage systems (BESSS) will continue to become more popular in utility-scale renewable projects.

Utility-scale wind and solar projects have had the most visibility in the renewables market in recent years, but battery storage systems are becoming increasingly common on these jobs. A post on Forbes magazine’s website says the growth rate of energy storage is expected to double in 2024 after double-digit growth in 2023. It mentioned a Wood Mackenzie study forecasting 45% growth in 2024 after 100% growth from 2022 to 2023 that states: “Annual storage installations are growing faster than wind and solar as the sector races to keep up with the growing need to balance renewables and support grid resiliency.” The storage market is also supported by falling module costs and IRA tax incentives, according to the post at www.forbes.com.

No. 8 — Electrical product price increases have moderated, but switchgear and some other products are still seeing some increases.

Two monthly price indexes that watch pricing trends in the electrical market reflected moderate price increases and even declines in some electrical product prices but marked increases in others. The Electrical Price Index (Table 5) published monthly in Electrical Marketing newsletter, one of EC&M’s sister publications, called out switchgear’s gains in its September 2024 data — with a +1.4% monthly increase and a +8.8% year-over-year (YOY) increase (the highest in the 20-plus electrical products it monitors).

S&P Global also monitors electrical product pricing as part of its Engineering and Construction Cost Indicator, which covers the broader construction market as well as the electrical construction industry. This index, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector, declined -4.4 points to 55.3 points this month, according to an S&P press release. “The materials and equipment indicator saw a minor increase in October and continues to show rising prices. Only five of the 12 components increased compared to last month, but the magnitude of the increases was larger than the declines. The primary drivers of the increase were the +19.4-point jump for electrical equipment, the +12.7-point increase for alloy steel pipe, and the +10-point increase for shell and tube heat exchangers. On the other hand, only transformers saw a double-digit decline, down -11.1 points to 66.7 this month.”

No. 9 — Quanta’s acquisition of Cupertino Electric may usher in a new wave of contractor mergers and acquisitions.

More baby boomers than ever are reaching retirement age, and if they own an electrical contracting business, they may be looking for a buyer. Some M&A specialists have said contractors have become a hot commodity in the private equity market, particularly if they are involved with lighting and other digital technologies or renewables.

According to a recent article in The Wall Street Journal, a post at www.pitchbook.com said private-equity investors have purchased almost 800 electrical, plumbing, and HVAC companies since 2022. As these acquirers grow from large local firms to regional or even national electrical contractors, they may become formidable competitors in bids to win commercial project business in new markets. For example, over the past few years, some large regional contractors, including Cupertino Electric and Rosendin Electric, have worked on data centers nationwide and far outside their original bases of operations in northern California.

Quanta’s acquisition of Cupertino Electric in July 2024 was one of the largest electrical contractor acquisitions in recent years. EC&M magazine ranked Quanta as the largest electrical contractor in the nation in its 2024 Top 50 Contractors listing with 2024 sales of $11.8 billion, while Cupertino was ranked No. 7 on the list with $1.96 billion in sales. Quanta was involved in the first wave of roll-ups in the electrical contracting business in the late 1990s. It first acquired four firms that focused on utility work, and since that time, it has acquired more than 200 other contracting firms, according to www.quantaservices.com/history. If other companies follow suit, this trend could have a direct impact of the electrical construction market because they may force smaller contractors to compete with large regional or national coming into their markets.

Integrated Electrical Services Inc. (IES), Houston, Texas, quietly took shape as a national electrical contracting corporation in June 1997 and as a public company in January 1998. Back then, IES acquired 15 electrical contractors from around the United States and a related electric supply company, according to a 2003 report in Electrical Wholesaling magazine.

No. 10 — Newer technologies, like app-based digital lighting control, digital power, and small modular reactors (SMRs), will offer the electrical construction market new profit and revenue opportunities.

It’s hard to pinpoint a past era in the electrical construction market when so many new technologies offered this level of future business potential. As the demand for new sources of power and advancement of digital control technologies from the R&D labs to the job site continue, they will provide electrical contractors with new opportunities to differentiate their businesses next year and beyond. Following is a brief discussion of several technologies of particular interest to keep your eyes on:

Lighting control. App-based lighting control is already in the market. It continues to get more intuitive to use, easier to commission, and sophisticated to control more complex lighting systems.

Small modular reactors (SMRs). Because of their insatiable appetite for power, data centers, EV charging stations, and other new electrical loads are asking more of the U.S. electrical grid. Some power experts are re-evaluating nuclear power as a potential source. Ninety-three conventional nuclear power plants already produce about 20% of the nation’s electrical power.

While it will take several years for SMRs to provide a notable amount of electrical power, they are attracting plenty of attention because they will be easier to bring online. Their modularity will make them easier to build, and — due to their smaller size — data centers and other big-time power users may be able to have them right on site. Commissioning is a years-long process with conventional nuclear power generators, but SMR advocates believe there will be less red tape in getting them online. They are in the early-development stage and prototype stage right now, but you can expect to see some of them being built after 2025.

Digital power. Digital power is a potentially game-breaking technology first seen in the lighting market with Power over Ethernet (PoE) LED lighting systems. While these lighting loads are comparatively small, digital power is now used for much larger projects because so much of the electrical load is serving digital devices and systems that operate on lower voltage electrical systems, including computers, lighting, security, televisions, and other electronic loads. Since digital power can be run through much smaller cables, such as 18/2 speaker cables and Cat 5e cable as a Class 2 wiring system, it can save quite a bit on installation time and material costs. Some savings estimates for PoE run as high as 30% because these systems don’t need to be installed in conduit or utilize more expensive metal boxes or support systems.

Although digital power is in its infancy, Sinclair Digital, Fort Worth, Texas, has wired two hotels with digital power: the Sinclair Marriott in Fort Worth, and the Hotel Marcel in New Haven, Conn. It also wired an office for Southwire, which has invested in the firm. According to a Southwire post, Sinclair installed PoE wiring in roughly 23,000 square feet of offices, meeting rooms, workstations, and multi-purpose space in the Battery Atlanta mixed-used development adjacent to Truist Park, home of Major League Baseball’s Atlanta Braves.

Voltserver, East Greenwich, R.I., also wired a large hotel with digital power — the 777-room Circa Hotel & Resort in Las Vegas. This hotel was wired with Voltserver’s digital power products to power advanced building automation, digital in-room controls, LED lighting, and electrical power distribution.

On the 2025 horizon. On the whole, the 2025 U.S. electrical construction market at worst should see low single-digit growth. If lower interest rates have the expected positive impact on construction loans and residential mortgages, many local markets could see much higher rates of growth. Construction economists also expect a looser regulatory environment under the Trump Administration and a Republican-controlled Congress to accelerate environmental or local approvals for construction projects. And if your company is a player in one of the high-growth construction niches like data center or utility grid revitalization, 2025 could turn out to be a very good year indeed.

About the Author

Jim Lucy

Editor-in-Chief, Electrical Wholesaling & Electrical Marketing

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling, Electrical Marketing newsletter and Electrical Construction & Maintenance magazine on topics such as electric vehicles, solar and wind development, energy-efficient lighting and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas. In 1999, he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in communications and a bachelor’s degree in journalism from Glassboro State College, Glassboro, N.J. (now Rowan University) and studied electrical design at New York University and graphic design at the School for Visual Arts.