The Future of R&D Legislation on Design/Contractor Firms

Engineering and construction industry interests are lobbying hard for legislation that would restore friendlier tax treatment to research and development (R&D) expenditures.

The focus is on spurring U.S. Senate action to take up the Tax Relief for American Families and Workers Act of 2024, which contains a provision to allow qualifying R&D costs to be expensed in the year incurred, rather than amortized over five years. The act, which passed the House in January, reverses the amortization requirement that was included Tax Cuts and Jobs Act of 2017 and took effect Jan. 1, 2022. Prior to that, tax relief was immediate for qualifying R&D expenses.

A return to that approach, says American Council of Engineering Companies, will give member firms more incentive to conduct R&D by the book in the course of their work. In a 2023 survey of members, ACEC found 58% of engineering firms conduct R&D spending. Of that number, 87% believe amortization would be burdensome. For those impacted the average and median predicted loss was put at $1.5 million and $400,000, respectively.

The 2022 legislation it hopes can be corrected by way of at least delaying amortization until 2026, has, it says, “created significant tax burdens and cash flow problems for engineering firms and other businesses engaged in cutting-edge research and development activities. Engineering companies rely on R&D in the work they do for our public and private sector clients, but (that) recent change in the tax code is literally punishing them for the innovation our economy needs to stay competitive.”

Consideration of the House legislation — H.R. 7024 — has been stalled as debate continues over other contentious provisions. In letters to key U.S. senators, ACEC urges support, noting that House passed the act with wide bipartisan support.

Associated General Contractors (AGC), representing construction industry interests, also supports a fix to R&D cost recovery. Construction companies would benefit, it says, from better tax treatment for expensing “costs including staff salaries, for design/build project activities, developing and improving pre-fabrication methods and other ways to increase efficiency, performance, and reliability, and many other construction-related activities.”

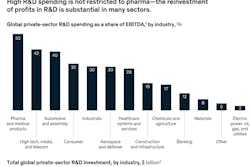

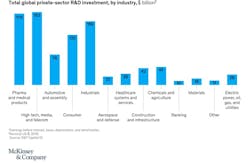

Construction contracting and associated engineering and design could be entering a period of increased reliance on R&D. Experimentation, testing, creation of new products and processes and utilization of technology to create greater efficiencies are activities firms likely will be engaged in more routinely that broadly meet the test for tax-reducing qualifying R&D expenditures. Construction and infrastructure companies have been in the lower tier of industry sector R&D spending. A 2018 McKinsey & Co., analysis estimates the sector put about 19% of its 2018 earnings, or $42 billion, towards R&D (see Fig. 1 and Fig. 2).

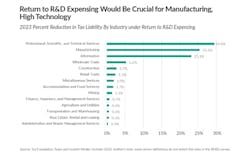

An analysis by The Tax Foundation estimates the construction industry could realize about a 3% reduction in its tax liability if R&D amortization is repealed. Engineering and design firms could see an even bigger boost. They are likely part of the “Professional, Scientific, and Technical Services” sector the analysis breaks out, which it says spent some $53 billion on domestic R&D in 2019 and could see an almost 30% reduction (see Fig. 3 below).

Restoring immediate expensing of R&D, at least temporarily, would help HED, a Southfield, Mich., engineering and design firm, says principal/president, Michael Cooper. Amortization has been a source of concern for engineering firms, including those in the electrical arena, since the change was made, bringing cash flow problems and disincentives for investments in innovation, and HED has felt the impact.

“Design firms, like ours, are engaged in R&D activities on a regular basis,” Cooper says. “No two projects are the same, and so the effort to evaluate project parameters and constraints, consider how new technologies and systems can be adapted to support those conditions, develop options and methods to prioritize those options, are all facets of industry R&D. We utilize the associated tax credits to help support them so that we can continue to improve efficiency and provide greater value.”

More electrical contractors may also find themselves in a position to claim R&D tax breaks. With interest growing in greater utilization of prefabrication, virtual design construction, generative design and other time saving, efficiency-boosting tools, the door is opening to more interest in instituting more formalized, documentable R&D activities. Adam S. Davis, senior manager of fabrication and modularization at Miller Electric, Jacksonville, Fla., says elements of work he’s regularly engaged in, such as development of generative AI-enabled conduit routing, digital twin applications for predictive maintenance and power monitoring, and VDC for component prefabrication, pursuits many other contractors are likely to engage in over time, are strong candidates for meeting the R&D tax-break test.

“We still have underutilization of the R&D tax credit by the industry, and it’s something we constantly try to educate our National Electrical Contractors Association members on,” says Davis, a member of NECA’s Innovation & Strategy Task Force. “I think if there were fewer issues with compliance or if it was just generally an easier process that was less costly we’d have more interest.”

For that reason, he says, anything that can be done legislatively to make R&D work easier to expense should lead to wider utilization in an industry that is likely to find itself more on the cutting edge of innovation and experimentation.