Even before the pandemic hit, it was always going to be tricky to forecast the 2021 construction market. Huge macroeconomic and demographic changes were already in play that were reshaping demand for new projects and would determine how many buildings would be built in the future, how big they would be, and where they would be located.

Anyone who depends on the office, multi-family construction, or retail markets for business is already feeling the impact of these market-shaping mega changes. For example, while new office construction saw an 11% gain in square footage in 2019 over 2018 to 152 million square feet, Dodge Data & Analytics said that mark was 66 million square feet below the office market’s high point in 2007. Even before COVID-19, many companies were already quietly experimenting with work-at-home or remote officing policies that would trim their need to build or rent new office space in the future. These existing trends were accelerated in 2020 because of concerns with the coronavirus, and Dodge Data & Analytics expects the office construction market to decline 20% this year to 122.1 million square feet, gaining back some of that loss with a 5% increase in 2021.

Big Changes Ahead for Office Construction & Multi-Family Housing

You can get a sense of the challenges ahead for the office market from an October 2020 survey of major employers located in the Big Apple by the Partnership for New York City. It said that only 10% of Manhattan office employees had returned to the workplace as of late October — and that the total share of employees expected to return by July 2021 decreased from 54% to 48%. Even if office construction wasn’t quite hitting the same numbers as in the past, residents and visitors to New York and other cities like Boston, Chicago, Miami, San Francisco, Seattle, and Washington, D.C., marveled at how many high-end condo and luxury apartments were being built over the past few years. New York was getting a big share of these projects, and in 2019, 32 multi-family projects valued at $100 million or more broke ground, according to data from Dodge Data & Analytics.

Several of these luxury condo buildings now tower over Central Park, but it’s anyone’s guess what the demand for buildings like these will be in the post-COVID-19 world. Many city dwellers have hit the highways and moved to the country or suburbs because of public health concerns not only with subways, buses, and other forms of mass transit, but also because of the amount of time they spend riding in elevators in close proximity to other residents and co-workers. No one knows if this urban flight is permanent or just a short-term reaction to the pandemic, and construction economists still believe the long-term future for the multi-family market is decent. Nevertheless, this always-cyclical chunk of the construction business appears to be cooling off, and Dodge data shows a 14% decline in 2020 to $86 billion, followed by a 1% decline in 2021 to $85 billion.

While you can construct a case for the multi-family market to rebound in the not-too-distant future, it may be a different story for what has been another major piece of the construction market — stores and shopping centers. Online shopping was already nibbling away at the sales of brick-and-mortar stores, but there’s little doubt the pandemic forced more shoppers away from shopping malls and to the comfort of their couches, where they can easily make purchases and schedule deliveries on laptops, tablets, or smartphones.

The data points to a tremendous drop in new retail construction over the past four years. According to Dodge Data & Analytics, total retail square footage will decline 28% in 2020 from 2019 before rebounding 5% next year to 58.1 million square feet, which is 48% less than the retail square footage put in place back in 2016. It’s tough to find optimistic numbers for the retail construction market. When you read the 2021 Dodge Construction Forecast’s analysis of this market segment, the news doesn’t get any better. According to Business Insider, a record 9,300 stores closed their doors in 2019. The report said COVID-19 has only added to the problem. In just the first eight months of 2020, 66 brands closed 13,262 stores — more than in all of 2019 — and the list is expected to get much longer by the end of the year.

Light at the End of the Tunnel

Despite the challenges confronting the office, multi-family, and retail markets, once a vaccine is widely distributed, the construction market will look a whole lot better than it did in spring 2020 — when more than 1 million total construction jobs were lost. The single-family housing, data center, warehouse, and utility-scale renewables segment of the market look particularly promising for electrical contractors, specifying engineers, and other electrical professionals. Check out some of the larger commercial projects and utility-scale solar and wind farms in Table 1.

Let’s briefly look at the construction market as a whole with the 2021 Dodge Construction Forecast before drilling down to the hottest market segments. After a 14% decline in total construction this year to $770.5 billion, Dodge Data & Analytics sees a 4% increase next year (Table 2). During the 2021 Dodge Construction Outlook presentation held November 10, which was a virtual event for the first time ever, Richard Branch, chief economist for Dodge Data & Analytics, gave a measured outlook for 2021.

“The COVID-19 pandemic and recession have had a profound impact on the U.S. economy, leading to a deep drop off in construction starts in the first half of 2020,” he said in a press statement released after the conference. “While the recovery is underway, the road to full recovery will be long and fraught with potential potholes. After losing an estimated 14% in 2020 to $738 billion, total construction starts will regain just 4% in 2021.

“Uncertainty surrounding the next wave of COVID-19 infections in the fall and winter and delayed fiscal stimulus will lead to a slow and jagged recovery in 2021,” Branch said. “Business and consumer confidence will improve over the year as further stimulus comes in early 2021 and a vaccine is approved and becomes more widely distributed, but construction markets have been deeply scarred and will take considerable time to fully recover. The dollar value of starts for residential buildings will increase 5% in 2021, nonresidential buildings will gain 3%, and nonbuilding construction will improve 7%. Only the residential sector, however, will exceed its 2019 level of starts thanks to historically low mortgage rates that boost single-family housing.”

Branch offered the following forecasts for key market segments:

- Single-family construction. The dollar value of single-family housing starts will be up 7% in 2021, and the number of units will grow 6% to 928,000 (Dodge basis). Historically low mortgage rates and a preference for less dense living during the pandemic are clearly overpowering short-term labor market and economic concerns.

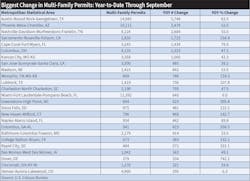

- Multi-family construction. This market segment “will pay the price for single family’s gain,” he said in the press release. “The large overhang of high-end construction in large metro areas combined with declining rents will lead to a further pullback in 2021. Dollar value will drop 1% while the number of units started falls 2% to 484,000 (Dodge basis),” he said. The Austin-Round Rock-Georgetown, Texas, metropolitan statistical area (MSA) led the nation in multi-family building permits through September with 14,945 permits (Table 3).

- Commercial building. The dollar value of commercial building starts will increase 5% in 2021. “Warehouse construction will be the clear winner as e-commerce giants continue to build out their logistics infrastructure,” Branch said. “Office starts will also increase due to rising demand for data centers (included in the office category) as well as renovations to existing space. Retail and hotel activity will languish.”

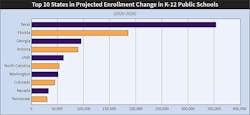

- Institutional construction. In 2021, institutional construction starts will increase by 1% as growing state and local budget deficits impact public building construction. Education construction is expected to see further declines in 2021, while health care starts are predicted to rise as hospitals seek to improve in-patient bed counts.

- Industrial construction. The dollar value of manufacturing plant construction will remain flat in 2021. Declining petrochemical construction and weak domestic and global activity will dampen starts, Branch said, although he expects a small handful of project groundbreakings will level out the year.

- Public works. Branch said this segment of the construction market will see little improvement as 2021 begins due to continued uncertainty surrounding additional federal aid for state and local areas. “The unfinished appropriations process for fiscal year 2021, which began October 1, raises doubt on the sector’s ability to post a strong gain in 2021,” he added. “Public works construction starts will be flat over the year.”

- LNG export and renewables. Dodge Data & Analytics forecasts that electric utilities/gas plants will gain 35% in 2021, led by expected groundbreakings for several large LNG export facilities and an increasing number of wind farms.

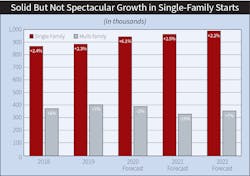

The Hottest Markets

Single-family housing. Accounting for 43.2% of all construction put in place through Sept. 2020, single-family housing appears to have a brighter outlook than any other construction niche over the next few years. The National Association of Home Builders (NAHB), Washington, D.C. expects single-family housing starts to increase 2.5% in 2021 to 971,000 and another 2.2% in 2022 to 993,000 (Fig. 1). Historically low interest rates and some positive demographic trends will support this growth. Millennials make up one of the largest age groups in the United States, many of whom are in their prime home-buying years. The high cost of lumber and plywood and the lack of skilled craftspeople needed to build these new homes are two potential challenges that could tamp down the anticipated increase in demand for new homes.

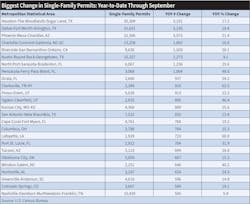

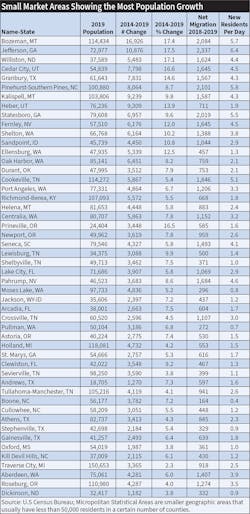

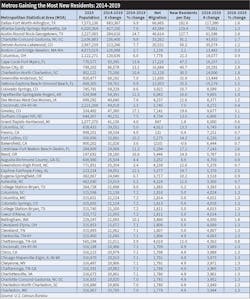

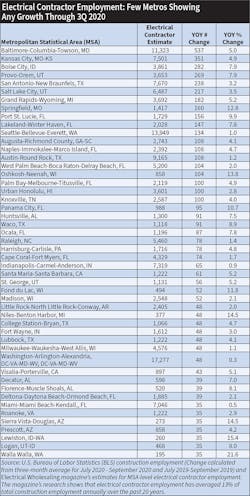

Branch of Dodge Data & Analytics provided some interesting analysis of where much of the housing market is taking place that supports the urban flight premise of city dwellers leaving cities to build homes on the fringe of suburbia or in more rural areas. He said smaller metropolitan markets in counties with less than 250,000 residents were growing fastest with a 10% growth rate year-to-date through September, followed by rural communities not close to any metropolitan areas at 9%. You can find out where homebuilders are pulling the most permits in Table 4, and also get a sense of which areas are ripe for development in Table 5, which highlights the smaller towns and cities that have gained the most new residents over the past few years. Of the smaller metros, Bozeman, Mont., has added 16,926 new residents between 2014 and 2019. Houston, Dallas, Phoenix, and Charlotte, N.C. are leading the pack of larger MSAs, as shown in Table 6. You can also get a sense of which markets are growing the fastest by watching electrical contractor employment (Table 7).

Data centers. Scarcely a month goes by without news of another large data center being built by Amazon, Facebook, Google, Microsoft, or one of the other tech giants. Over the past year, we have logged more than 20 data center projects into our construction project database that were either under construction or on the drawing boards. Most of these data centers have a total contract value of at least $200 million, but the Golden Plains Technology Park project now being planned for the Kansas City, Mo., metro by Diode Ventures, a wholly owned subsidiary of Black & Veatch, could eventually dwarf all of these projects. When its three phases are complete, it’s expected to have 13 buildings and 6.75 million square feet at a contract cost of more than $6 billion.

It’s not unusual to find data centers being built in regional clusters. West of Washington, D.C., Loudoun County, Va., is generally regarded as the biggest hotspot in the nation for data centers because of all the security, technology, and government firms in the D.C. suburbs. Other states that have seen a ton of data center construction over the past few years include Nebraska, Iowa, and Oregon.

One electrical contractor that’s developed a major specialty in data center construction across the United States is Rosendin Electric, San Jose, Calif. The company says it has completed $4 billion in total value of electrical construction. The company recently opened an office in Gallatin, Tenn., to support the construction of Facebook’s $800-million data center being planned for that town located northeast of Nashville.

Warehouses. While many of the e-business players have been building large warehouses to support their online sales, none is doing it on the scale of Amazon. According to the 2021 Dodge Construction Outlook, since 2017 Amazon broke ground on at least 47 warehouse projects with a total of 27 million square feet. Dodge valued the construction of these warehouses at $19.4 billion and says that at least three of these distribution centers topped 3 million square feet — the Project Sophia in Wilmington, Del., Project Charm in Pflugerville, Texas, and a facility in New Windsor, Conn.

Utility-scale renewables. Construction of utility-scale wind and solar projects continues to grow, and we logged no less than 20 large projects into our database over the past year (Table 1). Many of the larger solar projects planned or underway are located in California and Texas. A January 2020 post at www.desertsun.com said that over the next few years, as much as 30,000 acres of photovoltaic solar farms (producing up to 4,000MW) could come online in the Southern California desert and produce enough power for up to 400,000 homes. Two large solar projects are now underway in Desert Center, Calif.: the $625-million Palen and $438-million Athos solar farms.

The construction of wind farms is on pace to set a record this year, according to the American Wind Energy Association (AWEA). AWEA’s Wind Powers America Third Quarter 2020 Market Report said the U.S. wind industry installed nearly 2,000MW of new wind power capacity in the third quarter of 2020, setting a record for third-quarter additions and bringing total American capacity to nearly 112,000MW. “Ten new wind projects totaling 1,934 MW started operations across nine states during the third quarter, enough to power more than 600,000 American homes,” wrote AWEA in a press release. “Texas led the country with 687MW of new wind projects installed, followed by Colorado (496MW), Illinois (200MW), Iowa (168MW), and Indiana (147MW). Of particular note, the two largest single-phase wind projects in U.S. history came online during the third quarter: the 525MW Aviator Wind project in Texas and the 496MW Cheyenne Ridge project in Colorado. There are now 111,808MW of operating wind power capacity in the United States, enough for over 34 million American homes.”

AWEA is also closely tracking the development of offshore wind farms, which are getting closer to development off the Atlantic Coast from New England down through New York, New Jersey, Maryland, and Virginia. Even if contractors, specifiers, and other electrical professionals aren’t involved with the onshore grid connections or the offshore cabling, there will still be plenty of new electrical construction business opportunities available at the staging areas at the ports and docks where barges and ferries will bring products and work crews out to the offshore wind farms.

“The offshore wind market continued to advance in the third quarter,” said the AWEA release. “Coastal Virginia Offshore Wind, slated to be the second offshore wind project in the country and the first in federal waters, completed reliability testing in September and is expected online before the end of the year. Offshore wind makes up 47% projects in advanced development, with developers planning to bring 9,100MW online by 2026.”

Looking ahead

After what the construction market endured in 2020 because of the pandemic, next year will seem like heaven. The anticipated increase in single-family construction and the related construction that typically follows new housing developments should stand out in 2021. This trend is expected to be particularly strong in the Sunbelt and Intermountain regions, which showed sizeable increases in building permits in the latter half of 2020.

One macroeconomic trend that may be of concern to many commercial electrical contractors, engineering firms, and other electrical professionals is the continuing decline in demand for new office construction because of the move to remote officing. While retrofitting existing office space can cover some of this decline, the construction of new private offices is one of the largest niches in the construction market, typically accounting for approximately 5% of all private construction.

Demand for institutional construction, particularly hospital and school projects, will depend on local market growth, age demographics, and — in the case of schools (Fig. 2) — the success of local bond issues. It’s expected to be soft outside of the evergreen growth markets in the Sunbelt. All in all, however, 2021 looks positioned to be a solid year of recovery.

SIDEBAR: EC&M’s PICKS FOR THE HOTTEST LOCAL METROS IN 2021

For most EC&M readers, this is where the rubber meets the road. The national data at the 35,000-foot-level discussed in this article is good for an overview on the overall direction of the market and is an important point of comparison, but local market conditions can and typically do vary wildly from the national level — and can change from year-to-year. In analyzing the latest available data on population increases, electrical contractor and industrial employment, and building permits, we found that despite the current economic misery, you can still find some growth on the local level in metropolitan statistical areas (MSAs) that fit one of the following profiles.

The big dogs. Metros with more than 2 million residents are expected to add population the fastest over the next few years. Phoenix; Dallas; Austin, Texas; Atlanta; and Tampa-St. Petersburg, Fla., continue to add new residents.

Growth belts. Economically supercharged regions of the United States. Raleigh-Durham, Austin-San Antonio, San Jose-San Francisco, and Colorado’s Front Range (Colorado Springs north through Denver and Boulder to Fort Collins, and out to Greeley), and about 125 miles along Utah’s Wasatch front from Logan, Utah, in the north, down through Salt Lake City and south to Provo, Utah, in the north are examples of regions are doing better than most other metros right now. San Jose’s downtown area will have a completely new look in a few years because of all the downtown construction there right now. Before COVID-19 hit, news reports out of Austin, Texas, said there were more than 30 new office towers planned for the city. Later in the year, Tesla’s Elon Musk announced he will be building a billion-dollar Gigafactory in Austin as well.

Tech is tops. While commercial construction has slowed in these markets, in “normal” economic conditions, you can typically count on tech hubs like Silicon Valley-San Francisco, San Diego’s biotech patch, Boston, Austin, and Seattle to outpace other metropolitan areas.

Stars of the Sunbelt. Big-time population growth continues to drive residential and commercial markets in multiple MSAs in Florida, South Carolina, North Carolina, Texas, Phoenix, and much of Colorado’s Front Range (Table 5).

Swinging high and low. Cyclical metros can be really hot or ice cold. Examples of these markets include Dallas, Houston, Orlando, and Phoenix. Atlanta isn’t as cyclical as these other Sunbelt cities, but it has some similar growth characteristics.

Vacation land, lifestyle, retirement havens, and nirvana for telecommuters. Bozeman, Mont.; Bend, Ore.; Boise, Idaho; St. George, Utah; Myrtle Beach, S.C.; and Southwest Florida bank on the leisurely lifestyles they can offer to attract new residents and businesses. The latest population data shows that the Myrtle Beach-Conway-North Myrtle Beach, S.C.-N.C., MSA averages 47 new resident moving in every day.

Ports, freight rail lines, and intermodal hubs. Port construction and investment in rail lines and intermodal hubs drive growth in these MSAs. All of the larger ports, including Long Beach-Los Angeles, Houston, Oakland, and New York-New Jersey, have benefited from this trend. Activity in some smaller ports, like Savannah, Ga., also is strong.

Small but mighty. Metros with less than 200,000 residents are showing all the signs of big-time growth. See vacation/retirement/lifestyle metros. Census data shows that micropolitan markets in more rural/ex-urban areas like Bozeman, Helena, and Kalispell, Mont.; Cedar City and Heber, Utah; and Williston, N.D., are growing the fastest.