Turning Point: EC&M’s 2014 Top 40 Electrical Design Firms Special Report

Project owners delayed and canceled projects in 2012, creating significant pent-up demand. A year later, as some projects began to be released, some work rushed in like a tidal wave, while other jobs never quite washed up on shore.

Despite varying market conditions nationwide, 25 out of the 40 companies on EC&M’s annual proprietary 2014 Top 40 Electrical Design Firms listing experienced year-over-year revenue increases, and 17 of the companies reported at least a 10% jump.

For example, Morris Plains, N.J.-based Triad Consulting Engineers, Inc. (No. 18) posted a 14.1% increase in electrical design revenue due to work opportunities in the data center, pharmaceutical, and power industries, as well as growth in overseas markets. Ronald Regan, president of Triad, says 2013 was a very strong year for his company.

“When the economy was dragging, a lot of our clients postponed their projects,” he says. “It got to the point where their power systems were overloading and crashing, and they had to release work to patch things up due to growth.”

Tim Cutshaw, executive vice president for Madison, Ala.-based Mesa Associates, Inc. (No. 7), agreed, saying many customers held back on their typical spending due to uncertainty with the elections and the economy. When they had more of a clear direction, however, they began releasing funds — and the market went back to normal.

“Last year was a year of growth for us and also a year of optimism,” he says. “We saw growth across all of our market sectors and regions, with the exception of government.”

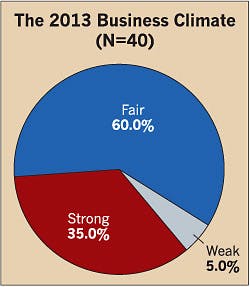

For some firms, 2013 was a year when many project opportunities moved off their backlog pile to the “active” stage, and their clients began investing in new construction and renovation projects. About 22.5% of the electrical design firms exceeded revenue expectations (Fig. 1) in what 35% of the respondents characterized as a “strong” business climate and 5% deemed as “weak” (Fig. 2). About 60% of the respondents considered 2013 as a fair business climate, including Madison, Wis.-based Affiliated Engineers, Inc. (No. 10).

“Depending on the market, we found a lot of variability,” says Greg Quinn, managing director of external operations. “It wasn’t a robust market, but it was better than 2011 or 2012.”

While the top four firms on last year’s listing held on to their respective spots, more than half of the other companies slid down in the rankings — and only a few climbed up the list. In addition, four new firms were added including Augusta, Maine-based TRC Engineering (No. 5); Muscatine, Iowa-based Stanley Consultants (No. 6); New York-based WSP (No. 11); and Omaha, Neb.-based Leo A Daly (No. 25).

Out of the companies listed from last year, five companies posted more than a 40% increase in electrical design revenue. These companies included Englewood, Colo.-based CH2M Hill Companies, Ltd. (No. 2) with 47.1%; Wheat Ridge, Colo.-based M-E Engineers (No. 12) with 42.3%; Harrisburg, Penn.-based Gannett Fleming, Inc. (No. 13) with 68.1%; Walnut Creek, Calif.-based Carollo Engineers, Inc. (No. 16) with 58.5%; and Long Beach, Calif.-based P2S Engineering, Inc. (No. 23) with 93.2%.

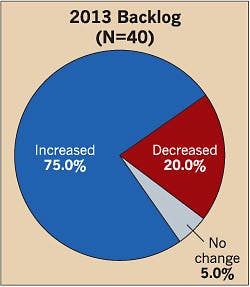

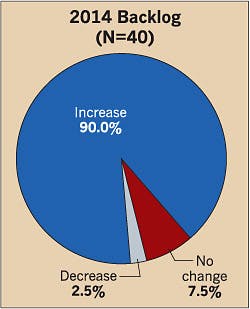

Many of these firms experienced an increase in revenue due to hot market segments and a healthy backlog of projects (Fig. 3). For example, CH2M Hill attributed its growth in electrical design revenue to strength in its industrial and advanced technology business group.

“The fourth quarter of 2013 was the best in our history,” says Ted Johnson, Facilities & Urban Environments, CH2M Hill. “Even though we had hoped to do better, we’ve always been confident of our ability to read changing market conditions and respond quickly to those changes.”

While some respondents exceeded expectations, the majority of the firms generated their expected revenues. In fact, about 57.5% of the respondents earned their expected profits (Fig. 1). For example, Dublin, Ohio-based Varo Engineers, Inc. (No. 35) met revenue expectations despite working in what it considered a “fair” business climate.

“We had several large jobs that started in 2011 and were still in progress through 2013,” says Jim Schlunt, vice president of electrical engineering. “We continued to receive a large portion of the capital projects from some of our major clients due to our performance.”

At the same time, however, some of the firm’s clients cut back on total work and canceled jobs, preventing the company from increasing its electrical design revenue even further, Schlunt says. Other firms on the listing also faced challenges in the market. Eleven firms reported a decrease in electrical design revenue, and two of those companies reported more than a 15% drop including Nashville, Tenn.-based Smith Seckman Reid, Inc. (No. 14) with a 25.1% decline and Gaithersburg, Md.-based Shah & Associates, Inc. (No. 33) with a 16% decline in revenue.

Shreedhar Shah, president of Shah & Associates, attributed the drop in revenue to continued project delays in 2013 and project owners’ focus on price, rather than value, when it came to selection of design firms.

“As the business has grown, we’ve seen delays across different geographies and almost every market,” says Shah. “There have been so many one-off delays with RFPs and the government shutdown, which has gummed up the process. Now that some of those issues have been resolved, we think some of these things will soon be cut loose.”

Despite facing project delays and other challenges, the firms on the annual listing reported higher revenues than the year before. In fact, the respondents posted total electrical design revenues of $1.808 billion in 2013 — up from $1.348 billion last year (see PDF version of Top 40 Electrical Design Firms List).

Preparing for future growth

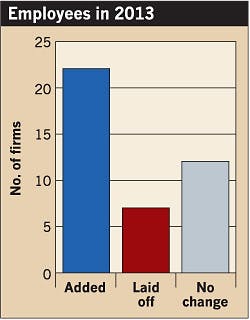

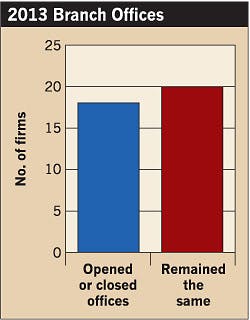

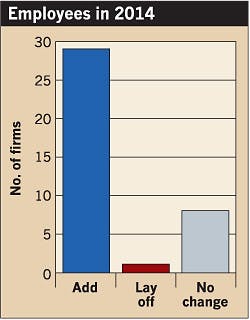

To handle the increased workload and to cover geographical and vertical markets, some of the nation’s largest electrical design firms are hiring new employees (Fig. 4) and opening branch offices (Fig. 5). Twenty-two firms added employees while seven companies laid off employees, and 12 didn’t make a change in their staffing levels. (Note: The total is greater than 40 because some firms added and laid off employees in the same year.)

For example, Kansas City, Mo.-based Burns & McDonnell (No. 1), which topped the list again this year, hired 500 new employees in 2013 and plans to continue adding more new hires this year. Other firms are also following suit by making plans to hire more staff rather than focusing on reducing head count (Fig. 6).

For example, Varo Engineers is boosting staffing levels to handle increased work from its manufacturing clients, growth in the petroleum, gas, and transmission and distribution industry, and upcoming opportunities in the design-build sector. Alameda-Calif.-based The Engineering Enterprise (No. 37) is also planning to hire employees for its Bay Area office, which has seen increased activity over the last year.

Overall, about 18 firms opened or closed branch offices while 20 companies had the same number of branch offices in 2013 (Fig. 5). The majority of the firms added five or less new branch offices, but Stantec (No. 3) added 25 new branch offices with 13 in the United States, 10 in Canada, one in Puerto Rico, and one in Qatar, says Glenn Stowkowy, vice president of Stantec.

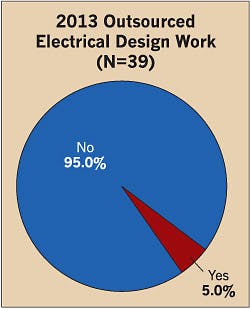

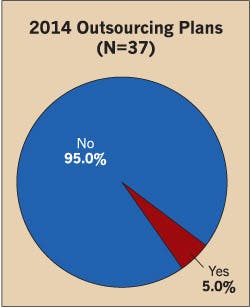

Other electrical design firms are maintaining a global presence by establishing offices in other countries rather than outsourcing electrical design work (Fig. 7 and Fig. 8). For example, Triad has leveraged opportunities in the resort industry with its offices in Puerto Rico, the Bahamas, and the Dominican Republic, and San Francisco-based Glumac (No. 21) collaborates on work with its office in Shanghai, China.

CH2M Hill, which has 26,000 employees in 122 countries, serves not only the United States, but also Asia, Australia/New Zealand, Canada, Europe, northern Africa, Latin America, and Europe. The company posted a 47% increase in electrical design revenue due to increasing global activity and economic recovery worldwide, says Johnson.

“As a company with many years of global project experience and resident staff resources in many parts of the world, we’ve all been well positioned to react quickly to new project opportunities as they surface internationally,” he says.

Zoning in on hot markets

When working internationally or in the United States, market diversification was the key to success for the nation’s largest electrical design firms. For example, Portland, Ore.-based Interface Engineering, Inc. (No. 27) posted a 35.4% increase due in part to its focus on a number of different market segments.

“We are very diversified and work in many markets,” says Joel Cruz, principal for the San Francisco office of Interface Engineering. “When something is not up to par in one market, the other one helps out.”

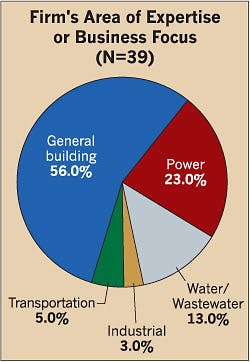

About 56% of the respondents listed general building (commercial, educational/institutional, health care, and housing) as their prime area of expertise (Fig. 9). P2S Engineering is currently experiencing a surge in both the health care and higher education markets. To cover these segments, the company recently opened a new branch office in San Diego. President Kevin Peterson attributes the growth in the education market to the passage of local and state bonds.

“The funding continues to expand the educational market and present great opportunities for us in terms of helping the campuses upgrade their infrastructure, their old and aging equipment and systems and provide design for new energy-efficient facilities,” says Peterson.

Other firms are also finding strength in the education market (Table). In California, Scott Wheeler, principal in charge of the Sacramento, Calif., office of Engineering Enterprise, says hospitals are investing in state-mandated structural upgrades. In the San Francisco area, health care providers are building new hospitals to meet requirements for seismic upgrades, and they’re transforming existing hospitals into outpatient clinics, Cruz says.

Affiliated Engineers has also noticed a shift toward more ambulatory and outpatient care as well as a move by hospitals to invest in infrastructure for the future. While the company hit a low in its health care practice last year due to industry consolidation and uncertainty about patient reimbursements, Quinn sees the market rapidly changing.

“It was slower than past years last year, but in the first quarter of 2014, health care has been one of our busiest markets,” Quinn says. “The pent-up demand is creating a situation where people need to do something.”

Firms are also discovering a wealth of opportunities in the electric utility market, especially the transmission and distribution segment. For example, Varo was one of 14 firms that reported power as one its three hottest markets. Schlunt attributed the strength in this market to the general increase in the population, growth in manufacturing and office facilities, and reliability issues. In the Midwest, he says coal is the primary source of energy for electrical generation, and environmental issues are driving much of the work in this sector.

As more plants are decommissioning their fossil plants and replacing them with more environmentally friendly options, firms now have the opportunity to help upgrade existing plants or build new facilities. In addition, the aging infrastructure in the power industry is providing opportunities for the nation’s largest electrical design firms.

“The infrastructure is to the point where it is getting tapped out and aging, which all plays well for our industry,” says Shah.

Other opportunities stem from the need for electric utilities to upgrade or rebuild equipment to prepare for or handle a natural disaster. Case in point: Following the Fukushima incident in Japan, U.S. nuclear plants are hiring design firms like Mesa Associates to specify equipment and adhere to new processes. In addition, companies like Triad are lending a hand to electric utilities and plants following Hurricane Sandy, which destroyed infrastructure throughout the Northeast.

Design firms are also helping data centers to guard against severe storms by raising equipment to higher elevations, building collocation centers to handle the growth of data transmission, and upgrading and constructing new data centers.

“Many data centers were built in the early to late 1990s, and they are very outdated,” says Cruz. “They are renovating their facilities to integrate the changing world of electronics, data, and technology.”

Along with data centers, a lot of the top firms also discovered a lot of opportunity in the manufacturing arena, especially when it came to automobile plants.

“Some plants are increasing their capital spending plans due to the new gas mileage requirements for new automobiles, and as they prepare to meet this requirement, it has an impact on manufacturing,” says Cutshaw. “Aluminum plants are expanding production for the automotive industry, which will decrease vehicle weight and increase their fuel efficiency.”

Another market that 13% of the respondents listed as one of their main areas of focus was the water/wastewater market (Fig. 9). Carollo Engineers jumped five spots up in the rankings due to its electrical, instrumentation, and control system consulting services in this sector. Clients are hiring the firm to conduct electrical and arc flash studies, make SCADA improvements, and replace antiquated equipment. In addition, the plants hired the company to try to achieve net zero status by using digester gas for cogeneration or peak shaving.

“The infrastructure is aging across the country, and we saw more of our clients improving and replacing the infrastructure, not for capacity sake, but due to new regulations,” says Anthony Morroni, senior vice president and national director of discipline engineering for Carollo Engineers.

Enhancing energy efficiency

As project owners invested in upgrading their aging infrastructure, they strived to save energy through renewable energy technologies and energy-efficient equipment.

The Engineering Enterprise reported that 80% of 2013 projects had a renewable energy component last year, and 85% will feature a renewable energy component this year. To help its clients save energy, the firm evaluates the use of renewable energy on every project and has designed PV systems for office facilities, schools, and public buildings.

When Title 24 goes into effect on July 1, however, Engineering Enterprise, as well as all other firms in the California market, will be mandated to design for future solar installations on every project. The firms must not only provide dedicated roof space for solar — and a pathway to this space — but will also face increased requirements for lighting controls, occupancy sensors, metering, and distribution systems.

Because Title 24 could increase building costs by 10% to 15%, Wheeler expects that some owners may not have the money to include certain renewable energy systems in the near future.

“There will be some hefty mechanical and electrical requirements, and it may potentially cause owners to move slower, not build, or move outside of California,” says Wheeler. “At the same time, we have put so much time into getting all of our people up to speed with the new energy code, and we are, in turn, educating all of our clients, architects, and contractors.”

Some California firms are already actively involved in solar including P2S Engineering, which plans to double its work in this area this year. The company is currently working on several smaller solar projects for higher education clients, and it is also supporting large solar installations with substation and utility interface designs.

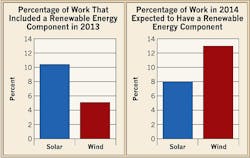

According to the Top 40 respondents, about 11% of their work included solar and 5% included wind in 2013. These numbers reversed course to 8% for solar and 13% for wind in 2014 (Fig. 10). One reason for the dip in solar work is due to the limited access to carbon credits and solar renewable energy credits, notes Regan. Up to this point, solar or wind has not comprised a significant amount of Triad’s workload in the United States, and the same has been true for Varo Engineers.

“There simply is not enough projects to require additional resources outside of the primary firms involved in the solar design itself,” says Schlunt. “We can see potential, but there would need to be a leap of great magnitude in the demand for solar.”

Until the solar market heats up, the majority of the nation’s largest engineering firms are focusing on other types of green design. For example, Varo has increased the use of variable-speed drives (VFDs) and high-efficiency motors, Shah & Associates is focusing on installing motor control centers and VFDs, and Mesa Associates is conducting studies and performing upgrades for hydro plants. In addition, Affiliated Engineers is designing solar water heating, geothermal, and building automation systems.

“Almost every building that we touch has some degree of sustainability in it,” says Quinn. “Even risk-resistant institutions are much more mindful of how they approach renewable energy opportunities.”

Dealing with down markets

Along with leveraging opportunities in hot markets, the nation’s top electrical design firms saw some markets that did not fare well in 2013, including retail, public building, residential, and hospitality (Table).

While the hospitality and retail markets have been down for several years, Peterson says his company is starting to see some activity in the hospitality market with some very large international developments. Similarly, Cruz says he’s seeing an uptick in this sector following the slowdown due to the recession.

“If people don’t have work, or they’re afraid to spend money, they won’t go on vacation or splurge, and that hurt the hospitality industry,” he says. “Now that the economy is getting better, people are starting to spend money, and the hospitality industry is investing in modernizing or renovating their hotels.”

One market that has tended to be down nationwide, however, is government and public works. When the federal government shut down for two months, the ripple effect lasted for close to eight months, Shah says. In turn, the lack of government money hurt the public works market.

For example, the city of Sacramento, Calif., is often heavy into public works because of the number of state buildings. Last year, however, the public works market was little to nonexistent due to the economy and the public entity budgets, Wheeler says. As a result, the company experienced a “mixed bag” business climate with a strong year in the Bay area and a slowdown in its Sacramento office.

Forecasting the future

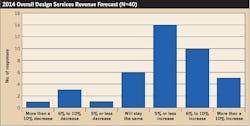

Despite facing a drop in certain market sectors, many of the nation’s top electrical design firms experienced steady to growing revenues in 2013, and the majority expect this trend to continue. For 2014, five respondents expect more than a 10% increase, 10 firms predict a 6% to 10% increase, and 14 companies anticipate a 5% or less increase (Fig. 11). Only five respondents expect a decrease in sales this year, and six companies think their revenues will stay the same.

For example, Varo expects to see a 6% to 10% bump in revenues this year due to its clients’ strong budgets and need for engineering and design work in electrical generation and the glass manufacturing sector. The firm faced a decreased backlog in 2013 but expects its backlog to increase this year through the efforts of its lead engineers.

“We spent much of 2013 developing new clients, and they appear to have many small to medium projects in hand,” says Schlunt.

While 75% of the firms saw increased backlog in 2013 (Fig. 3), 90% expect to have increased backlog for 2014 (Fig. 12), including Interface Engineering. While Cruz says it’s hard to forecast what the future holds for electrical design firms, at this point, he’s seeing more opportunities for electrical design firms.

“We are hoping that since the economy is getting better, the banks will loan money, the developers will start developing, and we’ll see things start picking up,” says Cruz. “There are more projects out there than there were before.”

Fischbach is a freelance writer based in Overland Park, Kan. She can be reached at [email protected].

JOIN THE LIST

To get on the list to receive the proprietary survey for next year, please contact Executive Editor Ellen Parson at 913-967-1986 or [email protected].