Rapid Recovery: EC&M’s 2015 Top 40 Electrical Design Firms Special Report

Pent-up demand for electrical design services has created a tidal wave of work opportunities for the nation’s Top 40 firms. Now that the economy has started to show signs of recovery, many design firms actually have more work than workers.

“We’ve got people working a lot of hours, and we are having trouble finding experienced employees,” says Scott Wheeler, principal for The Engineering Enterprise (No. 35), Alameda, Calif. “Last year at this time, we may have gotten two requests for qualifications a week, and now we have between five and 10 per week. We also have a backlog of projects that will go on for three or four years.”

During the economic downturn, electric design firms struggled with limited work opportunities, fierce competition, and a decreased backlog. Due to the ongoing recovery, however, many of the nation’s Top 40 firms are now posting revenue gains, pursuing new work opportunities, and rapidly expanding their teams — leading to an impressive total of electrical design revenues in 2014 of $1.68 billion, which is down slightly from $1.808 billion in 2013 and up from $1.348 in 2012.

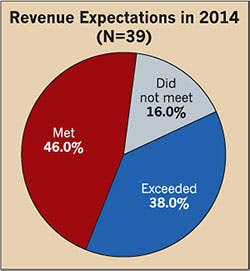

More than half of the firms on this year’s EC&M Top 40 listing reported a gain in electrical design revenues (click here to see the Top 40 Electrical Design Firms List), and 84% of the respondents met or exceeded their revenue projections for 2014 (Fig. 1). For example, Carollo Engineers, Inc. (No. 11), Walnut Creek, Calif., scaled five spots in the rankings — posting the biggest percentage increase in electrical design revenues of all the Top 40 firms (28%).

“Our increased workload and backlog is indicative of the economy growing and turning around,” says Anthony Morroni, senior vice president and national director of discipline engineering for Carollo Engineers, Inc. “We also made a strategic investment in marketing, even during the downturn. There was not much out there at that time, but it has positioned us better right now.”

Despite all of this good news, not all firms experienced a growth in revenue last year. Four firms posted more than a 15% drop in electrical design revenues including CH2M (No. 3), Englewood, Colo. with a 38.2% decline; Leo A. Daly (No. 25) with a 17.5% decrease; P2S Engineering, Inc. (No. 26), Long Beach, Calif., with a 29.7% drop; and KCI Technologies, Inc. (No. 40), Sparks, Md., with a 52.7% dip. Charles A. Phillips, Jr., senior vice president of KCI Technologies, attributed the decline in electrical design revenue to the substantial pullback in the federal market, which had been very strong for the firm in 2013.

“The market was fair based on the number of opportunities in the public and private sector,” Phillips says. “We are looking for 2015 to be better based on increased activity in the industrial market.”

Shreedhar Shah, president of Shah and Associates (No. 32), Gaithersburg, Md., says his firm’s growth was limited by projects that were delayed or put on hold.

“These projects were just random one-offs, but because they were so large, it affected everything and had ramifications,” Shah says. “I think they were delayed for various reasons related to the economy or the reallocation of capital budgets.”

Gearing up for growth

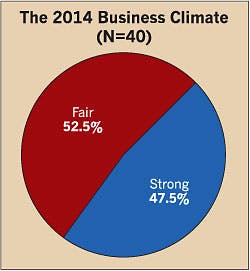

While none of the Top 40 firms considered 2014 to be a weak market (Fig. 2), about half of the respondents characterized the business climate as “strong,” while the other half described it as “fair.”

Mak Wagner, chief electrical engineer and senior project manager for Stanley Consultants, Inc. (No. 5), Muscatine, Iowa, says last year, many hungry competitors were competing for fewer projects. After having trepidation about moving ahead with projects, however, there has been a wholesale shift since the beginning of the year, says Steven Straus, CEO of Glumac (No. 16), San Francisco.

“It seems like corporations and developers finally felt like everything was going to be moving forward,” Straus says. “The economy was good, and it was almost like the flood gates opened up across the West Coast.”

In the Bay Area market, Wheeler says his firm has noticed a huge jump in the high-rise residential market, especially in San Francisco. Also, a stronger economy is boosting the tech market, which is, in turn, driving increased activity in the Northern California design and construction market.

The construction market is also heating up on the East Coast, and Jaros, Baum, and Bolles (No. 12) is leveraging the steady growth in the construction industry in the New York tri-state area, where it performs about 80% of its work. Last year, construction spending in New York City was up 26% to $36 billion; the cost of residential development rose to record levels with spending up 73% to $11.9 billion; and non-residential commercial construction experienced its first increase since 2010 by rising 20% to $9.8 billion, says Mark Torre, a partner in the firm.

“We are fortunate to have a significant portion of our project work in the New York tri-state area, which is increasing construction spending in many sectors, including residential, commercial, and institutional,” Torre says.

Expanding operations

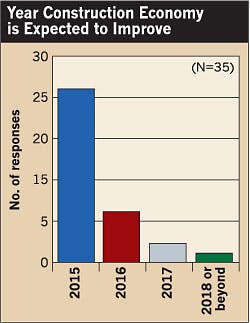

Due to the increased level of activity across all market sectors and companies’ bursting backlogs, nearly 75% of the Top 40 firms expect the market to turn around this year (Fig. 3).

Ray Kowalik, president of global practices for Burns & McDonnell (No. 1), Kansas City, Mo., says the economy has been steadily improving since 2008, and the company had its best year ever in 2014.

“It’s getting better and better beyond this year,” he says. “We see more project opportunities with low energy prices. As a whole, we think the economy has already turned around.”

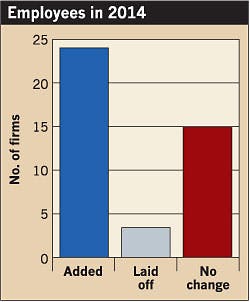

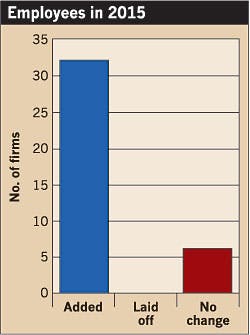

To keep up with the increased amount of work, electrical design firms are definitely in a hiring mode. For example, last year, nearly a quarter added employees while only three firms reduced headcount (Fig. 4). This year, even more firms plan to hire more employees (Fig. 5).

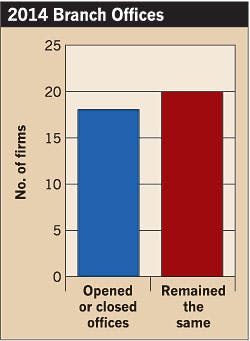

Oftentimes, the firms are hiring employees to help staff new branch offices. For example, 19 firms added or closed branch offices last year, and one firm — Stantec, Inc. (No. 2), Edmonton, Canada — hired 1,229 employees and opened 51 branch offices (Fig. 6).

In most cases, the firms opened between one and five new branch offices to cover a new market or geographical area. For example, Shah & Associates opened a new branch office in Pittsburgh to help to grow its electrical studies practice, and Elcon Associates, Inc. (No. 36), Portland, Ore., is hiring new engineers to cover demands in the rail transit and electric utility markets.

Other Top 40 firms are taking the acquisition path to drive growth and enter new markets, according to the recent FMI’s Mergers & Acquisitions Trends report. For example, KCI Technologies, Inc. expanded geographically in mid-2014 and added staff in several large cities in Texas through an acquisition. Since that group will be onboard for an entire year in 2015, it will add substantial sales to the company, Phillips says.

“Many of those hires came through an acquisition we made of an MEP firm in Houston,” Phillips says. “The others came as the result of expanding our operations in both Maryland and Pennsylvania. Some hires were made specifically to cover needs in the renewable energy sector as our clients look for us to be on the leading edge of design in this area.”

Not all firms, however, are growing via acquisition. Burns & McDonnell, an employee-owned company, has been able to grow 10% to 15% per year organically. Kowalik says. Last year, the company grew by more than 600 new employees and opened five new branch offices.

“All of our branch offices are growing right now,” Kowalik says. “Part of our business model is to move beyond a Kansas City-based organization and closer to where our projects and customers are to give us a good opportunity to work with them.”

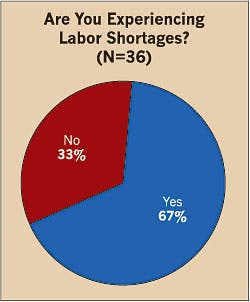

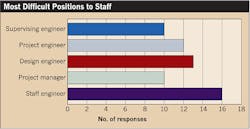

As the nation’s Top 40 firms expand their operations by opening new branch offices, many are not challenged with finding available work opportunities, but rather by being able to hire enough qualified engineers to handle the increased workload. Slightly more than two-thirds of the firms reported facing a labor shortage (Fig. 7) with staff engineers, design engineers, and project engineers highlighted as the top three most difficult positions to fill (Fig. 8).

Morroni says he expects revenues to be flat this year due to the challenge of locating and retaining quality staff in the growing industry. Right now, he says the mid-level engineers, who typically have about five to 10 years of experience, are nearly impossible to find.

“There are a minimal amount of schools that offer power engineering courses, and you’re now seeing more instrumentation and control engineers than electrical power engineers,” Morroni says. “I think the electrical power industry will be facing a real resource limitation ahead, and I don’t know if there is a silver bullet that will help to fix that.”

To successfully handle this challenge, the firm is actively recruiting through its internal and outside recruiters and trying to use consultants if they have the right skill set. Morroni says it’s imperative for the firm to not just find any employee — but the right one to do the job for the long-term. Over the last year, the company opened three new branch offices in Texas, Illinois, and Florida and hired 75 new employees.

“We’re very selective about the people we want, Morroni says. “We want them to have a career with us because we spend a fair amount of time, effort, and money on training and educating them.”

Next to the labor shortage, the next top challenge faced by the Top 40 firms is the shift from value-based to price-based award decisions on electrical design projects. Shah says this approach isn’t in the best interest of the client. While a value-based approach may be cheaper in the long run, it is often much more expensive in the short term.

“Due to constant budget pressures, we see more clients taking this approach,” Shah says. “If they choose architectural and engineering services in a low-bid environment, they won’t get value. It’s not like buying pencils and construction equipment — and it’s no way to treat engineering services.”

Another challenge facing the Top 40 design firms is the surge in pricing and the unparalleled demand for electrical contractors in today’s market, Straus says.

“Electrical contractors can call their own game now, especially on the West Coast,” Straus says. “Pricing is through the roof from the contractors. I’ve never seen anything like this before.”

The smaller electrical design firms are also challenged with the rise in design-build projects. Kinh Pham, managing principal of Elcon Associates, Inc., says it’s difficult for smaller firms to compete for these types of projects because it can cost hundreds of thousands of dollars to create detailed proposals in a one-step process. For that reason, he prefers a two-step process, in which his firm is only required to provide qualifications during the first step. Then only qualified short-listed firms are included in the second step to provide detailed proposals.

“Small businesses, in particular, do not have the luxury to spend limited resources to apply for a design-build project when the chance of being chosen may be less than 10% in a one-step process,” he says.

Embracing opportunities

From coast to coast, electrical design firms faced variations in the amount of activity within certain market sectors, but most firms found work opportunities in five key markets — water/wastewater, rail/transit/transportation, aviation, defense/security, and manufacturing (Markets on the Move). Three of the top markets, however, were health care, power, and education/institution (Table).

Health care has had a significant increase in the demand for technically updated, more sustainable, and more energy-efficient, patient-friendly facilities nationwide, Torre says.

“As a direct result of the improving economy, medical and academic institutions have had more money to spend to keep up with this demand,” Torre says.

In California, green-field hospital projects are nearly non-existent because most hospitals have been upgraded or replaced over the last 10 years to comply with seismic regulations, Straus says. Today, the focus has shifted to medical office buildings (MOBs), which can feature several doctors, a central lab, MRI suite, Cat scan, surgery rooms, and physical therapy, Straus says.

“Obama Care and ongoing changes in insurance policies are pushing the medical industry to do as much work as possible on an outpatient basis,” Straus says. “The super MOBs have anything and everything that a hospital has but just not with an overnight occupancy.”

Beyond the health care market, about 22% of the firms have zeroed in on the power market, which provided a wealth of opportunities. While utilities were reluctant to invest in projects for many years, they are now outsourcing design work to build new capacity and upgrade infrastructure. Because some utility system equipment dates back 50 years, firms like Burns & McDonnell are designing replacement systems (electrical equipment and cable) that have reached the end of their life.

“Transmission and distribution and oil and gas have been very hot markets for us and are very robust,” Kowalik says. “Upgrading electrical equipment has kept the electrical industry very busy, and I see that continuing.”

Not only the aging of the plants, but also the real or perceived vulnerability of energy and utility infrastructure systems are changing how assets are viewed, managed, and protected — both from the energy supply side and the customer demand side, Wagner says.

“Threats to our country’s energy system infrastructure come from multiple fronts, including physical and cyber terrorism, natural disaster, aging equipment, reduced system capacity margins, and generation and distribution capacity constraints,” Wagner says. “Interruptions to any part of these critical infrastructures can result in widespread disturbances.”

Within the higher education market, clients are investing in central plant, upgrades/expansions, and efficiency projects to prepare their campuses for expansion or reduce costs on already built infrastructure, says John Burns, senior vice president of Burns Engineering, Inc. (No. 23), Philadelphia.

The K-12 segment is also gaining traction as schools are investing in renovation projects or building new charter schools, Wheeler says.

“Since our economy has been on the downside over the last few years, schools have been limping along even though their facilities need upgrades,” he says. “Now that the economy is on the road to recovery, and bonds have passed, nearly every other school district has a decent chunk of money, and that work is feeding into our backlog.”

Sector slowdown

Not all markets, however, experienced strong levels of activity in 2014. Three markets in particular — private office, retail, and residential — were slow for the majority of firms.

Both the residential and retail markets slowed down for KCI Technologies, but Phillips says these two market sectors are now hitting their stride, and 2015 is seeing increased demand.

“We will remain focused on garnering our share of this market as it continues to rebound from the record lows of the past decade,” Phillips says.

The private office market was also very competitive last year, and with most projects requiring commodity engineering, Burns says. Within this sector, however, firms found two bright spots: mixed-use projects and corporate headquarters. For example, quite a few projects of this type are now underway in Seattle, the Silicon Valley, and Los Angeles.

“Tech businesses are growing and expanding significantly, and there is an appetite for space in the office market,” Straus says.

Electrically, these projects have increased from 4 watts per square foot to about 10 watts per square foot due, in part, because the density has doubled from one person per every 250 square feet to one person per every 125 square feet.

“They are putting more people into the same space by using bench seating,” Straus says. “Also, these office projects have significant IT loads — both in terms of server loads and central processing units as a work station.”

Enhancing energy efficiency

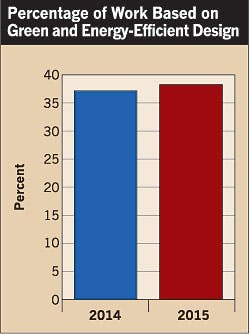

When working with clients, another trend experienced by electrical design firms nationwide was energy efficiency. For more than one-third of the electrical design firms on this year’s listing, green design accounts for a large percentage of their work (Fig. 9).

Energy-efficient and sustainable design is required on virtually every project, Pham says. For example, large light-rail transit stations now use building management systems to manage energy demand. Also, engineers at Shah & Associates are specifying more energy-efficient equipment like motor control centers, variable-frequency drives, and combined heat and power, Shah says.

In addition, power plants are going green with projects like LED lighting and adding variable-frequency drives on cooling tower fans, says Kowalik of Burns & McDonnell. In addition, the firm’s clients are looking for more energy-efficient transformers, transmission lines with higher voltages and thus lower line losses, and combined heat and power units for heavy-energy users like large hospital and college campus projects.

Straus has also found that zero-energy projects seem to be gaining popularity with higher education and tech company clients. In addition, he says Glumac’s clientele are also looking for photovoltaic and wind turbine systems, LED lighting, and gray water and black water systems.

To meet the need for green energy, many clients are also turning to JB&B to provide electrical design services for large on-site cogeneration plants, which provide heating, cooling, and electrical power for facilities and reduce demand on the local utility infrastructure.

“We believe there will be more opportunity going forward for these types of plants as well as an increase in the demand for photovoltaics and wind energy,” Torre says.

One factor that is driving growth in the photovoltaics market is the new energy code in California, which was implemented last July. Now, nearly every project must set aside 15% of the roof area for a current or future photovoltaic system.

“Our new energy code really shook our market quite a bit last year,” Wheeler says. “It was one of the most substantial code changes that I have seen since I’ve been in the industry, and it took what we have to do for photovoltaics up about three notches.”

KCI Technologies is also taking on a vast number of solar projects — ranging from small installations covering a rooftop to large farms spanning hundreds of acres. Within the photovoltaic market, the firm faces two key challenges: the diversity of the installations — as far as complexity, geographic location, and size and scope — as well as future financing.

“At the end of the year, many of the incentives, including tax credits, sunset,” Phillips says. “The engineering and contracting community needs to get behind these energy conservation technologies and push for the continued support of government in this area.”

Looking ahead

With the increasing number of opportunities across all market sectors, the majority of the Top 40 firms forecast that their revenues will increase this year. Although only five firms expect their revenues to increase more than 10%, 19% are looking to post a 5% to 10% gain (Fig. 10). Wagner says he is noticing a renewed optimism.

“The economy is trending in the right direction, although slowly,” he says. “There is an increase in the availability and production of energy resources here in the United States, which is fueling domestic production and attracting domestic and foreign investment.”

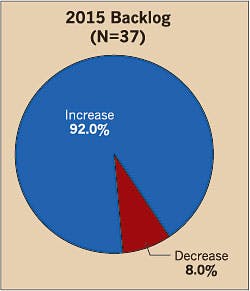

One indication of the economic turnaround is the number of firms experiencing an increased backlog. Case in point: 92% of firms expect to have an increased backlog this year (Fig. 11). Torre says his firm is currently booking new work now, which will increase the backlog of work for 2015 through 2018.

“Looking forward, we have a healthy backlog of work, and we have several new projects starting as well,” Torre says.

From coast to coast, electrical design firms are positioning themselves for growth to handle the anticipated flood of opportunities that lie ahead.

Fischbach is a contributing writer and editor based in Overland Park, Kan. She can be reached at [email protected].

Sidebar 1: Markets on the Move

1. Aviation. The expansion of air traffic is pressing airports nationwide to add more capacity and, in turn, hire electrical design firms to help make infrastructure improvements, says Shreedhar Shah, president of Shah and Associates. Also, John Burns, senior vice president of Burns Engineering, Inc., says the aviation industry is gaining momentum due to steadily improving financing options and the industry’s growing economic confidence.

2. Defense and security. As clients seek to protect their people, property, and information, the demand for security services will continue to grow for the foreseeable future, says Charles A. Phillips, Jr., senior vice president of KCI Technologies, Inc.

3. Manufacturing. Another market that is gaining traction is manufacturing due to the low energy prices and pent-up demand, says Ray Kowalik, president of global practices, Burns & McDonnell. Due to the low energy prices, the United States is now cost competitive for manufacturing and, as a result, some corporations are looking to move their operations state-side, Kowalik says.

4. Rail and transit. While everyone is hopeful for a robust federal transportation bill, state, regional, and local agencies are creating their own dedicated funding to move projects forward, says Burns.

Also, the market is gaining strength due to light-rail transit extensions and expansions in California, Oregon, and Washington, says Kinh Pham, managing principal, Elcon Associates. Going forward, design firms can provide design for supplying power not only to traction power substations for train propulsion power but also to station platforms, light rail tunnel, operation, and maintenance facilities, he says.

“High mass transit ridership is creating a demand for public works construction,” Pham says. “Track and rail bed construction increased about 70%, and there is enough work lined up in 2015 to keep this sector moving.”

5. Water and wastewater. Triggered by the recovery of the housing market and changing regulations, this market is releasing large capital projects and focusing on upgrading and replacing equipment that has reached the end of its useful life, Shah says.

“Older plants are getting renovated to become more energy efficient, and different chemical processes necessitate more electrical power,” Shah says.

Sidebar 2: Top 40 Firms’ Secrets to Success

Strive for excellence. If an electrical design firm exceeds expectations on a project, the business often snowballs, says Scott Wheeler, principal of The Engineering Enterprise. For example, when electrical contractors don’t have an in-house engineering department or are overloaded with work, they often hire The Engineering Enterprise directly for design-build projects.

Constantly adapt to market changes. Firms must be poised to meet the needs of customers on the way up and down, says Charles A. Phillips, Jr., senior vice president of KCI Technologies. For example, a significant amount of the firm’s business is directly tied to the energy market. The growing oil prices have fueled record growth in the commercial and residential market in Texas and the Northeast, but the recent decline in energy prices has caused this sector to slow down. “As oil companies have adjusted to the new pricing levels to survive and slowed spending, the consumer is adjusting to lower energy bills,” Phillips says. “They are now spending more in other areas. This creates demands in market sectors, such as retail and residential.”

Partner with electrical contracting firms. On large solar projects, Mark Wagner, chief electrical engineer and senior project manager for Stanley Consultants, Inc., anticipates more project teaming and partnerships between electrical contractors and consulting engineering firms. With this collaborative approach, companies can help to ensure the proper installation and implementation of increasing system complexity, system reliability, resiliency, and environmental and energy performance.

Focus on recruitment and retention. John Burns, senior vice president of Burns Engineering, says his firm works hard to attract and retain talented staff that the clients like to work with. Back in 2008, he says the market went through lean times, but his firm weathered the storm by retaining talented staff — and is now positioned to capitalize on changing market conditions of improved demand for engineering.

Transfer knowledge from veterans to new hires. Burns & McDonnell is continually training new hires and working with veteran engineers to pass on the years of knowledge, skills, and experience gained over a life-long career.

Join the List

To get on the list to receive our proprietary survey next year, please contact Executive Editor Ellen Parson at 913-967-1986 or [email protected].