Upward Bound: EC&M’s 2013 Top 40 Electrical Design Firms Special Report

The nation’s top U.S. electrical design firms weathered the storm during the economic slowdown with slim margins, fierce competition, and drastically reduced opportunities. By diversifying their services and expanding into new areas, however, the companies are now reporting a brighter outlook ahead.

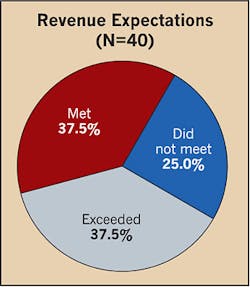

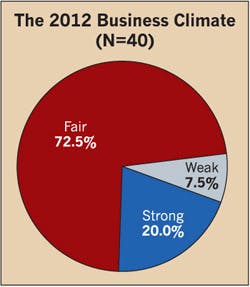

Case in point: Nearly 75% of the firms on this year’s annual proprietary Top 40 listing met or exceeded their revenue expectations for 2012 (Fig. 1), despite working in what nearly three-quarters of the respondents characterized as a “fair” business climate (Fig. 2).

For example, Kansas City, Mo.-based Burns & McDonnell (No. 1) had the best sales year in its history by earning $2 billion in sales, including $500.7 million in electrical design revenue in 2012. The company surpassed the $1 billion mark just five years ago. CEO and Chairman Greg Graves attributed the jump to strong activity in the electrical transmission group and the global practices group, which specialize in design-build projects for transmission and distribution, process, energy, water, and federal work.

But Burns & McDonnell, which experienced a 24.6% increase in year-over-year electrical design revenues, wasn’t the only firm to enjoy more than a 20% increase from last year’s numbers. Pasadena, Calif.-based Tetra Tech, Inc. (No. 4) had an 81.1% increase, Madison, Ala.-based Mesa Associates (No. 5) jumped up 51.4%, Folsom, Calif.-based Glumac (No. 12) reported a 50% rise, Sparks, Md.-based KCI Technologies, Inc. (No. 19) posted a 110.7% jump, and Gaithersburg, Md.-based Shah & Associates (No. 26) experienced 107.7% growth.

Glumac, which was ranked as No. 19 in last year’s listing, jumped up seven spots in this year’s ranking. Angela Sheehan, CFO, attributed the 50% growth in electrical design revenue to the mission critical facilities market, which went from $2 million in sales in 2011 to $10 million in 2012.

“Mission critical projects have a stronger focus on electrical engineering than a lot of the other types of work we do,” Sheehan says. “We started working with a strategic client seven years ago, and that work is just now starting to take hold. Fortunately, we have the type of people with the project experience that positioned us for that work. A lot of it has to do with doing the right thing at the right time and having a little bit of luck.”

Not all of the firms on the Top 40 listing, however, experienced increases in revenue. Seven reported a decrease in electrical design revenue, and four of those slipped down in rankings by reporting more than a 20% decline in year-over-year revenues, including: Walnut Creek, Calif.-based Carollo Engineers, Inc. (No. 21) with a 29.3% drop; Orlando, Fla.-based TLC Engineering for Architecture, Inc. (No. 22) with a 24.6% decrease; Portland, Ore.-based Interface Engineering, Inc. (No. 25) with a 26.8% drop; and Albuquerque, N.M.-based Bridgers & Paxton Consulting Engineers, Inc. (No. 28) with a 20.7% decline.

Overall, the companies on this year’s listing reported total electrical design revenues of $1.348 billion in 2012 (click here to see a PDF of the Top 40 Electrical Design Firms List).

Expanding operations

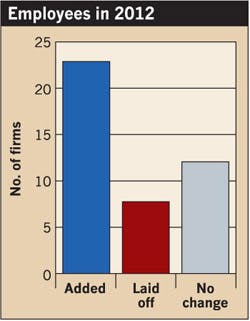

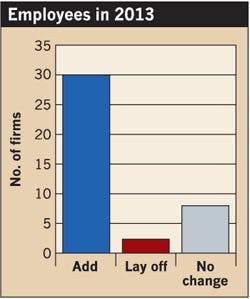

When the economy slowed down, many electrical design firms were forced to lay off employees. In 2012, however, more firms hired new workers than made reductions in the workforce (Fig. 3). A total of 23 firms added employees while eight companies laid off employees, and 12 didn’t change head count. In 2013, respondents indicated that those numbers would climb even higher, with 30 firms saying they expect to add head count (Fig. 4).

Tetra Tech added the most employees of any of the Top 40 design firms with 1,000 new workers. David Bloxom, vice president, attributed the rapid company growth to multiple international acquisitions.

“We have acquired several firms in Canada, and we now have an active electrical transmission and distribution engineering practice in Canada,” say Bloxom.

Salt Lake City, Utah-based Spectrum Engineers, Inc. (No. 30) only added 10 employees in 2012, but this year, the company is planning on adding more employees in anticipation of a greater workload, says David Wesemann, president and principal electrical engineer.

“When we take on additional work, we want to have the staff onboard and already trained,” he says. “We strive to hire ahead of the curve so we don’t respond too late as markets continue to expand and local economies rebound.”

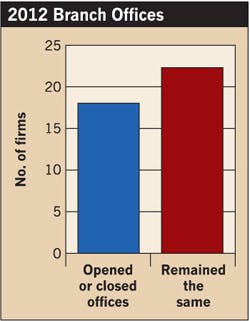

One way companies are preparing for the upcoming upturn is through opening branch offices. According to this year’s survey, 18 firms opened or closed branch offices while 22 companies had the same number of branch offices in 2012 (Fig. 5). While Glumac didn’t open any new offices last year, the company opened new branches in Corvallis, Ore., and Shanghai, China, in 2011. Glumac, which hired 80 new employees and laid off 40 workers in 2012, is now starting to see growth across both of these locations.

To recruit new talent, Glumac situated its Corvallis office near Oregon State University’s School of Engineering and hired its students as interns. After only one year, Glumac has been able to hire four interns as full-time employees, Sheehan says.

Burns & McDonnell also keeps its eye open for new talent. Over the last year, the firm has hired 400 new employees and opened branch offices in Hampton Roads, Va.; Oklahoma City, Okla.; Calgary, Alberta; and Portland, Maine.

“We open branch offices based upon specific market tendencies or the ability to attract great new folks,” Graves says. “We believe very strongly in organic growth whenever possible.”

Working overseas

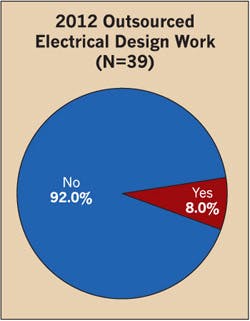

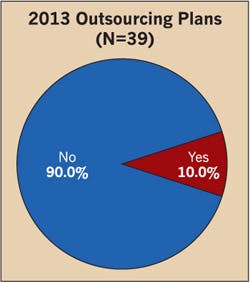

American engineering firms are not only expanding nationally, but also globally. A total of 8% of the responding firms outsourced some of their electrical design work overseas in 2012 (Fig. 6), and this percentage is expected to increase to 10% by 2013 (Fig. 7). For example, Burns & McDonnell, which does a significant amount of work in Canada and Qatar, recently acquired an engineering firm in Mumbai, India, named it Burns & McDonnell India, and has about 300 people working there every day.

For 2013, the company plans to outsource 2% of its electrical design. Although Graves says outsourcing may not be right for some clients, such as the federal government or aviation, some of the clients in the United States require the company to use a lower source of engineering talent.

“We have found that our fellow employees in Mumbai, India, are terrific engineers,” he says. “We realize that there are some in the industry who may have concerns about quality of work, but those concerns are completely unfounded.”

Grand Island, N.Y.-based Cannon Design (No. 24) has also had success outsourcing electrical design work overseas. In fact, the firm outsourced nearly 40% of its electrical design work in 2012, which includes 20% to China, India, and the Middle East and another 20% to Canada. For the overseas work, Cannon Design designs through 50% to 65% construction drawings before turning a design over to local partners to wrap up. The international offices look over their shoulder in early design for peer reviews, and then Cannon does the same for final design and construction. In addition, the Shanghai office technical staff members have also been used for some 24/7 domestic project and reference standards production, including the conversion from 2D to 3D/BIM software.

In Canada, Cannon Design maintains four architectural offices, but is only licensed in Saskatchewan for engineering. The firm provides conceptual planning, facility assessment, energy, lighting design, and commissioning services in conjunction with other Canadian project teams.

“The benefit of outsourcing is that we sometimes make out better on production costs,” says Ted Fowler, principal for Cannon Design. “The fact that you are working 24/7 really helps in expediting the work. It doesn’t matter where you are located as long as you are able to communicate well and have the right people doing the work. Technology can pull everyone together.”

Other companies, however, are working internationally but not outsourcing electrical design. For example, Tetra Tech maintains 350 corporate offices globally, performs a large share of energy work in-house, and has Tetra Tech employees based in different countries.

Because codes and requirements can vary widely from one country to the next, having in-country employees is a significant advantage, Bloxom says. In addition, Tetra Tech can train its employees and build institutional knowledge by having offices overseas, says Charlie MacPherson, a vice president for Tetra Tech.

Going green

In addition to working internationally or outsourcing, many of the nation’s top electrical design firms are also basing their work on green or energy-efficient design. In fact, 25 of the 40 firms reported that at least 20% of their design work revolved around energy efficiency (Fig. 8).

For example, Spectrum Engineers reported that in 2012, 95% of its work was based on green and energy-efficient design. The reason why energy efficiency is so important is because a green building equates to less energy and lower operating costs, Wesemann says. Owners can achieve a clear benefit over the life cycle of the building, which equates to less money spent on operation and maintenance. For example, Spectrum is working on several projects that are striving for NetZero status, and the firm’s philosophy is to design sustainable, environmentally responsible buildings whether or not the owner is seeking LEED certification.

“Ten years ago, green buildings were almost never discussed, and five years ago, it was an afterthought late in design,” Wesemann says. “Today, it’s almost the first thing discussed in the initial design meeting. Due to private and government sustainable green building initiatives and the public’s awareness regarding green projects, it’s almost the most important aspect of a building.”

Scott Gerard, a principal for Wheat Ridge, Colo.-based M-E Engineers (No. 15), says his firm’s clients want to promote the fact that they are being environmentally conscious. While the premium to go to a sustainable design may be a 1% to 2% increase, operationally, they can save that over a 10-year period. To conserve energy, they are investing in LED lighting, more energy-efficient mechanical and HVAC systems, and photovoltaic systems.

“Buildings have improved their efficiencies over a 10-year span,” he says. “If you look at 2002 versus 2012, it is night and day as far as the energy code. In the past, it wasn’t thought of as much across the United States to save energy.”

Boushra Hanna, senior vice president and electrical department head for Glen Allen, Va.-based H&A Architects and Engineers (No. 18), expects to see more projects with requirements for green design due to the federal standards and policies in energy intensity reduction and the executive orders for renewable energy.

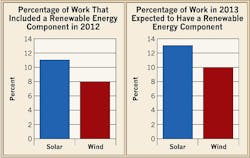

Kenneth Diehl, Jr., senior vice president of Nashville, Tenn.-based Smith Seckman Reid, Inc. (No. 8) agrees. His company, which expects to have half of its work based on green or energy-efficient design in 2013, believes that these designs will be in greater demand than ever before due to new codes and regulations coupled with the increasing pressure on owners to reduce operating costs. The challenge, however, will be in finding capital to implement savings opportunities in existing buildings. Of course, the country’s largest engineering firms are also getting involved in renewable energy projects, including on-shore and off-shore wind and photovoltaics. For Spectrum, photovoltaic projects are more abundant than wind energy jobs at this time.

“Solar, unlike wind, is available everywhere, so it’s the first renewable source we go to,” Wesemann says. “Wind is selectively available, so wind projects are few and far between. The economics of building a wind turbine has to have enough wind to pay that investment back.”

In the on-shore wind industry, Tetra Tech is seeing a push toward larger turbines, which can provide more electricity and save money during construction, says Senior Vice President Craig MacKay. On the solar side, the age of the large solar thermal projects is over, and Tetra Tech is seeing a transition toward more modest photovoltaic systems — ranging from several megawatts to more than 100 megawatts. These projects are often located as close as possible to interconnection points to minimize costs and increase efficiency.

“The renewable market has been the most active power sector in the United States and Canada in the last few years,” MacKay says. “There’s been some twists and turns with production tax credits, but it’s stayed a robust market, and we’re planning on participating in it as it grows.”

Pursuing hot market segments

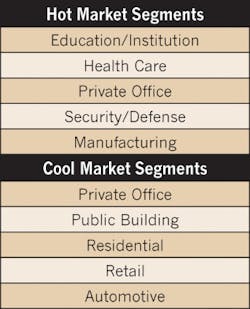

The nation’s top firms not only expressed their involvement in renewable energy projects, but also voiced their views about the hot and cool markets in 2012. Fifteen of the 40 firms listed health care as one of their top three hot markets (see List), a trend Wesemann attributes to the aging of the U.S. population.

“Unlike most industries, regardless of the economy, there will always be a need for education and health-care facilities, and to some degree, for public services,” Wesemann says. “These markets will always be strong markets due to the aging population, aging infrastructure, and continued complexity of these building types.”

In the health-care industry, engineering firms have noticed a shift from the construction of large-scale hospitals to smaller clinics. Diehl from Smith Seckman Reid says health care is in a period of transition, and anytime this occurs, there will be a change.

“Health-care facilities will have to change to make money in the future,” he says. “It probably means there will be less hospitals as we know them today and more clinics and outpatient services, which have better reimbursement rates.”

Oftentimes, these clinics are moving into nontraditional settings like retail centers or pharmacies to make it more convenient for consumers, says Scott Webb, principal/mechanical engineer for Tulsa, Okla.-based MPW Engineering LLC (No. 40). In addition, Sheehan noted that more health-care providers are redesigning their spaces with a focus on sustainability and flexibility. By having a more efficient design, they can have a multi-functional space with less square footage.

An additional area of growth for many design firms is the education market, specifically colleges and universities. In fact, 17 of the 40 firms considered education/institution as one of their top three market sectors.

In the education market, most engineering firms are reporting an uptick in college and university work. For example, Glumac is designing student unions to be energy-efficient, inviting, and flexible as a way for universities to help attract students going forward. Smith Seckman Reid is also seeing a surge in university work, and Diehl attributes this growth to the bubble in the population driving more students to universities as well as the fact that Americans are now placing a higher value on a college education.

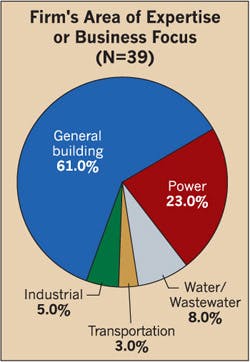

Another hot market for the engineering firms is the power industry. In fact, 23% of the engineering firms on this year’s listing named this market segment as their top area of expertise (Fig. 9). While Burns & McDonnell’s energy group has seen clients hold back certain projects due to the uncertain future of coal and nuclear, the transmission projects to improve electrical reliability have moved forward.

In turn, this is creating a strong market for engineering firms. For example, Tetra Tech reported a year-over-year growth in both electrical transmission and distribution and substation design.

“The infrastructure has been somewhat neglected over the last 10 to 20 years,” MacKay says. “Coupled with that, there is load growth, population has shifted, the system in place needs to be enhanced, and new capacity must be added.”

Facing a dip in slowing markets

For every hot market, however, the design firms noted cool markets that postponed projects and delayed investment. For many firms, the commercial sector, namely retail and private office, topped the list as their slowest market in 2012. The continued slow pace of work in commercial sector construction had an impact on overall business opportunities, Hanna says.

“Retail and private office were slow markets due to the lack of confidence in the economy by private investors,” Hanna says. “We do expect them to rebound, but believe a full recovery may still be a few years out.”

One reason why the private office market took a hit in 2012 is because when there is a downturn in the economy, companies start to delay moving because of the significant cost associated with moving to a new space.

“There were a lot of firms that were holding off on making moves,” Sheehan says. “If the market vacancy rate was going up, they wanted to hold off until the rate was higher, and they could secure a lower rent per square foot.”

While some companies moved to new offices or redesigned their existing space to make it more employee-friendly, the market was not as active as it is typically for Glumac, Sheehan says. Smith Seckman Reid also experienced a dip in private office work, and Diehl attributes the slowdown to the 8 million unemployed Americans.

“You don’t need offices if you don’t have jobs,” Diehl says. “I think we are also finally seeing the impact of computers. We don’t need as many people anymore to do the things we used to do.”

Another market that was hard hit in 2012 was retail, and one contributing factor to the slowdown was the convenience of online shopping, says Gerard of M-E Engineers. Rather than showcasing all of their products in stores, companies are instead selling a lot of their inventory online.

“The retail market is shrinking in terms of actual building space because it’s more of an online environment,” Gerard says. “I see that trend continuing, but I think retail outlets can only get too small. Not everyone will buy everything online, and sometimes they may go into a store and then buy it online.”

The problem with the trend toward smaller stores is that some owners are shrinking their engineering fees along with their stores’ square footage, Webb says.

Sometimes, they erroneously think that a smaller store will require less engineering expertise, but that is not always the case. Also, the selection of engineering firms is much more fee-driven than in the past, Webb says.

Other trends that Webb sees in this market is that in the building sector, contractors are hiring unlicensed professionals to design the mechanical and electrical systems on smaller projects, and they’re also waiting until the last minute to hire engineering firms so they can keep their fees down.

“They decide not to spend any money until they have to pull the trigger,” Webb says. “In the past, we would get involved a year or two before construction began, and now we are getting involved right before. If you don’t know if you have the project until it starts, you have less time to plan.”

Looking ahead

Even though the last few years have been challenging for the commercial engineering and construction industry, Graves believes that it’s soon time for a rebound. As such, Burns & McDonnell is preparing to take advantage of opportunities once it does turn around. In fact, the company recently launched a Kansas City-based Global Facilities Group, which will focus on the design and construction of commercial projects.

“I think the job of a firm like ours is to enter a market two or three years before it becomes vibrant,” Graves says. “While the commercial industry still has some recovery yet to go, now is the time to get good at it. Strength is just right around the corner.”

Other firms feel the same way about the general business climate for 2013. In terms of electrical design revenues, nine respondents expect more than a 10% increase, eight firms predict a 6% to 10% increase, and 13 companies anticipate a 5% or less increase (click here to see Fig. 10). Only six respondents plan to report a decrease in sales for 2013, and four companies predict their revenues will remain the same.

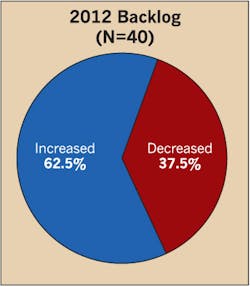

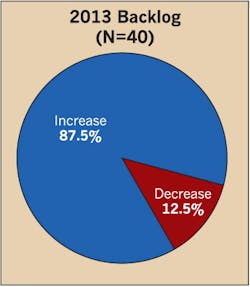

The nation’s top design firms are also expecting to have an even more significant increase in their backlog for 2013. While 62.5% had an increased backlog in 2012 (Fig. 11), 87.5% expect to have an increased backlog for 2013 (Fig. 12).

“Spectrum is very optimistic about 2013,” Wesemann says. “People are willing to spend construction dollars and spend now. We feel an uptick continuing as we look back over the past couple years.”

Fischbach is a freelance writer based in Overland Park, Kan. She can be reached at [email protected].