Now that the recession is in the rearview mirror, consumer confidence is climbing, unemployment rates are dropping, and developers are investing in new construction projects. In turn, nearly all the sectors across the board — with the exception of a few select markets — are preparing for an upturn in 2016.

“The construction expansion is continuing, and the ongoing increase should result in greater demand for the services of electrical contractors,” says Robert Murray, chief economist and vice president, Dodge Data & Analytics.

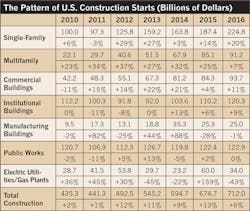

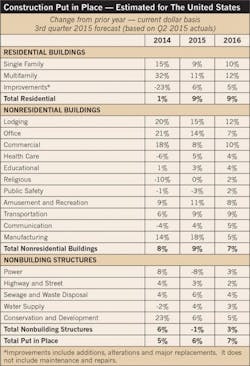

In his annual Dodge Construction Outlook report, Murray states that the economy is expected to grow 3.1% in 2016, and total construction starts are forecast to edge up 6% to $712 billion (Table 1) Specifically, he forecasts that nonresidential building will increase 9%, residential will advance 16%, and the nonbuilding sector will slide 14%. Looking at five different geographical areas, Murray expects the South Atlantic region to lead the way with an estimated 12% year-over-year increase in construction put into place.

For 2016, FMI economists forecast that the total construction put in place will increase 7%, which includes a 9% jump for residential, a 7% rise in nonresidential, and a 3% uptick in nonbuilding (Table 2).

The big picture

While the economy is expanding domestically, it is contracting abroad in select countries. For example, Europe is experiencing momentary weakness, and China is suffering from a current slowdown, says Beth Ann Bovino, chief U.S. economist for Standard & Poor’s.

“We have been seeing the U.S. economy holding up relatively well, but what is slowing us down is what is happening abroad,” Bovino says. “The dollar is stronger, which hurts exports into those areas. Also, the concerns about slowdowns in Europe and China have weighed down on consumer confidence and spooked the stock market.”

Looking ahead to 2016 is like looking back in time, says Alex Carrick, the North American chief economist for CMD and CanaData Construction. Next year’s “throwback forecast” mirrors the 2000s prior to the Great Recession when China was driving the world economy, and the United States took a back seat. Now, the positions have switched. While China’s growth has slowed, the United States currently has the standout economy.

“People need to understand how far the United States has come back and how strong it is compared to the rest of the world,” Carrick says. “Because we are not completely dependent on foreign energy, the U.S. economy can more or less go on its own and be the engine of growth for the world at large. Even though we are getting our mojo back, so many people are looking in the rearview mirror afraid of the monster chasing them. We went through a bad recession, but the United States has every reason to be optimistic about 2016 due to some very strong indicators.”

Case in point: The United States posted 230,000 job gains a month for the last year, Bovino says.

“Compared to what we had to suffer through during the recession, those monthly job gains are good news,” Bovino says. “Because commercial construction has been so slow throughout this recovery, it’s a promising sign for the United States going into 2016.”

Ken Simonson, chief economist for the Associated General Contractors of America, agrees that the market for most types of construction looks positive. For example, construction spending increased 14% from September 2014 to September 2015, which is the steepest growth rate since early 2006. Construction employment, however, has been growing at a much slower rate, but the recent numbers show promise, he says.

“The industry added 31,000 jobs in the month of October, which is much stronger than we had seen earlier on this year,” Simonson says. “For those who have given up trying to find a job in construction or started a job somewhere else, this shows that there are jobs to be had in construction, and the industry has a higher pay rate, making it an attractive career choice once again.”

While the increased construction employment numbers are good news for the industry, the overall labor market is still facing challenges, namely tepid wages and a historically low labor participation growth, Bovino says.

In addition, given the sluggish global economy, the Federal Reserve is looking to increase the federal funds rate domestically at the end of next year. Murray expects the long-term interest rates to move up gradually but continue to stay at historically low levels.

“We think any increase in long-term interest rates will stay moderate in 2016,” he says. “In fact, it may stir greater activity as developers push projects ahead to take advantage of what are still low interest levels. The dampening impact from higher interest rates is still at least a year away.”

Regional trends

Looking ahead, electrical contractors and engineers should expect certain markets to slow down and others to experience moderate to double-digit growth. For 2016, Robert Murray, chief economist and vice president, Dodge Data & Analytics, broke down the data into five separate regions — Northeast, Midwest, South Atlantic, South Central, and West (click to see a PDF version of Dodge Construction Starts). According to Dodge Data & Analytics, the Northeast will experience strong residential growth. In fact, the single-family market should post the highest gain (25%), while non-building construction could retreat 7%. Out of all the regions, the Midwest could post the highest increase in manufacturing and commercial — 20% — while multi-family could experience a slight dip (4%). The South Atlantic area of the country is expected to post the highest increase in total construction put-in-place with double-digit jumps in both residential and non-residential. The only category that may decline is nonbuilding, which may dip 6%. The nonbuilding construction market in the South Central region could be hit hard in 2016, leading to an overall 3% decline in total construction put-in-place. The West could post the second highest percentage growth in construction put in place due to an increase in nearly all market segments except for nonbuilding.

Ups and downs of energy prices

The impending increase in interest rates isn’t the only thing that could have an effect on the construction market next year. When looking at the U.S. economy, many economists view the low energy prices as a double-edged sword. On the one hand, they are driving growth in manufacturing and construction, but, at the same time, they are also causing a slump in the energy industry.

For example, Simonson says he is seeing a huge drop-off in drilling in areas such as North Dakota and Texas. Due to the low oil and natural gas prices and the decline in coal mining activity and the energy services sector, the companies that supply equipment, pipe, or other services for oil drilling have also dropped off.

“The low oil prices and the abundant supply of natural gas have led to a mixed picture for construction,” says Simonson.

In addition, energy companies have cut investment and jobs, Bovino notes. While Standard & Poor’s expects a modest pickup in energy prices, Bovino says they are well below the point where they were a year ago.

“Going into 2016, we expect energy prices to continue to drop,” she says. “Depending on how low the oil prices get, any plans to invest in that sector may be shuttered. It will be a long haul ahead.”

Many planned projects for liquefied natural gas (LNG) export terminals have been put on hold. While several massive liquefied natural gas export terminals reached the construction start stage in 2014 and 2015, Murray doesn’t expect nearly the same push in 2016. Three LNG export terminals are going ahead this year, including a $9-billion and $6-billion project in Texas and an $8.4-billion job in Louisiana.

He also forecasted that after increasing this year, power plant construction might moderately pull back next year. At the 2016 Dodge Construction Outlook conference on October 30 in Washington, D.C., he reported that the electric utility and gas plant sectors combined would fall 43% in 2016 after jumping 159% in 2015 due mostly to a reduced dollar amount for LNG export terminals.

“The utility and plant category will decline next year, but it will still remain at decent levels compared to five or six years ago,” Murray says.

The low energy prices, however, have had an upside — specifically the increased reshoring of manufacturing plants (click to see a PDF of Fig. 1). Four factors have sparked the reshoring trend — the low cost of natural gas, the cost competitiveness of wages, the business tax credit, and cyber security, Bovino says.

Carrick says as such, the manufacturing put-in-place numbers have been strong this year due to pent-up demand.

“It has been surprising,” he says. “There have been huge increases.”

Residential ramp-up

Looking ahead to 2016, another trend that is capturing the attention of construction economists is the rise in the residential market. Unlike in past years, the residential market — including both single-family and multi-family — is picking up, Bovino says.

“We continue to see strength in the housing market, especially in multi-family,” she says. “The recovery has been underway since 2010. At this point, it is maturing, but the market fundamentals are still supportive of construction.”

While the single-family housing sector began to show improvements in 2012, multifamily continued to outpace single-family starts for a few key reasons (click to see a PDF of Fig. 2), Bovino says. When the financial crisis hit, many Americans foreclosed on their homes, making it difficult for them to buy another house in the near future. Also at that time, many families couldn’t afford a down payment, so they decided to rent instead of buying. Finally, some prospective homebuyers were afraid that if they bought a house, it would devalue in price. Today, the job market is showing gains, but some Americans are still reluctant to invest in a single-family home.

“While the job growth is positive, that is a recent phenomenon,” Bovino says. “Most of these jobs are low paying, and that’s the reason why people are still renting instead of buying.”

Simonson says multi-family has been growing about twice as fast as single-family for many key reasons. Some individuals choose to rent to live close to the center of a city, they don’t qualify for a mortgage due to credit problems, or they haven’t made a final choice about where they want to live.

“It used to be easy to buy or sell a house, but neither one is true right now,” Simonson says. “That makes people rent longer than they did a decade ago.”

While the single-family recovery has been much less than in past cyclical upturns, the continued gains in employment — plus the easing of bank lending standards for mortgages — should enable more potential homebuyers to finally enter the single-family market, Bovino says. As such, Carrick says he is seeing huge pent-up demand in the single-family sector.

“While the single-family housing market has been weaker than the historical norm for eight or nine years, at some point the market will come storming back,” Carrick says. “When that happens, I expect to see a dramatic increase in the new home starts for construction.”

Looking to 2016, Murray forecasts a 20% increase in dollars and a 17% rise to 805,000 units for the single-family housing sector. For the multifamily housing sector, he expects it to increase 7% in dollars and 5% in units to 480,000 units. While the percentage increase for multifamily is less than what will be posted in 2015, Murray says the demand for apartments from millennials, rising rents, and low vacancies will encourage more development.

While the single-family sector is still recovering, the multifamily sector has already resurged to about 400,000 to 500,000 units seasonably adjusted and analyzed, which is the size before the recession, Carrick says.

Even so, the multifamily market was one of the hardest hit during the downturn, and year over year, it suffered from significant losses, says Kevin Haynes, a senior consultant for FMI. Recently, however, this sector has continued to climb out of the slump, but the rate of growth isn’t sustainable, he says.

“There is overbuilding in almost every city, and the mid- to high-rise apartment condos have been one of the hottest segments over the last few years,” Haynes says.

Commercial uptick

Along with the residential market, the commercial sector is also showing signs of strength going into 2016, depending upon the particular market segment. In 2015, this sector is estimated to grow 4%. In 2016, Murray forecasts it will advance 11%, led by the office construction segment.

As more businesses are hiring, they need more office space, which translates to a boost in office construction. More of the office construction activity, however, is happening in the cities than was the case before the recession, Simonson says.

“It has been picking up, yet it is a different kind of market than it was a decade ago,” Simonson says. “The big office parks in the suburbs have pretty high vacancy rates, so companies are choosing to put the headquarters where the millennials are living, such as the downtown areas of big cities.”

Within these office buildings, the design of the space has changed to foster collaboration among employees, Haynes says. While the office space per employee is continuing to decline, companies are removing partitions and creating open spaces to strengthen team dynamics.

“In today’s current office market, contractors are focusing on renovating existing or vacant space rather than on ground-up construction,” Haynes says. “They are also modernizing buildings to handle new technology requirements.”

Within the first floor of these office buildings, contractors often build out retail spaces. Over time, retail has shifted from the large stand-alone developments to mixed-use facilities, where stores and services occupy the ground floor of apartments, office buildings, and hotels.

“It’s very different than it was before the recession,” Simonson says. “As far as the strip malls, big box stores, and regional shopping centers, almost none of that is happening this year.”

In his view, however, Carrick says that retail is hanging in better than one might think. He also predicts the increase in Internet sales will fuel the demand for warehouses, which will serve as docking stations to supply customers with orders.

“All you hear about is how the Internet sales are up, but if you look at employment in that sector, it is a slope that keeps on rising in certain categories,” Carrick says. “There is cyclical improvement in jobs and earnings, but it’s a sector that continues to exhibit growth next year.”

Another commercial sector — lodging — has gained strength due to the economic turnaround and a recent pickup in both business and tourist travel. While the strength of the U.S. dollar is holding back investment into this segment from overseas, many properties are spending money to modernize their lodging, creating a bandwagon effect, Carrick says.

Rise in institutional interest

The institutional market — namely education and health care — have both posted gains but also face challenges going forward. Due to numerous bond measures that have passed, the institutional building portion of the non-residential building market should maintain upward momentum in 2016, according to Murray.

“Starting in 2014, we saw a pickup in the K-12 and the college and university construction market,” says Murray, who expects a 9% increase in the institutional market next year. “The rate of increase has slowed in 2015, but we expect it to gain upward momentum in 2016, especially at the college and university level. Research facilities continue to be an important part of the increased activity.”

Simonson, however, raised a yellow caution flag for the education sector. A recent report from the Census Bureau said that for the third straight year, college enrollment has declined, and as such, he doesn’t expect a big surge in the construction of dorms or classroom space.

Both the employment and enrollment at colleges and universities has flat-lined, which may change as the economy improves, the unemployment rate comes down, and the grandchildren of Baby Boomers reach college age, Carrick says. Still, the higher education sector continues to face obstacles, Carrick says.

“Many young Americans are taking jobs rather than going to school and incurring a high level of student debt,” he explains. “Also, another factor mitigating enrollment is the rise in the number of programs that issue college degrees over the Internet.”

Haynes, however, says he is seeing a revival in the higher education sector. In the past, higher education only comprised about 30% of the market, but today, he estimates that it is closer to half of the segment.

“The higher education market was hit hard during the recession due to endowments, but it is coming back,” Haynes says.

Within the K-12 sector, Simonson says the rising of the school-age population has not yet been matched by an increase in school construction spending. Before the recession, families flocked to new subdivisions in the suburbs, and new school construction was in high demand. Today, more families are choosing to live in older suburbs or closer to the center of cities.

While the education sector has been depressed for quite some time, Brian Strawberry, a consultant for FMI Corp., predicts there will be pent-up demand in the next three to five years due to the rising residential market.

“They haven’t been building, but the population has been growing,” Strawberry says. “It’s just a matter of time before the money is there for the projects.”

As far as the health care sector, Carrick says at this point it can only increase. While Obamacare and the Affordable Care Act cast some uncertainty in this segment, he expects it to be cleared up by the next Presidential election.

“Employment in hospitals has really increased, and we are set up for some significant spending on infrastructure,” Carrick says. “There is a pent-up demand for hospitals that seems to be skyrocketing on account of the aging Baby Boomers. Between now and 2040, the number of people aged 65-plus will double.”

From one year to the next, the health-care sector continues to be the big question mark, Haynes says. Relative to the other vertical nonresidential segments, it is unclear how the legislation will impact health care building and the type of projects.

“I’m not seeing the large campuses as much as expansions to existing buildings,” he says. “The focus is more on how to better use existing space.”

Haynes also says the volume and cost of the projects is much smaller. For example, instead of working a $200 million project, the contractors are finding more jobs in the range of $20 million to $40 million. Larger cities, such as Los Angeles, however, are still experiencing a rebound in large hospital construction projects, Strawberry says.

Looking ahead

Overall, Murray sees a positive picture for construction activity.

“We saw a pause in the non-residential building market for 2015, but it followed some good percentage gains for construction starts in 2013 (up 11%) and 2014 (up 24%),” he says. “The market fundamentals still remain positive for commercial building, and we are still seeing support for the institutional building sector from the passage of numerous bond construction measures in recent years.”

In the near future, Simonson forecasted that the U.S. economy should continue to fluctuate at about a 2% to 3% growth rate. The GDP went from an increase of 3.9% to a 1.5% increase in the fourth quarter, but while that shows a bit of volatility, he says at least the figure has a plus sign in front of it.

“The story in 2016 should be about growth rather than bounding between growth and contraction,” Simonson says.

Fischbach is a freelance writer and editor based in Overland Park, Kan. She can be reached at [email protected].