Moving Forward: EC&M's 2014 Top 50 Electrical Contractors Special Report

When traveling on the road to recovery, the nation’s largest electrical contractors have been challenged by suddenly cancelled projects, meager margins, and a severe labor shortage. Last year, however, the construction market finally shifted into a positive direction.

Russ Lancey, vice president of estimating for Five Star Electric Corp. (No. 9.), Ozone Park, N.Y., attributed the long-awaited turnaround to renewed strength in the private sector.

“In 2013, more work became available, and margins slowly started climbing,” says Lancey, whose firm is new to EC&M’s annual proprietary listing. “This year, we are moving beyond the recovery, and there’s no shortage of work. A lot of people are busy, including our company.”

(To see a copy of the Top 50 Electrical Contractors List in PDF form, click here),

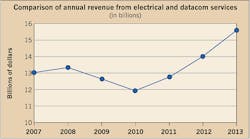

Case in point: The companies on this year’s listing reported combined revenues of $15.7 billion in 2013, compared to $14 billion in 2012 and $12.8 billion in 2011 (Fig. 1).

Since construction is a lagging indicator, it typically takes three years for the market to recover after an economic downturn. With the economy finally beginning to show signs of strength again, Joel Moryn, president of Parsons Electric LLC (No. 25), Minneapolis, believes the recovery is here to stay.

“Last year was a reality check,” says Moryn. “We have been talking about recovery for a long time, but now there is enough momentum for the recovery to continue. While the economy still has room to grow, a lot of people are short of help, which is a sign that things have turned around.”

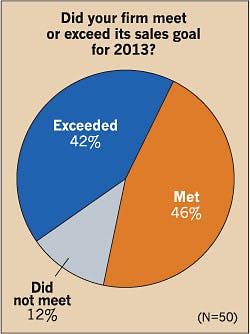

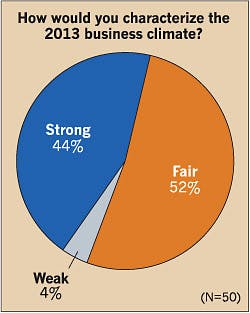

In fact, nearly half of the respondents exceeded their 2013 revenue goals (Fig. 2) in what 44% considered a strong business climate (Fig. 3). For example, 15 of the 50 firms posted a 20% or more increase in year-over-year revenues. Motor City Electric Co. (No. 21), Detroit, climbed five spots and increased its revenue by 48.6% while Cochran, Inc. (No. 35), Seattle, jumped up nine spots in the listing and reported a 63.2% increase in revenues.

Not all the contracting firms, however, enjoyed a significant increase in revenues or strength across all market sectors. Eleven firms reported a decrease in revenues, and 23 firms slipped down in the rankings. One firm on this year's list — The Truland Group (No. 10), Reston, Va., — even filed for Chapter 7 bankruptcy after abruptly shutting down operations in July of this year.

Although only 4% of the firms categorized 2013 as being a weak business climate, more than half of the respondents dubbed the business climate as fair, and 46% met, but did not exceed, their 2013 sales goals. Boris Shekhter, president of Helix Electric, Inc. (No. 14), San Diego, attributed his firm's 4% dip in revenues to less robust growth in the public sector, which is recovering more slowly and spending less than during the recovery period.

While more work may be available, contractors are still earning low margins, says Duane Hendricks, executive vice president for Egan Co. (No. 39), Brookly Park, Minn., whose revenues edged up 1.5% but dropped four spots in the listing.

“Our market tends to have a lot of good quality contractors on the mechanical and electrical side, which keeps it very competitive,” says Hendricks. “As we get more work, I hope the margins will also increase so firms will get paid what they are worth.”

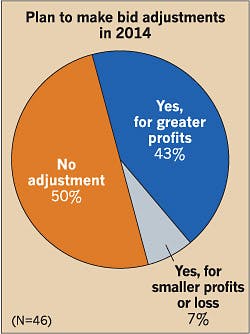

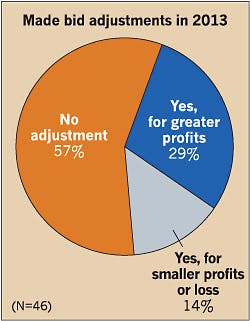

According to the Top 50 electrical contractors, profit margins could improve this year as 43% expect to adjust their bids for greater profits in 2014 (Fig. 4) compared to 29% last year (Fig. 5). In 2013, many contractors, including Faith Technologies, Inc. (No. 12), Menasha, Wis., had to occasionally pursue low-margin work with a dozen or more bidders on each project. This year, however, the contractor has record backlog, and the amount of industrial work is nearing pre-recession levels.

“There is a steep increase in demand for our services,” says Tom Clark, executive vice president of preconstruction for Faith Technologies, which moved up five spots in the listing. “The investment that we made during the downturn is paying dividends, and we see the growth ramping up moving forward.”

Preparing for the recovery

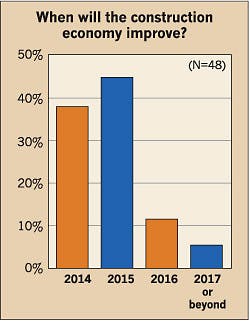

Despite the challenging market conditions over the last few years, more than 80% of the electrical contracting firms expect the construction economy to improve this year or next year, while only 18% don’t expect it to turn around until 2016 or beyond (Fig. 6).

Shekhter says the business climate has improved since the recession, and he expects to see larger cities like Washington, D.C., San Francisco, and New York City lead the recovery followed by mid-sized cities in other parts of the country.

“During the recession, clients closed up their wallets, and they decided not to build,” says Shekhter. “In busy cities with a growing population, people needed places to live, but no one was building them. Lately, however, the private market has come back in a big way due to all the pent-up demand, and we are very busy in the Bay Area and Washington, D.C. right now.”

In addition, the Northeast experienced a heightened level of activity due to the economic recovery and a pickup in construction, says Bob Mann, chairman of E-J Electric Installation Co. (No. 15), Long Island City, N.Y.

While many regions nationwide have already shown strong signs of recovery, the Northwest has not fully recovered from the 2008 economic recession, says Mike Douglas, vice president of construction for Electrical Construction Co. (No. 36), Portland, Ore. During a recession, the Northwest is among the hardest hit areas nationwide, and every time it follows the same pattern.

“The Northwest is almost immediately plunged into economic crisis, construction trades fall into an instant state of paralysis, and the general unemployment rates climb to some of the highest statistics in the nation,” he says. “When times are bad, they seem inexplicably bad here, and we are slow to recover.”

Six years after the recent economic meltdown, the Northwest is still in recovery, Douglas says. The recent approval of $2 billion in public school bond measures in the Northwest, however, could inject some strength into the education market, and opportunities are also emerging in Seattle when it comes to high rises, big-box construction, infrastructure, and aerospace work.

“We are witnessing some explosive growth in the Seattle construction market right now,” says Douglas. “We expect that 2015 will bring a host of new projects and a skyline of tower cranes in downtown Seattle.”

Pursuing strong market segments

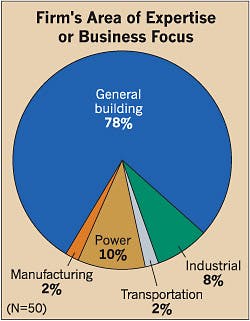

Nearly 80% of the respondents have also found success in the general building market (Fig. 7). More specifically, the health care, data center/mission critical, and private office markets ranked as the most active segments (Table 1) among respondents.

In the health care market, many facilities are in the process of expanding and updating their facilities to handle the aging population, says Hendricks of Egan, which is one of three preferred contractors for Mayo Clinic.

On the data center construction front, electrical contractors are seeing a mixed picture. While Cupertino Electric, Inc. (No. 6), San Jose, Calif., is pursuing data centers nationwide due to heightened demand, Electrical Construction Co. is seeing a much weaker range of work opportunities for 2015. Based on forecasts from prior years, the company hoped for a stronger growth potential, but the nearing completion of projects valued at hundreds of millions of dollars will drive down the volume of work, explains Douglas.

“The data center market won’t be dead, but it will be down,” says Douglas. “It has some big shoes to fill if you consider the scale and size of the current work that is nearing completion.”

Parsons Electric’s Moryn says the data center market has shifted from large corporate enterprise centers for the Fortune 100 companies to mostly colocation spaces and construction for the major Internet online companies. In addition to data centers, the “Samsungs, Googles, and Apples of the world” are purchasing large plots of land, tearing down old industrial buildings, and constructing new offices and campuses from San Jose to San Francisco, says Mike Jurewicz for Sprig Electric Co. (No. 38), San Jose, Calif.

“The booming high-tech companies are grabbing up the space and attracting more people to the Bay Area, which is causing housing prices to rise and a flurry of high-density residential projects,” says Jurewicz.

The strength in the private office sector is also spreading to the Midwest, where Deanna Gillett, CFO for Wachter, Inc. (No. 34), Lenexa, Kan., has seen clients open up cash reserves for infrastructure or technology upgrades to stay ahead of their competition. The firm, which had record revenues in 2013, also has experienced an increased level of activity in the retail and manufacturing sectors.

"We've had long-term relationships within these markets and have financially been able to weather the uncertain economy along with many of them," she says.

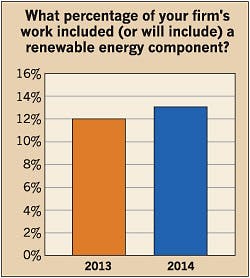

Another market that is increasingly becoming part of electrical contractors’ workload is energy management and renewable power. A quarter of the firms reported that their work will be based on energy-efficient design this year and next year (Fig. 8), and 12% of the firms’ work included a renewable energy component in 2013, edging up slightly in 2014 (Fig. 9).

A high concentration of the green design and construction is taking place in California where the California Energy Commission recently updated the Title 24 standards.

“We do solar installations on about half of the projects that we build, and if our clients don’t integrate solar, they are building in the capacity to add it in the future,” says Jurewicz, noting that Sprig Electric is a green-certified firm.

The solar market is heating up in select parts of the country, but the majority of the electrical contractors’ green design work revolves around energy-efficient lighting and electrical equipment. For example, Parsons Electric — a LEED-certified firm — installs low-frequency drives and motors, and one of FSG Electric’s (No. 13), Austin, Texas, core businesses is in the area of lighting upgrades and retrofits, says Bob Graham, vice president of FSG.

“We have had continual growth in that market because we can help our clients design upgraded energy-efficient lighting systems and manage the utility rebate programs,” says Graham.

Expanding operations

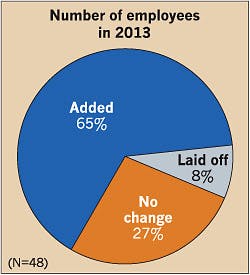

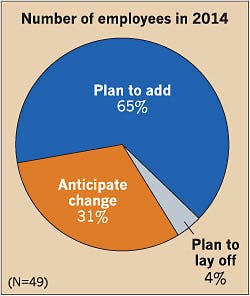

To handle the new work opportunities that are emerging nationwide in green design and other markets, 65% of the firms both last year (Fig. 10) and again this year (Fig. 11) plan to hire new employees.

For example, due to a rise in the industrial market, Parsons Electric opened a new branch office in northern Minnesota to support mining and another in Fargo, N.D., to support growth in health care and support services.

“We have added employees in every division of our business along with every geography, and we have added some new locations, which are seeing significant growth,” says Moryn.

In other cases, the nation’s top electrical contractors grew their operations through acquisitions. For example, Cupertino Electric recently acquired California Data Center Design Group, a data center design and commissioning firm; Egan purchased a direct-to-owner electrical contractor called Electric Resource Contractors; and O’Connell Electric Co., Inc. (No. 43), Rochester, N.Y., is in the process of purchasing a contractor in the Albany, N.Y., area.

Victor Salerno, CEO of O’Connell Electric, says with the upcoming acquisition, his company will have a presence throughout New York State. Within the last month, the contractor has hired about 25 new employees and hopes to grow the office to produce a stand-alone revenue of $25 million.

“We are adding people across the gamut since there is so much work right now,” says Salerno.

Searching for skilled leadership

To handle the increased workload, other firms are also trying to hire more field and office employees, but more than half of the respondents reported having an issue with a worker shortage (Fig. 12). The retirement of skilled workers and the lack of new people entering the business could stunt the growth of construction, according to Parsons Electric’s Moryn.

“Everyone is in a hurry and is working with small construction budgets and a very fast delivery,” says Moryn. “Field and project managers are in short supply; we must get them trained to serve the demand that is happening now. We would have a lot more work if we had the people to do it.”

The labor shortage is amplified by the fact that a lot of workers left the construction industry during the recession, and enrollment has plunged in training programs. For example, Moryn says the number of electricians at a local Minnesota college recently plummeted from 350 to 60, and the apprenticeship program enrollment dropped from 600 to 250. With apprenticeships lasting five years and trade schools requiring a two-year commitment, the exodus of workers during the recession created a gaping hole in skilled labor, notes Moryn.

“It’s starting to come back, but it’s still a long way from peak levels,” he says. “During the downturn, people made the decision to do something else, but now they are starting to think about construction again.”

Some of the nation’s largest contracting firms may still be facing a skilled labor shortage, but others have more than enough electricians on hand to do the work. For instance, Electrical Construction Co. is a union signatory contractor and draws from a large base of trained workers and an organized workforce.

“Our labor halls are nearing empty, and no one is sitting around because we are so busy, which is a nice problem to have these days,” says Electrical Construction Co.’s Douglas.

IBEW Local 3 has a mandatory furlough program in New York, and when the construction market was busy, it brought a lot of electricians into the labor force, says E-J Electric’s Mann. Now that the construction market has picked up and more opportunities have presented themselves, the labor force across New York City in both the office and the field is becoming limited.

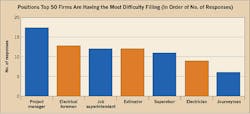

As a result, many of the New York union contractors are not facing a shortage of field labor but rather of qualified office employees. For example, Five Star Electric is always searching for new talent, especially when it comes to qualified project managers and engineers. Other job positions that are increasingly hard to fill are electrical foremen and job superintendents (Fig. 13).

“At the end of the day, you are only as good as your people, and it’s hard to find good people,” O’Connell Electric’s Salerno says. “Project managers, foremen, and estimators are worth their weight in gold in this business.”

To find supervisors and managers, some firms are training their internal employees to climb up the corporate ladder. Because it can be challenging to convince seasoned foremen to become project managers, Parsons Electric tries to train foremen early on in their careers to step up into this role. Additionally, Faith Technologies helps electricians advance their careers through its two-year High-Performance Program.

“We are taking the best electricians in terms of leadership, mentoring them, and giving them the tools to become successful,” says Faith Technologies’ Clark.

Using technology in the field

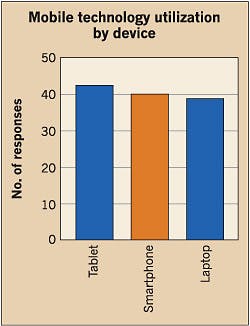

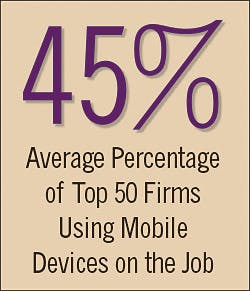

To help their workforces stay as efficient as possible both in the office and in the field, nearly half of the Top 50 respondents are equipping their employees with mobile devices such as tablets, laptops, and smartphones (Fig. 14).

At Egan, Hendricks estimated that 95% to 100% of its foremen are connected with data phones, notebooks, or laptops, and they do most of their day-to-day job site reporting on Google Chromebooks.

“Technology has brought us connectivity to the field, efficiency in layout, and the ability to prefab on-site as much as possible,” says Hendricks. “It is a key factor in large construction, and it’s driven by time and efficiency. You don’t have time to do it all on the construction site, and you need to be efficient to be competitive.”

At Cupertino Electric, most of the company’s office and supervisory field staff are supplied with mobile devices to access the company Intranet, procure materials, and stay connected.

“We are constantly evaluating which technologies and apps maximize productivity without compromising safety to ensure we’re getting the most out of what we deploy,” says John Curcio, the firm’s chief commercial officer.

Like Cupertino, 95% of the respondents have written procedures in place for mobile devices to keep workers and customers safe (Fig. 15). For example, O’Connell Electric monitors when and where its employees use their password-protected devices, and Sprig Electric employees must sign a letter affirming that they will not use a mobile device when operating a vehicle.

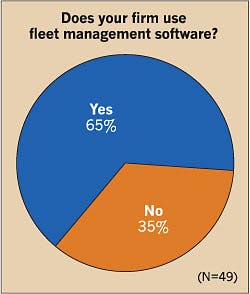

Wachter also requires its employees to pull over on the side of the road to take phone calls. In addition, the firm is one of the 65% of Top 50 contractors that uses a fleet management software program to keep its field workforce safe as well as productive (Fig. 16). The company relies on the software to track its workforce, deploy employees quickly, track vehicle speeds for safety purposes, and monitor time to validate timesheets, says Wachter’s Gillett.

Expediting project delivery

Another key benefit of deploying technology to the field workforce is the ability to streamline communication, provide real-time updates, and successfully deploy a wide range of project delivery methods, including integrated project delivery.

Through BIM and its in-house engineering team, Faith Technologies can get involved with a project during the design phase, which improves the productivity of the electricians and, in turn, provides better value to the client, says Clark.

“It gives contractors access to the most recent up-to-date information in the field, and electricians have the information at their fingertips,” he says.

Jurewicz says the number of BIM projects has exploded since 2010, and even if a job doesn’t require BIM, Sprig Electric still uses it for clash detection and prefabrication. About 80% of his company’s work, however, is design build, which ranked as the most popular project delivery method in 2013 next to design-assist (Table 2).

Now more than ever before, owners are more interested in different ways of delivering projects, and they want to find ways to control the budget, says Graham.

“Contractors can no longer just do what they are used to doing,” he says. “Owners are hiring contractors who can do prefabrication, lean delivery, and BIM at a high level.”

When looking ahead to 2014, Graham forecasts that the market could be flat next year, and while certain markets or areas may continue to be strong, electrical contractors will be fighting to restore margins that existed a few years ago.

“Although new project activity will be high, it will be difficult to backfill the mega projects that are winding down,” says Graham. “As the economy improves, it will be more and more difficult to acquire and maintain the talent to keep up with the demand.”

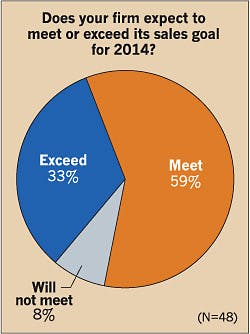

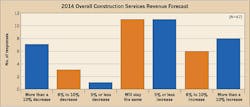

Nearly 60% of the respondents expect to meet but not exceed their 2014 revenue expectations (Fig. 17). With the economic recovery in full swing in many areas of the country (Table 3), the nation’s 50 largest contractors are priming for future growth (Fig. 18).

“From an electrical standpoint, things are solid,” says O’Connell Electric’s Salerno. “Barring any major catastrophes, we don’t see any bubbles on the horizon like we’ve seen in the past.”

Fischbach is a freelance writer based in Overland Park, Kan. She can be reached at [email protected].

Join the List

To get on the list to receive the proprietary survey for next year, please contact Executive Editor Ellen Parson at 913-967-1806 or [email protected].

Five Ways to Recruit the Next Generation of Leadership

Search. Use recruiters or nationwide sources, says Deanna Gillett of Wachter, Inc. Also, retain them by paying competitive wages, providing good benefits, encouraging teamwork and respect, and setting high expectations for the workforce.

Cultivate. Bring in interns constantly, even during hard times, says Boris Shekhter of Helix Electric.

Train. Offer short- and long-term training programs to help field employees expand their skills and knowledge, says John Curcio of Cupertino.

Recruit. Implement a robust university relations effort that leverages social media to find technologically savvy, results-oriented people, adds Curcio.

Reward. Use deferred compensation to vest certain job titles and offer ownership opportunities, says Joel Moryn of Parsons Electric.